18% p.a. returns? Why buying this fund alone can be potentially dangerous

Retirement planning, Investment • 2022-04-07

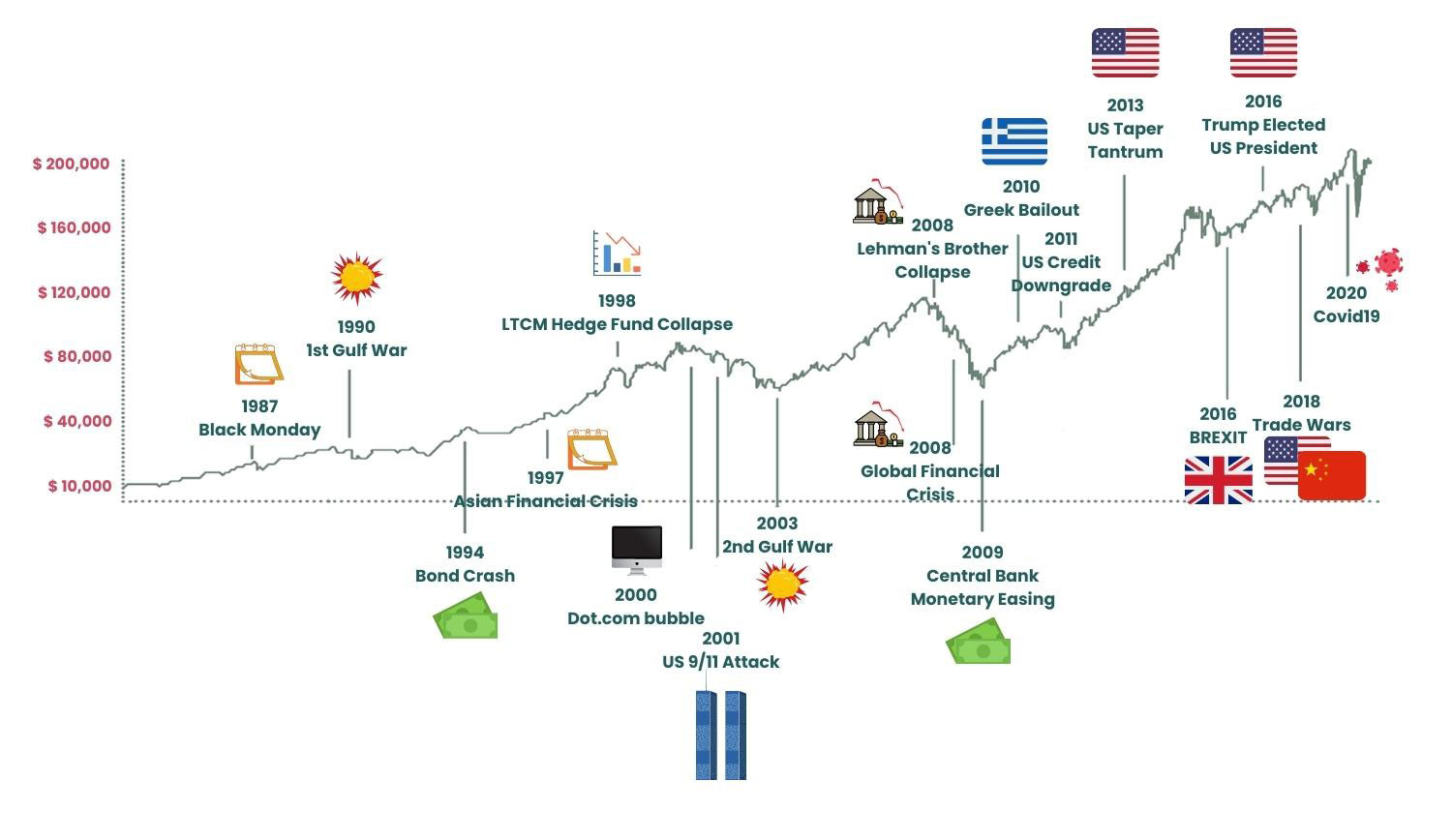

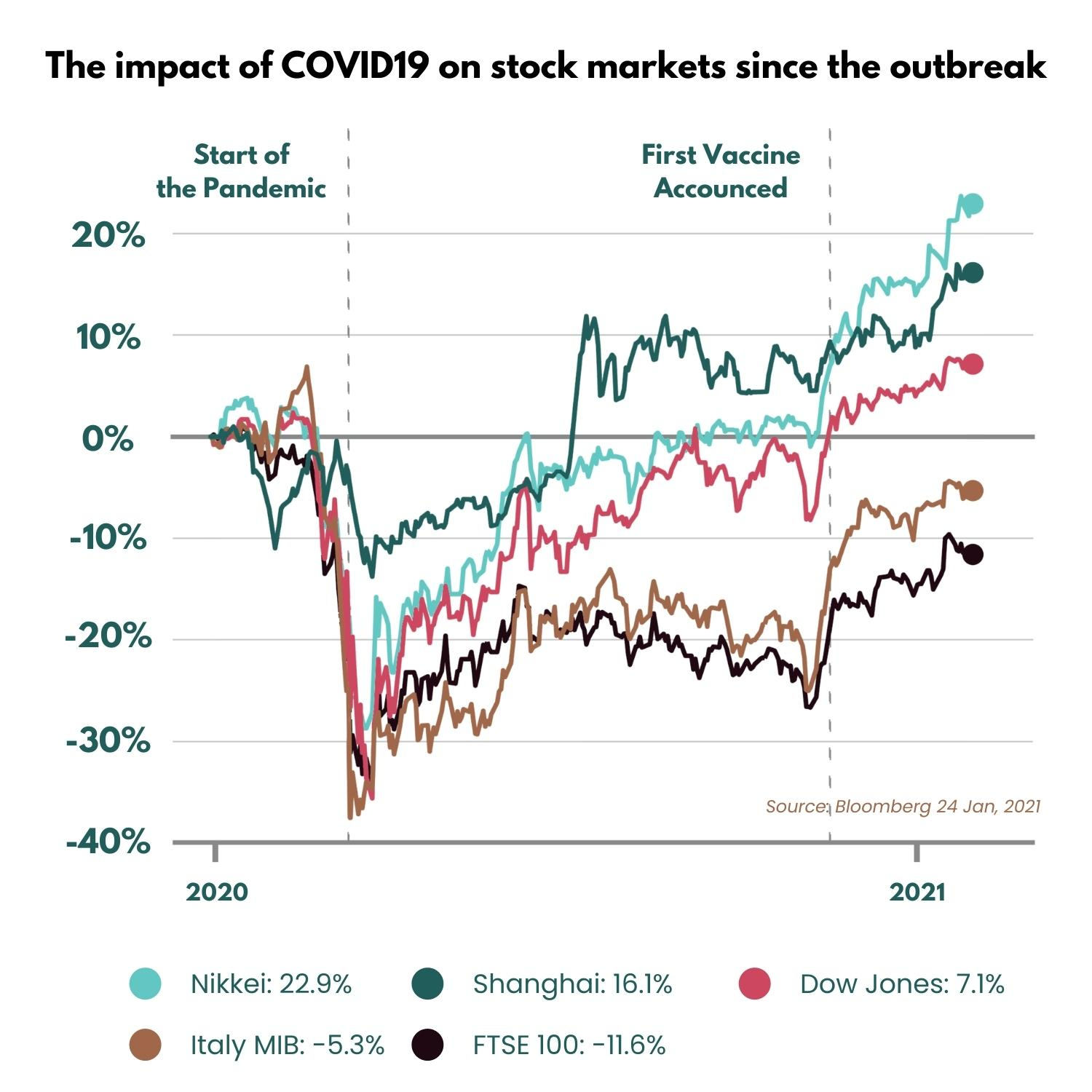

In the chaos of the pandemic, the financial markets went on a rollercoaster ride since 2020. Volatility and uncertainty were the themes for the past years in the market.

Despite the fluctuating market conditions, it is still important to invest in preparation for your future retirement needs. Studies have suggested that time in the market is the way to go instead of timing the market. It is good to acknowledge that fluctuations are a given in investing. The key is to manage your investments well.

If you are retiring and considering investing, the fluctuating market conditions may be pretty volatile to participate in.

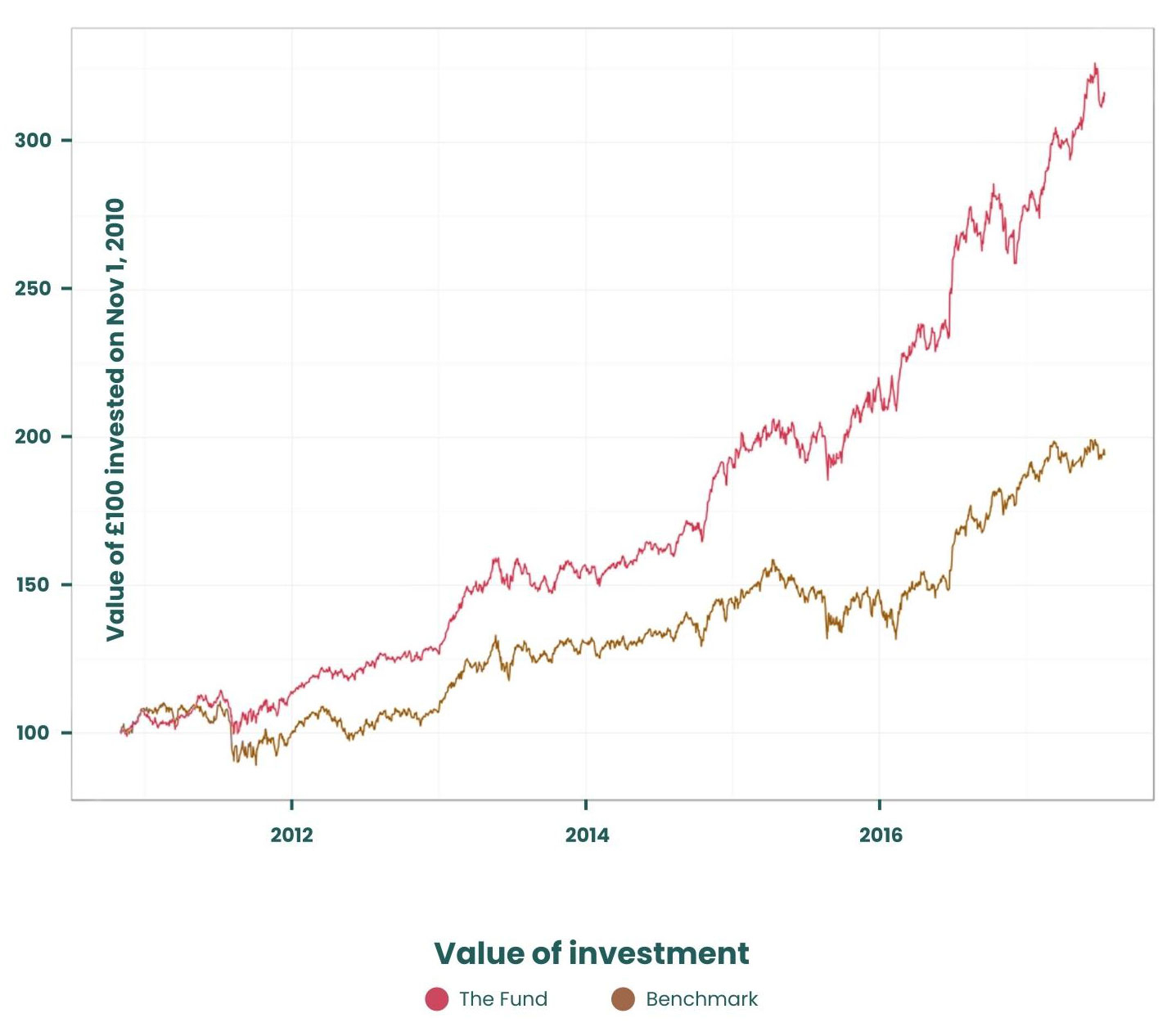

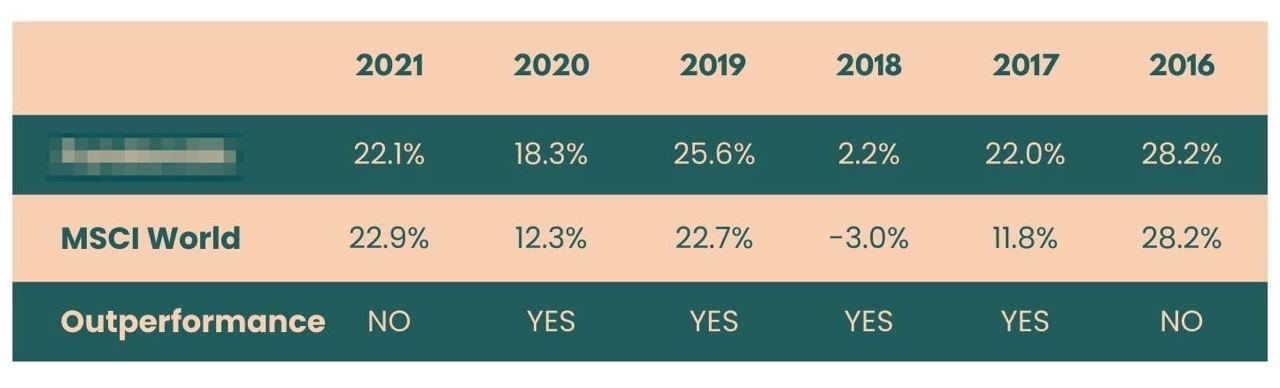

However, there is an actively managed equity fund that had outperformed its benchmark for many years since it was established. Even in 2020 when the pandemic struck.

Due to its stellar returns — which is actually rare for a fund to get 18% annualised return, this particular fund had grown in popularity amongst retail investors.

The fund had also been actively advertised by many financial advisor representatives and naturally, people are impressed by its amazing performance and ended up buying into the fund.

As above, this particular fund gained 18% annualised returns in 2020. This fund had outperformed its benchmark, MSCI World index, by 6%.

This is actually very impressive, because 2020-2021 had been a volatile time for investors with unpredictable market swings.

Almost all major regions and industries were affected by the pandemic.

Is this fund the gold pot at the end of the rainbow for retirees?

As we are approaching retirement years, it is understandable that we only want to invest in funds that give us maximum returns.

But, high returns may come with high risks.

Should a pre-retiree invest in this fund for a secured retirement?

Here in this article, we share why you should not just simply buy into high performing funds.

Don’t have enough for retirement? Many Singaporeans are asset-rich but lack strategy to generate passive income. At The Fin Lens, I help mass affluent clients keep up with the latest solutions and optimise their assets – so they can build multiple income streams and retire earlier. Find out how today.

Disclaimer: This post represents our personal views and opinions and is neither associated with any organisation nor reflect the position of any organisation. This content is also only for informative purposes and should not be construed as financial advice. Past performance does not necessarily equate to future performance. Please seek advice from a Financial Adviser Representative before making any investment decisions.

Will it be sustainable to just invest in this?

1) No financial asset is enough on its own

This fund thrived even during turbulent market conditions. And with fantastic returns, the risks that come with the funds may appear small to investors.

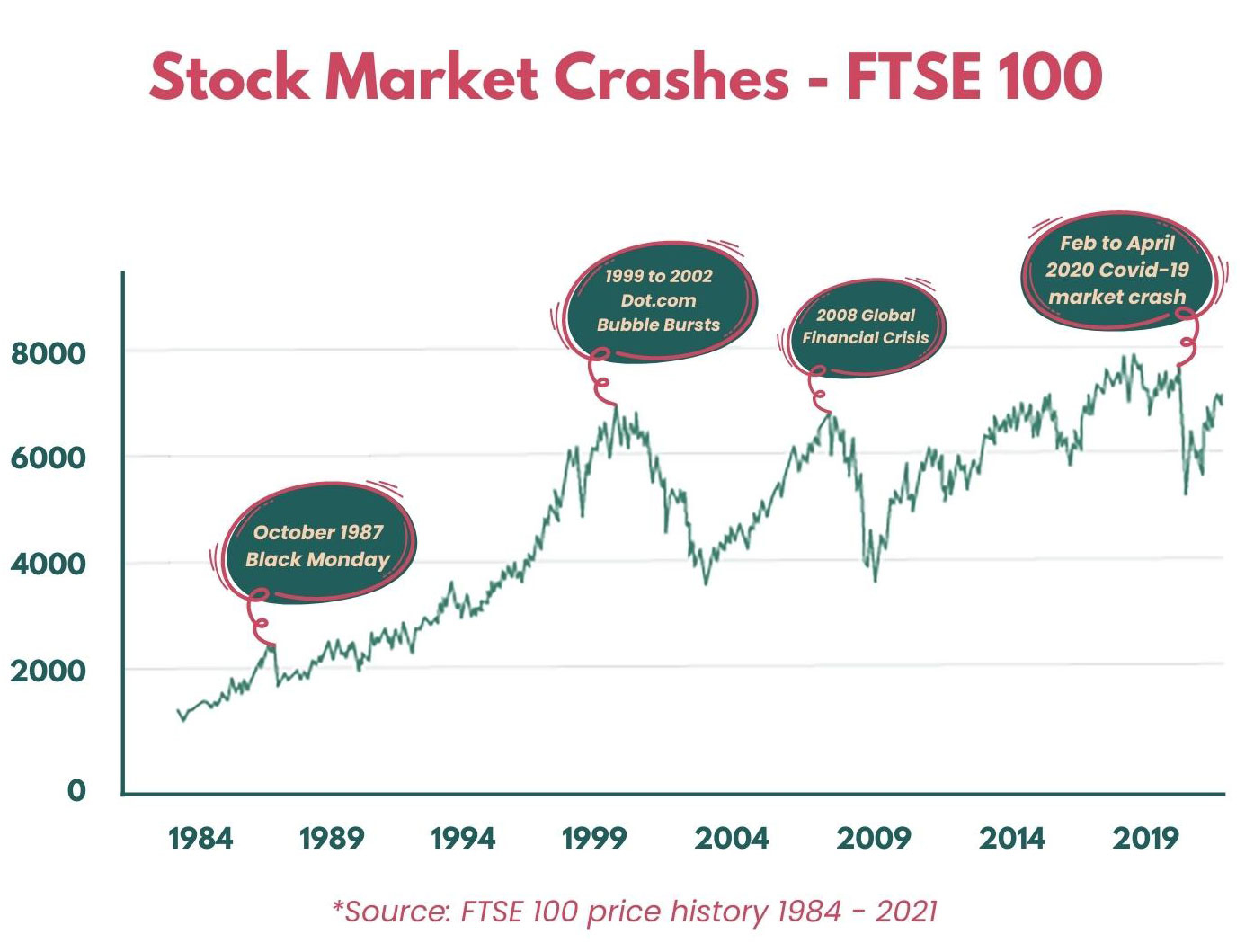

The said fund is actually an equity fund. And to invest only in this poses a concentration risk of investing in only one asset class. Therefore, you will actually be very vulnerable to the volatility of the stock market.

As someone who is about to retire, you may not have the time on your side to wait for a market recovery.

Although the 2020 stock market crash took only a few months to recover, it was mainly because the financial markets were driven by huge stimulus money (due to the pandemic).

Are you prepared for any future market crash in which any external support given will not be able to give you full recovery of your losses within a short period of time?

It is important to be prepared for any market weather and not be too dependent on external stimuli as these variables are not certain. In retirement, you will want a sense of security that your monthly income is not affected by the volatility of the market.

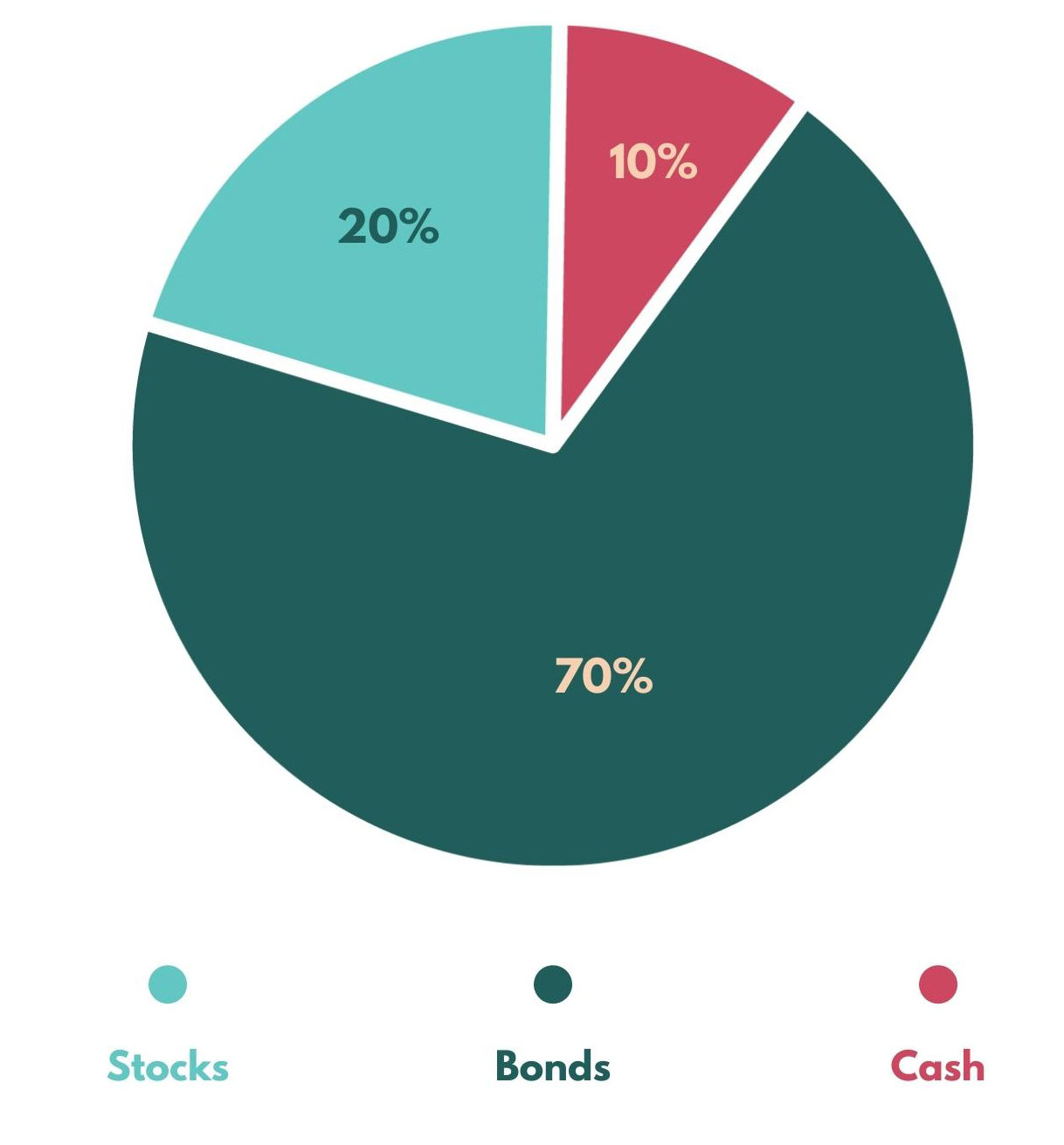

That is why a retirement portfolio is always made up of a combination of assets that are not positively correlated to one another as much as possible. So in the event that some are performing negatively, the others can cover any shortfalls and you can still be on track to reach your retirement goals.

Here is an example of an asset allocation one of my clients has:

This client’s portfolio is more bond-heavy to ensure that the portfolio is diversified in less volatile assets during down periods as it acts as a lower risk investment. This is what the client is looking for.

So, if you need help in determining an optimised asset allocation that fits your retirement goals, consult a professional that is specialised in retirement planning to help you figure it out.

2) Diversification spreads out your risk and opens the door to more opportunities

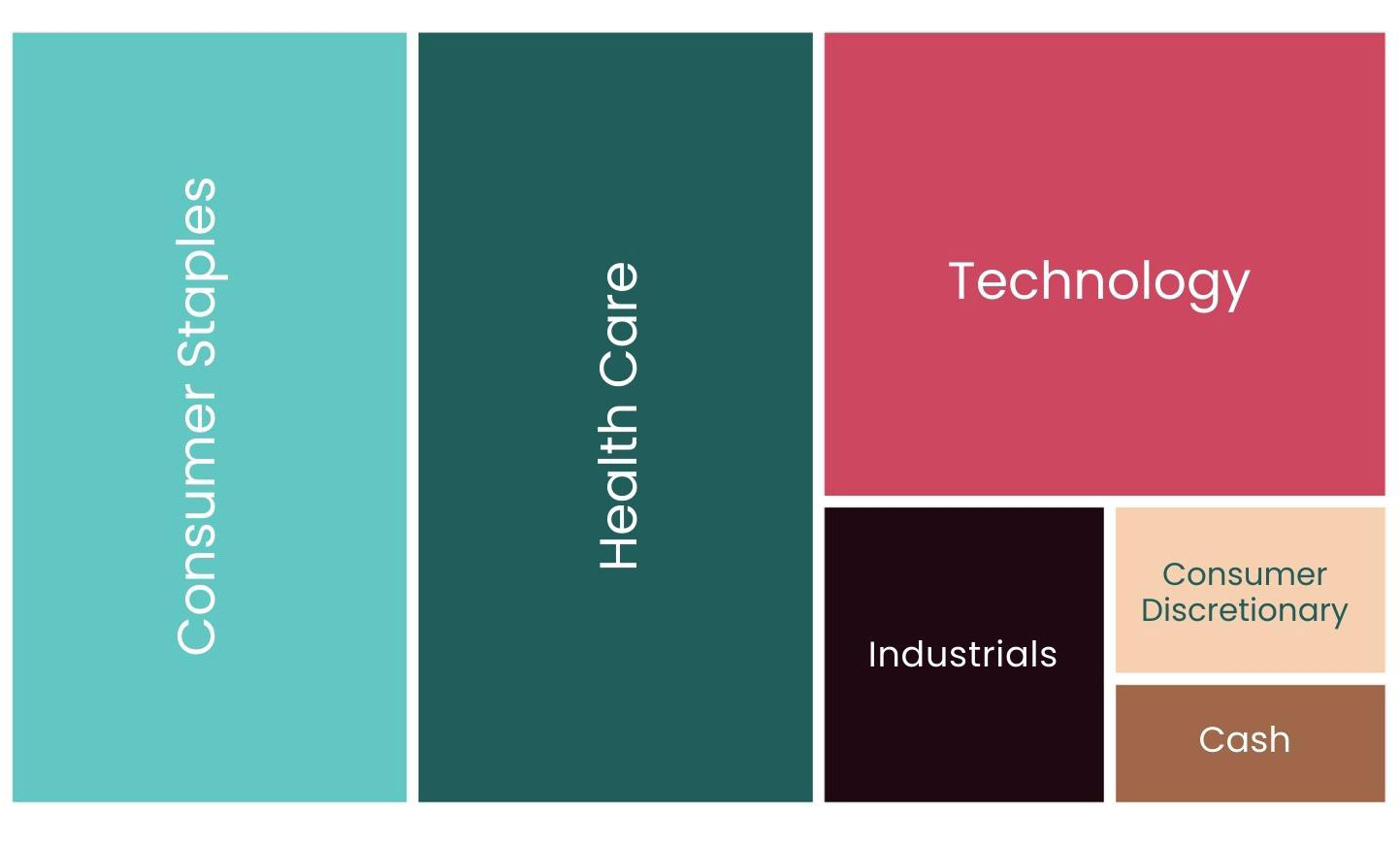

Besides the concentration risk of one particular asset class, investing in a single fund may not be enough for diversification. For example, here is a representation of the actively managed fund’s sector exposure:

While its benchmark is diversified into more sectors:

While the fund did outperform its index, we must understand the risk that this equity fund undertook by mainly investing in sectors such as consumer staples, healthcare and technology.

In investments with well-managed risks, it is important to consider other opportunities that other sectors might have to offer.

And as we approach retirement, we must not be blinded by the past performance that the fund had achieved as it is not indicative of its future performance.

Take the technology assets for example.

Below is the performance of the Hang Seng Tech Index in its glory days:

When the growth is great, many investors want to hop on the trend train. But this will then push the valuations of the assets to be overvalued and might cause the assets’ valuation to crash.

Even if there’s no overvaluation, factors such as geopolitical tensions may contribute to potential price changes as well.

In early 2022, the Hang Seng Tech Index — which consists of Chinese tech stocks — plunged by 61% from its high in 2021, following an announcement by the U.S. Securities and Exchange Commission that the U.S.-listed securities for five Chinese companies are at risk of delisting, as they failed to comply with the Holding Foreign Companies Accountable Act.

This sparked fear and panic that Chinese tech stocks might be delisted from the U.S. stock exchange.

Will you be able to stomach losses of this extent? Especially knowing that your investment goal is to have enough funds for retirement.

This is why it is important to have a well-diversified portfolio that takes into consideration the changes in economic cycles and even pull-through any geopolitical crisis.

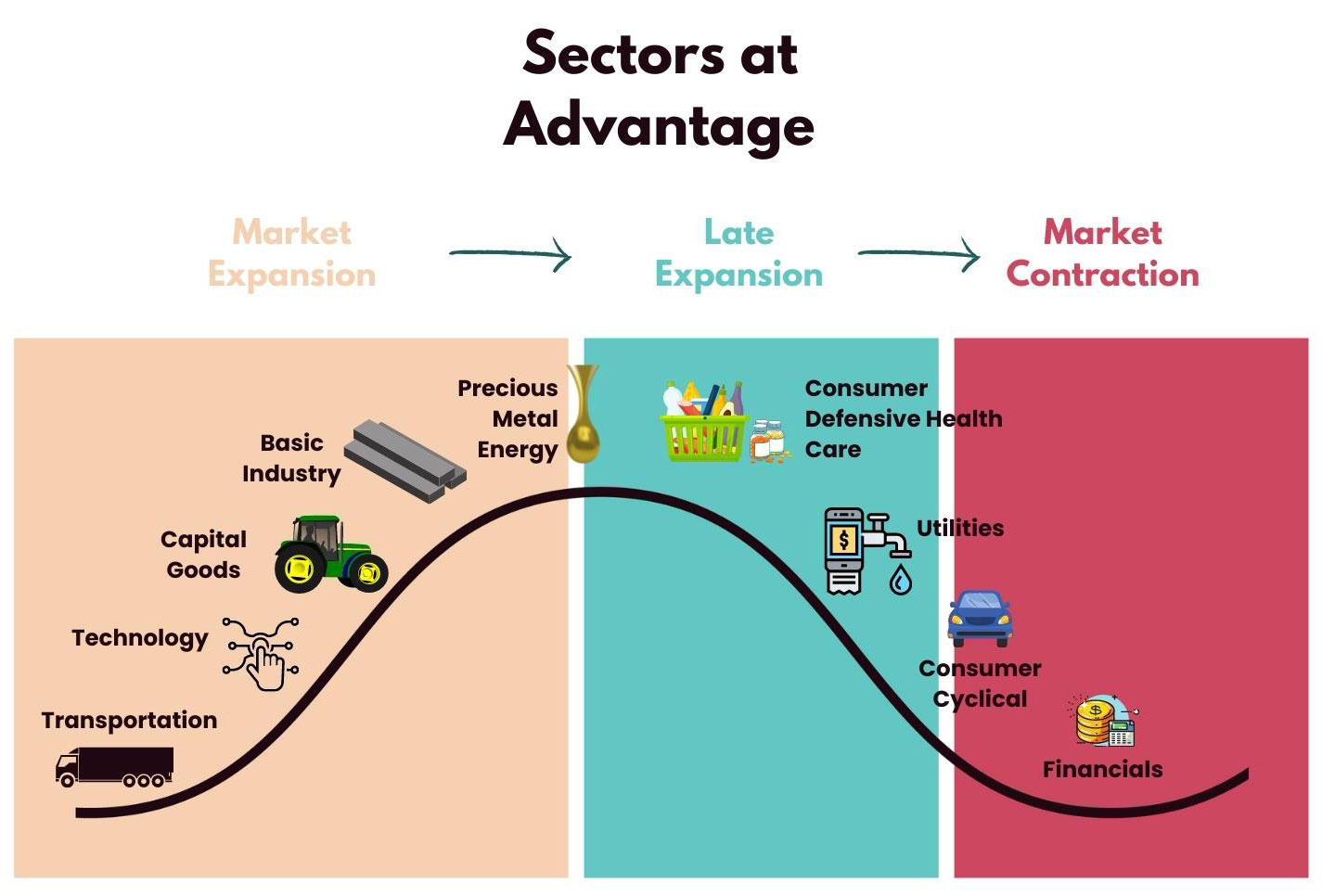

As seen in the diagram, different economic sectors fare best during different economic periods. To know which type of sector to invest in at the moment requires you to understand the current economic stage and conditions.

This way, you will not lose out on opportunities in thriving economic sectors.

Besides diversification of asset classes and economic sectors, it is also important for investors to be diversified geographically in their investments as well.

For example, if you are hyper-focused on the U.S. market, you might not realise that the Asian market may offer good returns as well at certain points in time. Have you considered your investment strategy globally instead of just what you are familiar with?

This can be overwhelming for you if you don’t have prior knowledge about investing and you may not have the time to learn on your own.

With the investment strategy I have crafted for my mass affluent clients, my clients are now well on track to potentially retire 10-15 years earlier than planned. Get your retirement planning roadmap here now.

Retirement planning is like preparing for a road trip to your dream destination

As we have established that one high performing fund may not be sufficient in one’s retirement portfolio, how do you know that your portfolio is set for retirement? Is your portfolio strategised to be resilient to any market changes?

Naturally, before you go on a road trip, you will make sure that the car that you are going to use is in a good condition to bring you safely to your destination.

By spending a little time and energy on your car for the trip, you may be able to avoid problems that might ruin your fun along the way.

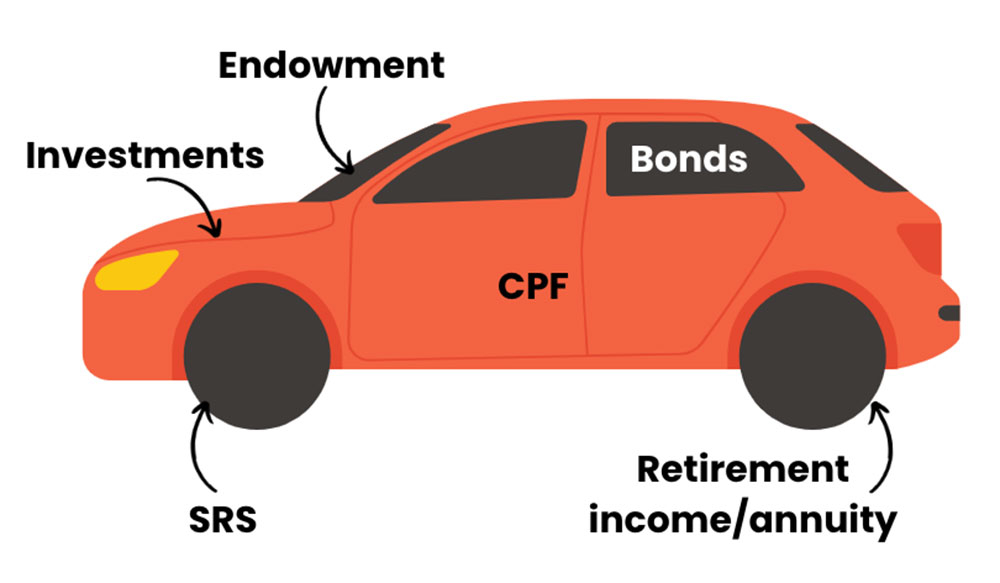

Similarly in investing for retirement, your vehicle is your investment portfolio and your destination will be having enough income for your retirement.

This is how you can make your portfolio more resilient.

It takes more than one component to make a car a functional one

Assume your engine, tyres and transmission are the components you need in a car for it to move forward. Similarly, you need different types of asset classes in order for your investment portfolio to bring the desired returns to you.

There’s no set of rules on which assets you need to be invested in to make sure your portfolio is good for retirement. But usually, due to the behaviour of each financial asset, a ‘functional’ vehicle is when there is a combination of financial instruments that complements one another well through any market weather.

For instance, if your retirement goal is to get regular passive income, investing only in one high growth equity fund may not be the best strategy to achieve this goal due to its volatility. Also, most of us know that it is very risky to put all your eggs in one basket.

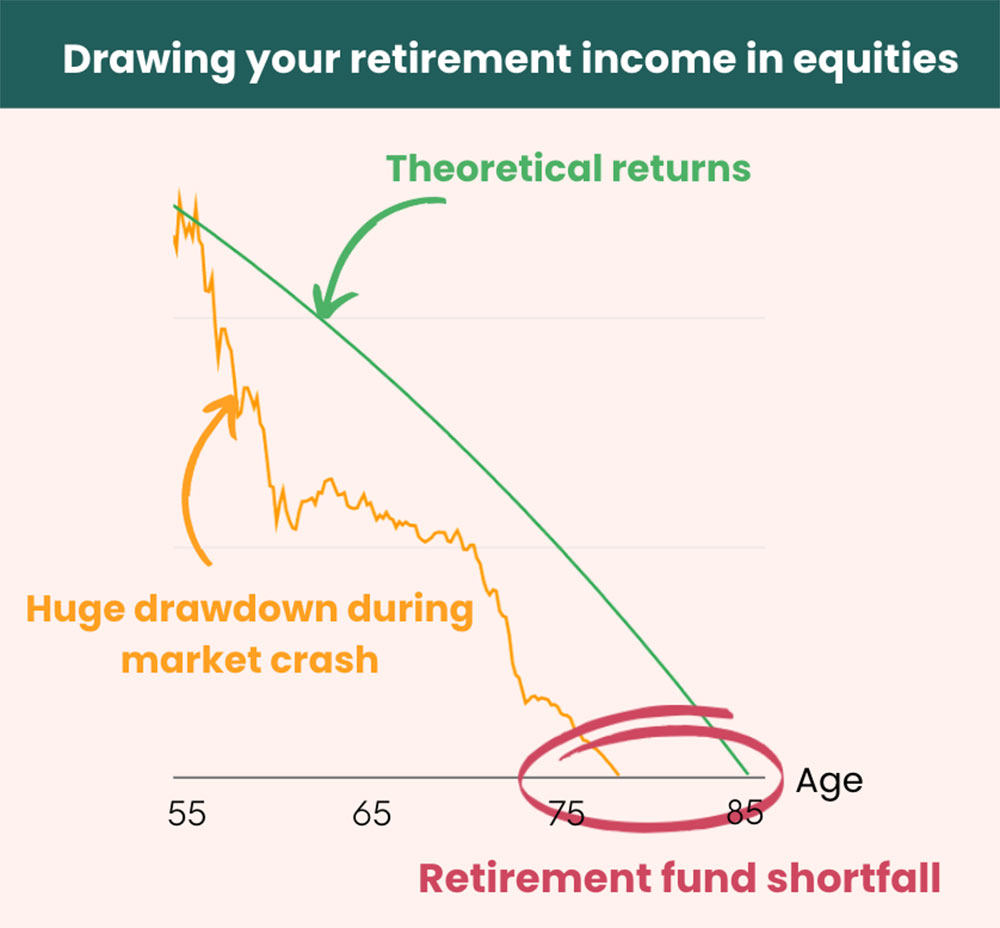

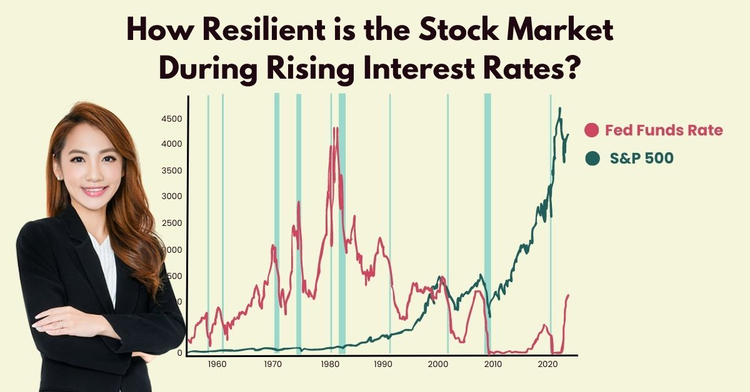

Also, if you are invested in just the stock market alone, are you aware that whenever the stock market crashes, it takes quite a significant amount of time to fully recover?

This might not be suitable for someone who expects a steady income from their retirement portfolio and does not have time to wait out for a market recovery.

It might also result in a shortfall in your retirement fund as you draw out a regular sum for your retirement expenses during a crash.

Hence, ensure that you are well-diversified in the financial assets that you are invested in so your portfolio can move forward to your goal despite any market changes.

Have you strategised how are you going to get there?

So you are all ready to get started for your trip — how do you get there? Usually, you will rely on maps like Google Maps to get the direction to your dream destination.

The same goes for investing for retirement. You have to make sure that your portfolio is going in the right direction — which is to retire comfortably without having to worry about money.

To do this, you have to craft your investment portfolio in the right direction by having the right asset allocation that matches your expected goals and risk appetite. This varies for each individual.

This way, you are investing with clear intentions.

For example, if you have a wider time horizon, you might be able to consider a more aggressive mix of assets. This type of asset allocation is great for people who are comfortable taking on more risks and their goal is to accumulate wealth, such as having a portfolio that leans more heavily toward equities, for example.

On the other hand, if your time horizon is relatively short (especially if you are retiring soon) and you are looking for steady passive income over time, you might not be too comfortable taking more risks. You may prefer a more conservative asset allocation, such as one that leans more heavily towards fixed income.

Proper asset allocation is key in determining whether your investment strategy is tailored to potentially achieve your goals.

You must regularly assess the safety measures of your vehicle for the long road ahead

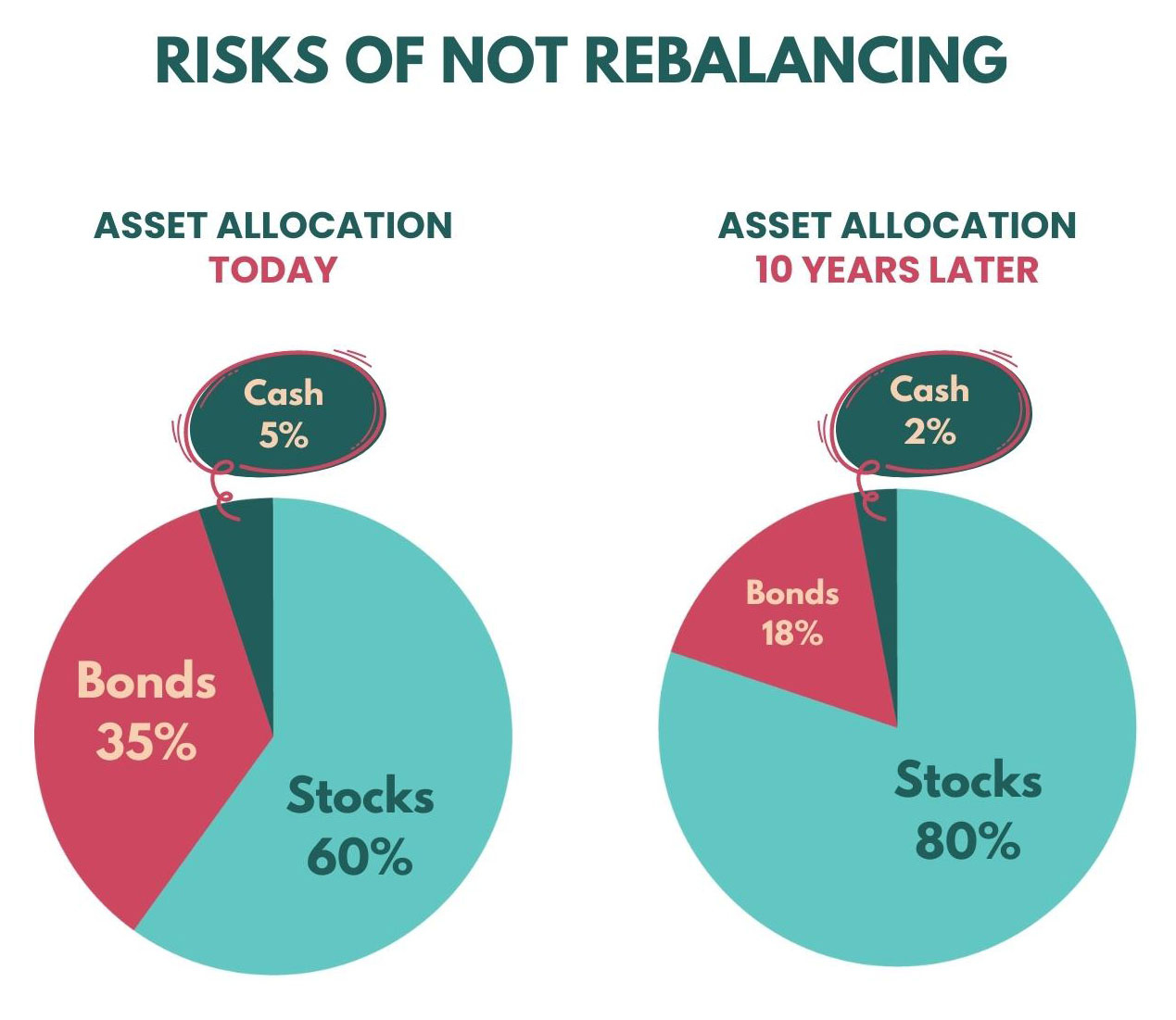

Furthermore, the safety measures in a car like brake pads, wipers and lights are the risk management elements in investment. This will be the act of rebalancing your portfolio — you will use it when you are facing any obstacle.

Rebalancing your portfolio regularly is important to make sure that your investments are still en route to your goals and that you are not losing too much money along the way.

Over time, the assets that you had invested in will perform at different rates. This may cause one to perform better than the other at different points in time. As a result, this might pose unnecessary risks to you.

As seen in the diagram above, your equities portion might grow at a faster rate than the other assets. This position might no longer be aligned with your risk appetite, as you are now more susceptible to the stock market’s volatility. You should always manage them regularly so you are not sidetracked by any market changes.

If no rebalancing is done, you might be holding a more aggressive portfolio than you can handle.

The concept of making your portfolio more resilient isn’t about making the biggest profits. It is about making regular adjustments and taking necessary actions in making sure you are on track to reach your financial objectives.

Get a skilled guide so you can reach your destination without worry

Do you usually consult a tour guide when you travel to someplace new?

Some will consider this as professional guides are more familiar with the place than you are. They might provide you with insights about the area and share the hidden gems you can check out.

Getting a skilled guide to bring you to your destination really helps to take away your worries during travelling. In planning for retirement, this applies the same. A professional in this area would be able to guide you through your retirement journey.

As a professional with more than 8 years of experience in the financial industry, I can say that the trick of the trade is knowing how to invest strategically to help my clients potentially retire earlier, without needing them to manage their own investments.

I have worked with more than 100 mass affluent families to help them be on track to potentially retire 10-15 years earlier. And I can also help you do the same.

Delaying your retirement despite having multiple assets?

What is lacking is a sound strategy with the latest solutions to optimise your assets, so you can receive multiple passive income streams. Get a complimentary consultation session now (for qualified applicants only).

Further Reading

High interest rates in 2023? What are the opportunity costs if you go for short-term returns?

Retirement planning, income investing, Passive income, Investment

With current high interest rates, is it a good time to grow your cash through opportunities that can generate short-term payouts? What are the potential risks?

Copyright © 2022 TheFinLens by Jasmine Siah. All rights reserved.