Post US-election euphoria: Should you wait or enter now?

Investment, Passive income, Retirement planning, SRS • 2024-11-22

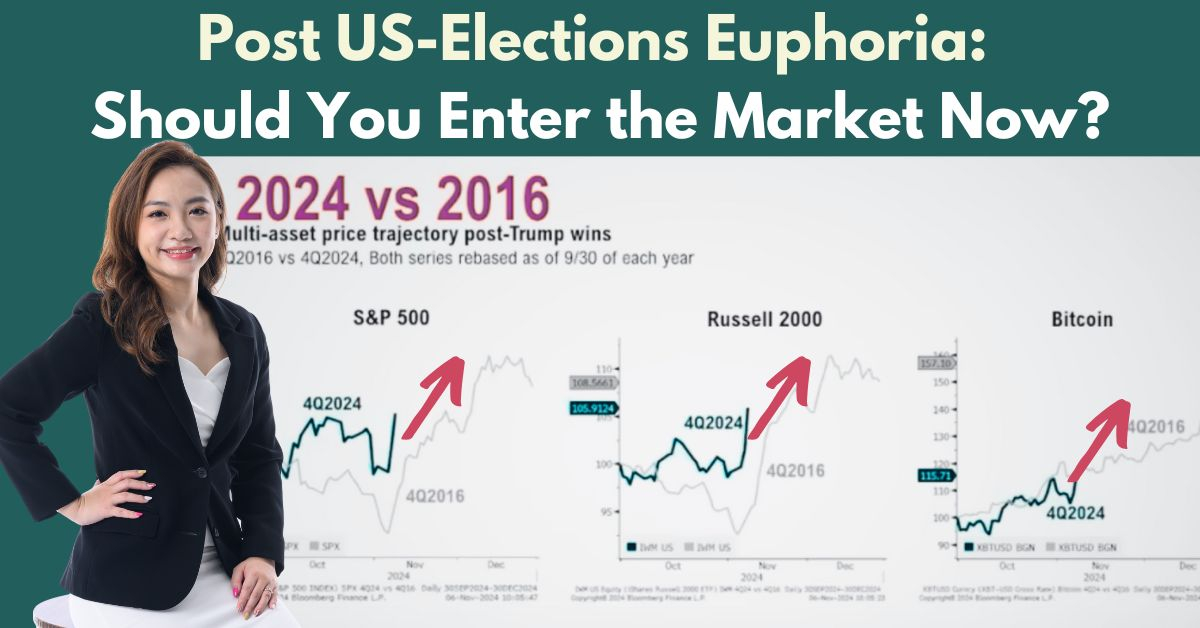

Many of you might have noticed that the US stock market soared to an all-time high after the US elections earlier in November.

Some investors might have concerns on Trump’s proposed import tariffs and their potential harmful effects on the US economy. The impact of trade uncertainty could also cause a larger economic hit than the tariffs themselves.

While generally Trump’s proposed policies such as tax cuts would be beneficial for corporate businesses, there are also concerns that they might result in higher inflation, which could potentially affect Fed’s rate cuts.

Antitrust regulation might be more relaxed, which could potentially increase mergers and acquisitions.

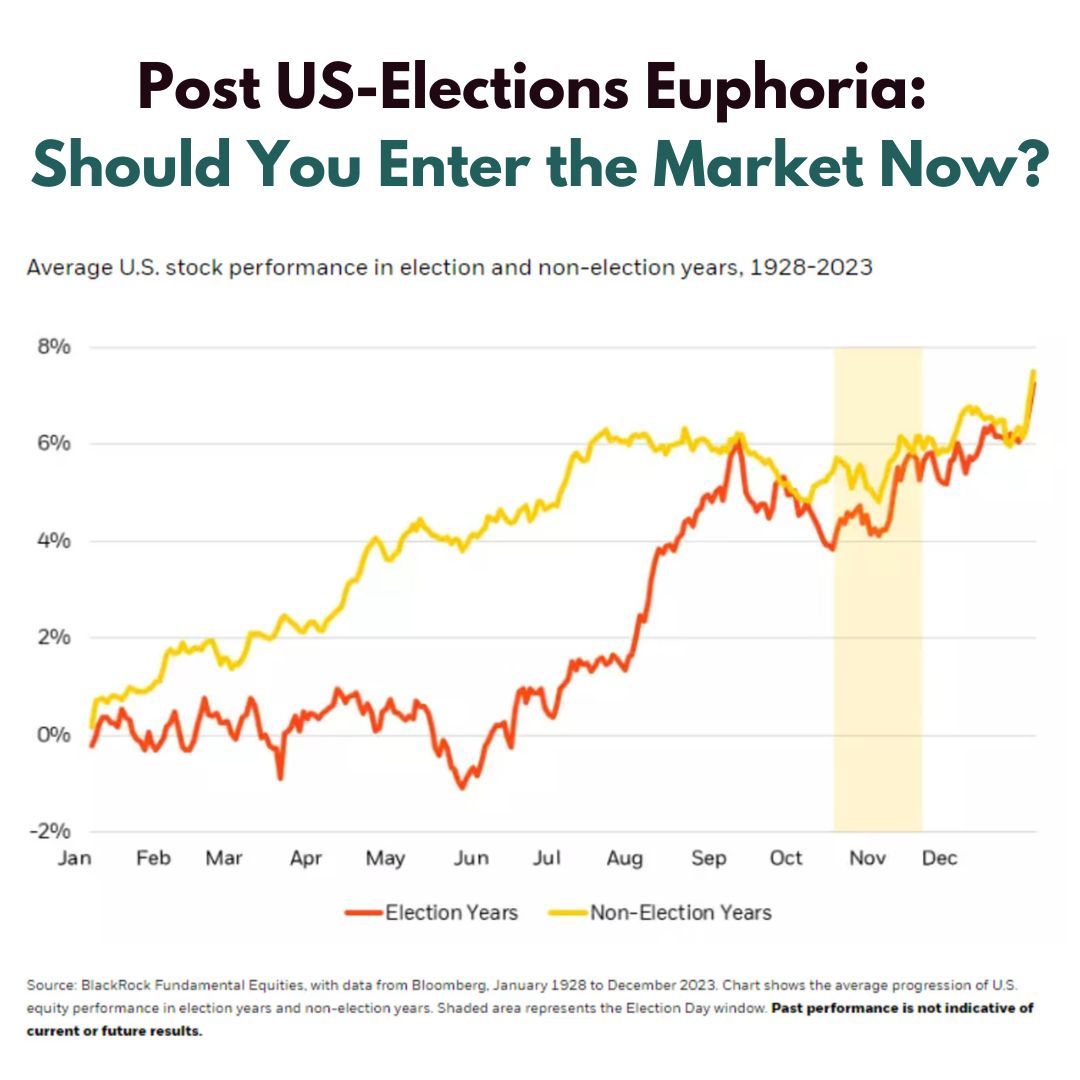

In general, although the stock market tends to be a bit more volatile during election years, especially before the elections, it is now relatively rational and could continue to rise.

In fact, Goldman Sachs projected that the S&P 500 could potentially climb by around 9% in the next 12 months.

For those of you who might be holding cash and waiting for the right moment, often, there is no “right” time to enter especially when it comes to long-term investments.

What’s crucial is using the right strategy at the right time.

If you are waiting for the CPF SA closure in January 2025 before taking action, we have upcoming opportunities coming up.

We also have an exclusive offer right now:

You can potentially save up to $3,060 in taxes this year and have the opportunity to earn annualised 10% p.a.* if you invest in an SRS-eligible fund with us.

To find out more, simply reach out to me at 96938745 or [email protected].

Disclaimer: This post represents our personal views and opinions and is neither associated with any organisation nor reflect the position of any organisation. This content is also only for informative purposes and should not be construed as financial advice. Past performance does not necessarily equate to future performance. Please seek advice from a Financial Adviser Representative before making any investment decisions.

Delaying your retirement despite having multiple assets?

What is lacking is a sound strategy with the latest solutions to optimise your assets, so you can receive multiple passive income streams. Get a complimentary consultation session now (for qualified applicants only).

Further Reading

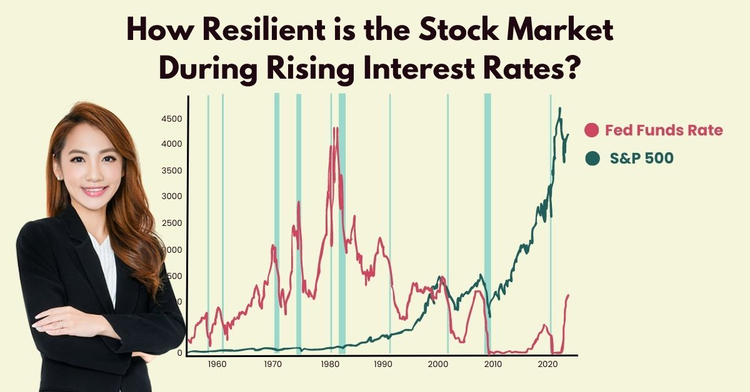

High interest rates in 2023? What are the opportunity costs if you go for short-term returns?

Retirement planning, income investing, Passive income, Investment

With current high interest rates, is it a good time to grow your cash through opportunities that can generate short-term payouts? What are the potential risks?

Copyright © 2022 TheFinLens by Jasmine Siah. All rights reserved.