How to potentially achieve 6-figure retirement fund and leave a recession-resilient legacy

Without taking higher risks and giving up your time to invest on your own

/nav

Get a complimentary financial consultation with me today (worth $1,000). Approved applications only.

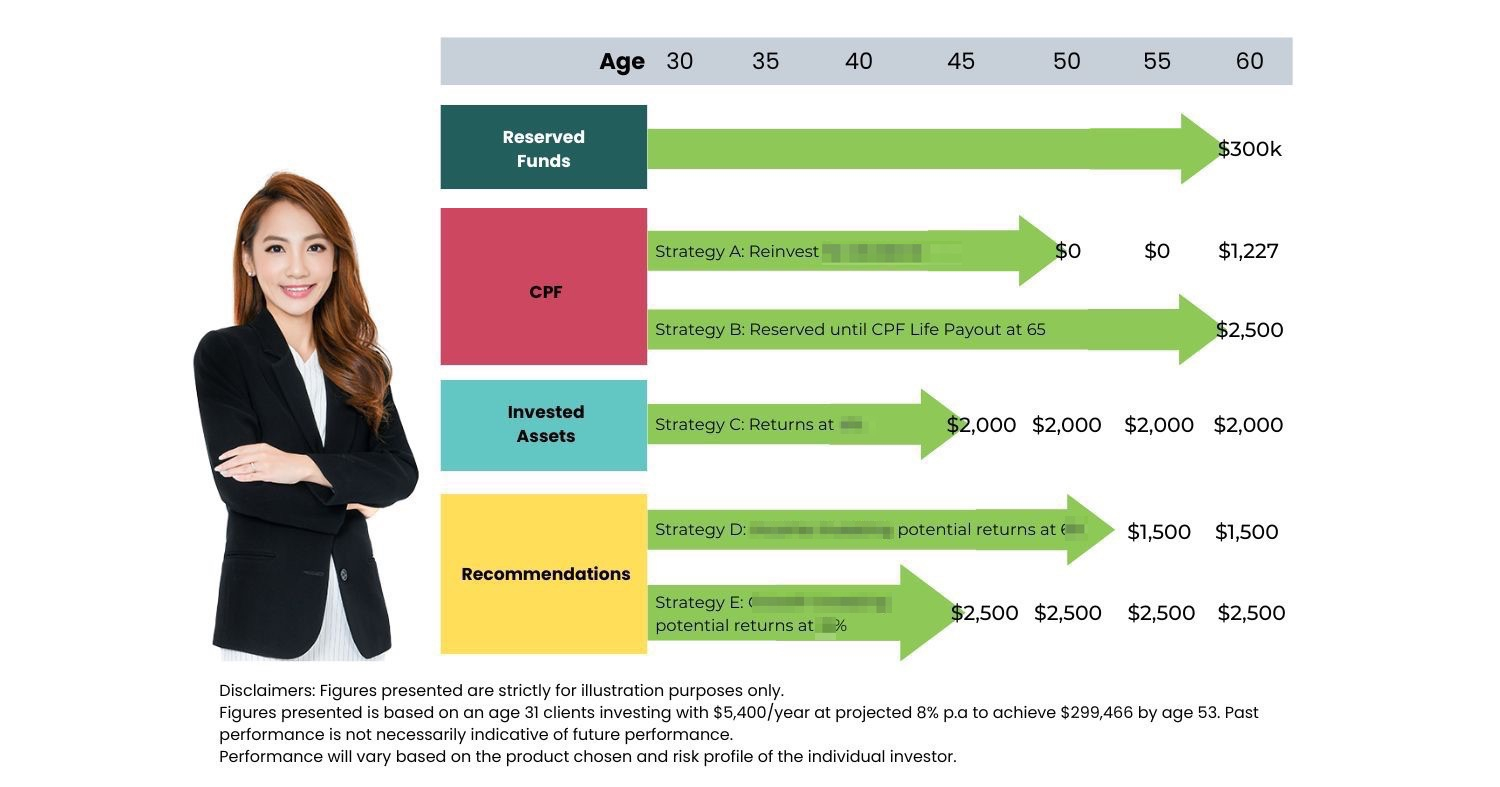

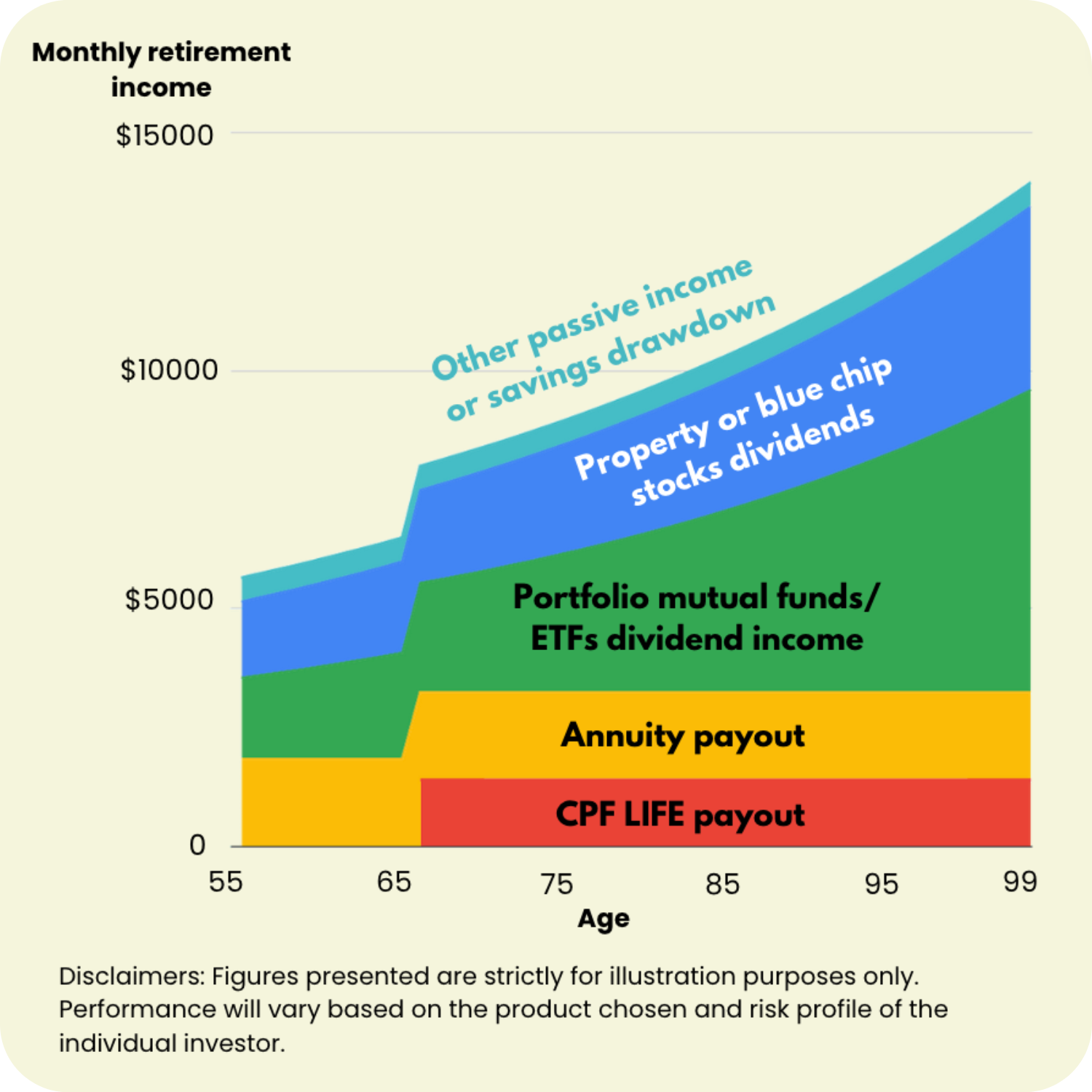

Invest and grow multiple income streams using this recession-resilient framework

Here's how I helped one of my clients create multiple income streams by making her money work harder for her.

She's 40 years old, and by the time she retires, she can enjoy a monthly retirement income of around $23,000.

Here’s how I helped George to optimise his portfolio

George, Managing Director of an e-commerce firm

Before getting to know me:

- George had taken up a $2 million premium plan with a leveraged annuity from the bank.

- This annuity comes with a USD interest rate.

- George was afraid of the interest rate hike as well as potentially over-leveraging.

- He was unsure if he could pay off the loan in the short term, especially if the interest rate rises.

- Although he was keen to invest, he does not know which funds he should invest in

- He also does not want to spend too much time figuring out what to do.

After I understood George’s concerns:

- I helped him invest in funds that can potentially achieve annualised returns of 10%, to offset the risk of an interest rate hike.

- I also advised him on what he could do in order to withdraw profit from the investment (whenever necessary) to pay off the loan or interest rate hikes.

- That way, I helped him grow his wealth holistically and managed his risks

- He appreciated and greatly valued this help and advice, which he previously did not receive

- George also subsequently referred his sister to me to help her invest her SRS.

Why work with Jasmine Siah?

Hi, I am Jasmine Siah, a Chartered Financial Consultant (ChFC®) and Retirement Wealth Specialist (representative of SingCapital Pte Ltd). I’m recognised as one of the top 1% in the financial services industry - having achieved Top of the Table ®(MDRT) in 2020, 2021, and 2022.

I am on a mission to help high-income individuals grow their wealth and retire like the top 1%. My clients value me as a one-stop consultant who can help them uncover the gaps in their existing portfolios and use the latest solutions to close those gaps

Over the past 8 years, I have worked with more than 100 mass affluent families to help them be on track to retire 10-15 years earlier with my recession-resilient income investing strategy.

Why work with Jasmine Siah?

Hi, I am Jasmine Siah, a Chartered Financial Consultant (ChFC®) and Retirement Wealth Specialist. I’m recognised as one of the top 1% in the financial services industry - having achieved Top of the Table ®(MDRT) in 2020, 2021, and 2022.

I am on a mission to help high-income individuals grow their wealth and retire like the top 1%. My clients value me as a one-stop consultant who can help them uncover the gaps in their existing portfolios and use the latest solutions to close those gaps

Over the past 8 years, I have worked with more than 100 mass affluent families to help them be on track to retire 10-15 years earlier with my recession-resilient income investing strategy.

Delaying your retirement despite having multiple assets?

⚠️ Many Singaporeans are actually asset-rich but lack strategy to generate multiple income streams.

⚠️ Many people don’t have an effective framework to preserve and grow their wealth for their loved ones.

⚠️ Their existing plans are not effectively optimised to provide enough passive income for a comfortable retirement.

⚠️ Many are either too busy to manage their own existing portfolios or find it daunting to reallocate their assets with changing needs for better returns.

Are your CPF Full Retirement Sum payouts of $1,500+ a month actually enough for you to retire in comfort?

With rising inflation and costs, how long can your retirement sum actually last?

What is lacking is a sound strategy to optimise your assets

You are NOT looking for someone who:

✖️ Just sells you a plan and does not review it regularly according to your changing needs and latest economic climate

✖️ Don’t have an effective investment framework to help you grow your wealth and hedge your risks in the long run.

✖️ May not be able to give you an unbiased and holistic comparison of a variety of accessible funds in the market

✖️ Is just another ‘guru’ sharing a secret investment framework that you have to DIY.

I help you earn your potential 6-figure retirement using a multiple-passive-income strategy

Here’s how I can help you optimise your wealth and generate several streams of income so you can retire like the top 1%:

Dividend Income Investing

I help you acquire income-generating assets while preserving your capital.

Growth Investing

With our Fundamental, Technical and Quantitative (FTQ) methodology, we build your retirement capital with a recession-resilient portfolio.

Multigenerational Wealth Strategy

Restructure your assets to ensure sustainable wealth growth for your loved ones.

Delaying your retirement despite having multiple assets?

Get a complimentary consultation session and we will map out your multi-income stream plan. (for qualified applicants only)

Here’s what some of my top clients have to say

Check out my awards and reviews →

Like these clients, I can help you achieve your financial goals and potentially retire 10-15 years earlier.

Retire like the top 1% with a 6-figure retirement fund.

Services I provide to my clients

- Wealth Accumulation: Retirement planning, growing passive income, investment planning, etc.

- Wealth Protection: Health and life insurance, critical illness plans, long term care planning, mortgage term planning and more.

- Wealth Preservation: SRS investing, other capital preservation strategies

- Wealth Distribution: Legacy planning, distribution of wealth, estate planning and more

Keen to grow multiple passive income streams and retire like the top 1%?

Get a complimentary financial consultation session (worth $1,000). Approved applications only.

Disclaimer: Figures and case studies mentioned are for illustration purposes only. Past performance is not necessarily indicative of future performance. Performance will vary based on the product chosen and the risk profile of the individual investor. Please seek advice from a Financial Adviser Representative before making any investment decisions.

1 Kim Seng Promenade Great World City, Office East, Tower 12-06, Singapore 237994

Copyright © 2024 TheFinLens by Jasmine Siah, is a group of Financial Adviser Representatives representing SingCapital Pte Ltd. All rights reserved.

Managed by Agency T Pte Ltd

Find something wrong? Reach out for technical support.