Multiple Assets? Here’s what we can Learn from the High Net Worth on Wealth Preservation and Legacy Planning

Wealth preservation, Legacy planning, Estate planning, Retirement planning • 2023-06-02

Wealth typically doesn’t last three generations… or does it?

It’s often said that the first generation creates wealth, the second maintains it, while the third loses it.

This often happens if there are insufficient wealth preservation strategies in place to ensure that your money can keep growing and be passed down to the next generations.

Some of us might be aware of this – before wealth gets passed down, it might be subject to taxation.

The U.S. imposes up to 40% estate tax rate (death duty) on U.S. assets above a $60,000 exemption threshold on assets of deceased non-residents. This means a non-resident’s stock holdings in American companies can also be subject to estate taxation.

Of course, there are several strategies investors can use to cover these taxes, which I usually discuss in greater detail with clients whenever needed.

But beyond investment strategies, the ultra-wealthy often makes use of other vehicles to ensure that their wealth is effectively preserved and passed down to several generations.

This involves proper legacy planning. They also make use of Trusts, to ensure that their children do not squander away their wealth after they pass on.

I have done this for a number of my clients.

Leaving a legacy sometimes can also get complicated when it involves business assets and entities.

For business owners out there, do you want to ensure business continuity after you have passed on?

History often teaches us hard lessons:

Some of you might have heard of The Swatow Group, a very successful restaurant chain back in the 1980s.

The 38-year-old owner passed away due to a sudden stroke in 1992, and that was the turning point when everything crumbled.

His wife, a full-time homemaker, had to take over the business but she was unable to run it.

This resulted in the closure of all their 18 restaurant outlets across Singapore, just within a few weeks of the owner’s passing. More than 500 employees lost their jobs.

The continuity of the business is often threatened when the key decision-maker is not around anymore – customers might lose confidence, staff morale might be low as they are not sure if they would lose their jobs, and your successors might have to deal with creditors who are unsure if they will get paid.

This is why it is crucial that business owners have asset protection in place, to ensure that there would be sufficient cash flow to inject into the business during the transition period when the successor takes over the business.

Building multiple passive income streams to cushion this transition period can also make a lot of difference.

A number of my clients are business owners, and they often face a unique set of cash flow and business succession worries, which are usually alleviated once they have asset protection and stable passive income strategies in place.

For those who may already have business succession plans in place, or even if you don’t want to have someone to take over your business, it is also important to have a plan on how and when you intend to wind down your business and liquidate your assets, as well as what would happen after that.

This is so that the wealth and assets you have accumulated can be successfully preserved and passed down to your loved ones.

Some of you may also have multiple assets.

How do you also ensure that the value of the assets you want to pass on to your beneficiaries are distributed according to your intentions?

For example, if you want to pass 50% to your spouse, and 25% each to two children, how do you ensure that these percentages allocated will be effectively executed according to your wishes without causing disharmony, especially when the assets are not easily divisible, such as when it involves properties or businesses?

Here is where estate equalisation comes in – dividing a deceased person's assets fairly among their beneficiaries to ensure that each beneficiary receives their intended share of the estate's total value.

This can be achieved through various means, such as by selling assets and distributing the proceeds or by providing beneficiaries with alternative assets of equal value.

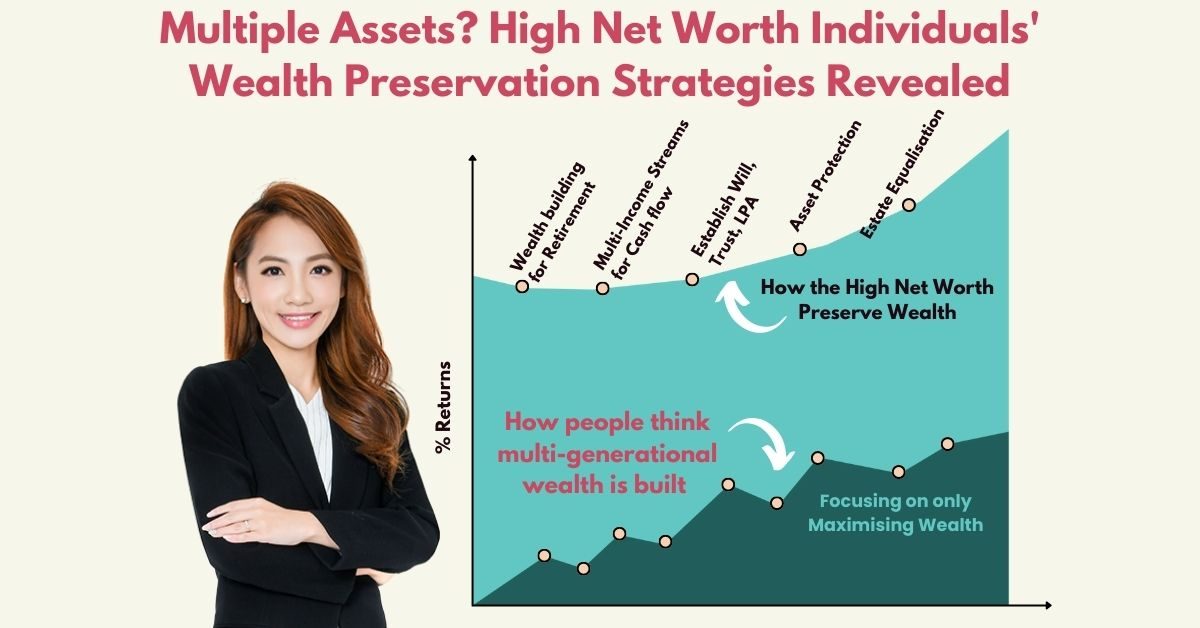

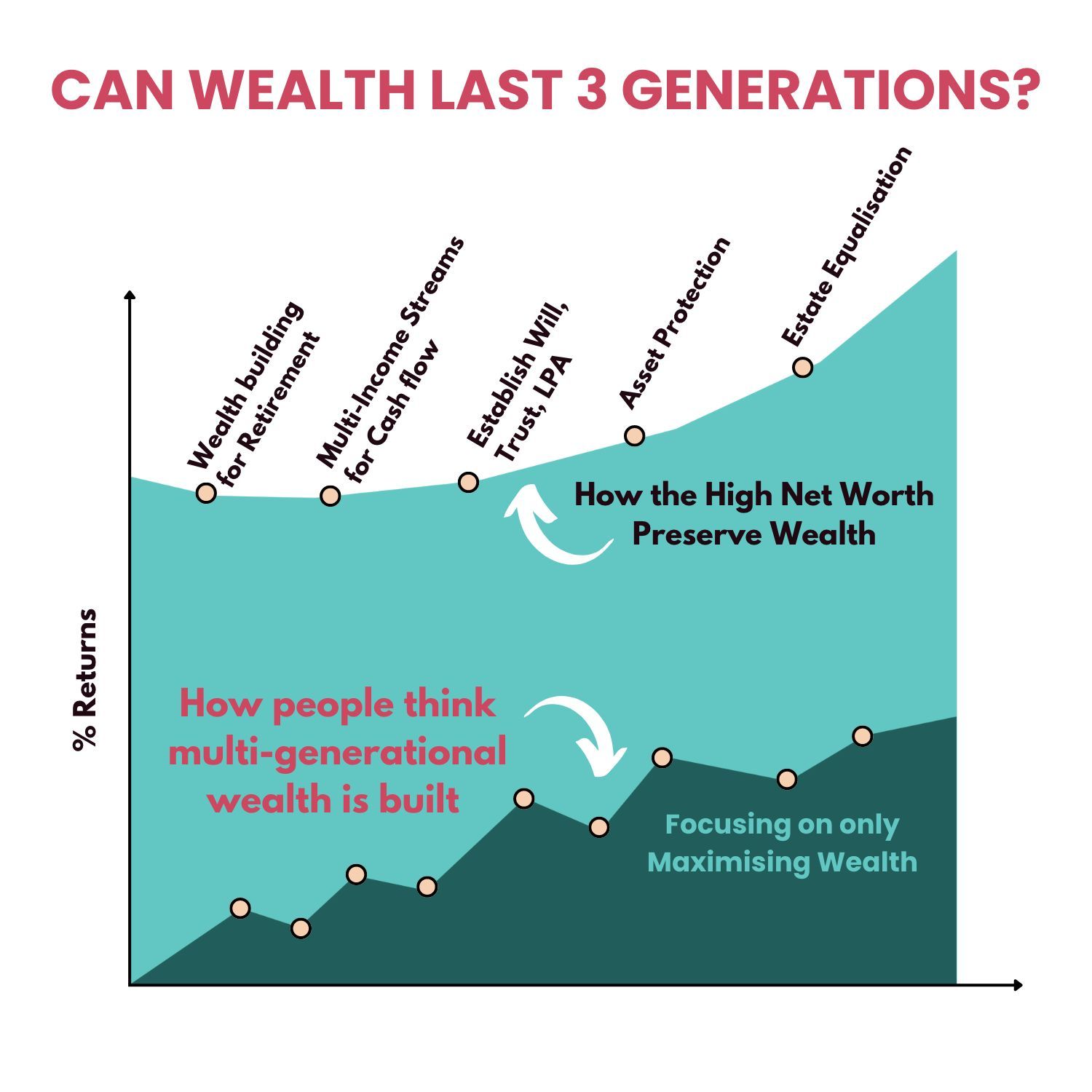

Some people think building multi-generational wealth can be achieved by simply maximising their wealth – this is a common misconception.

There are actually a lot more processes that high-net-worth individuals use to ensure successful multi-generational wealth preservation and wealth transfer.

Source: For illustration purposes only.

As a Chartered Financial Consultant (ChFC®) and Retirement Wealth Specialist recognised as one of the top 1% in the financial services industry, I can help you build stable passive income streams to provide an alternative source of cash flow, as well as preserve your wealth for your next generation.

I’m also a licensed legacy planner, and I can help to ensure that your wealth distribution is well taken care of.

If you are keen to protect your assets and preserve your wealth, simply fill up this short application here and I will be in touch.

Disclaimer: This post represents our personal views and opinions and is neither associated with any organisation nor reflect the position of any organisation. This content is also only for informative purposes and should not be construed as financial advice. Past performance does not necessarily equate to future performance. Please seek advice from a Financial Adviser Representative before making any investment decisions.

Delaying your retirement despite having multiple assets?

What is lacking is a sound strategy with the latest solutions to optimise your assets, so you can receive multiple passive income streams. Get a complimentary consultation session now (for qualified applicants only).

Further Reading

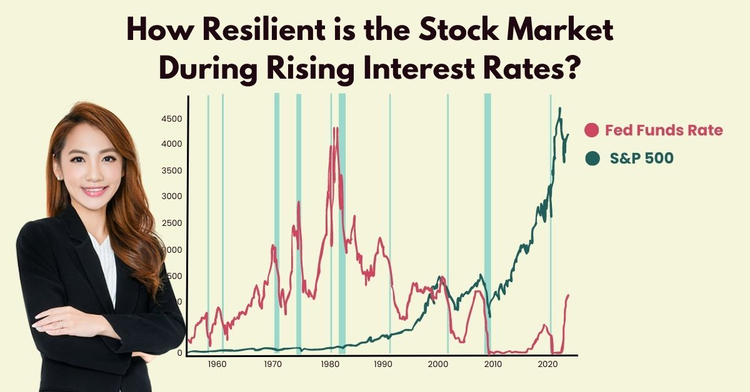

High interest rates in 2023? What are the opportunity costs if you go for short-term returns?

Retirement planning, income investing, Passive income, Investment

With current high interest rates, is it a good time to grow your cash through opportunities that can generate short-term payouts? What are the potential risks?

Copyright © 2022 TheFinLens by Jasmine Siah. All rights reserved.