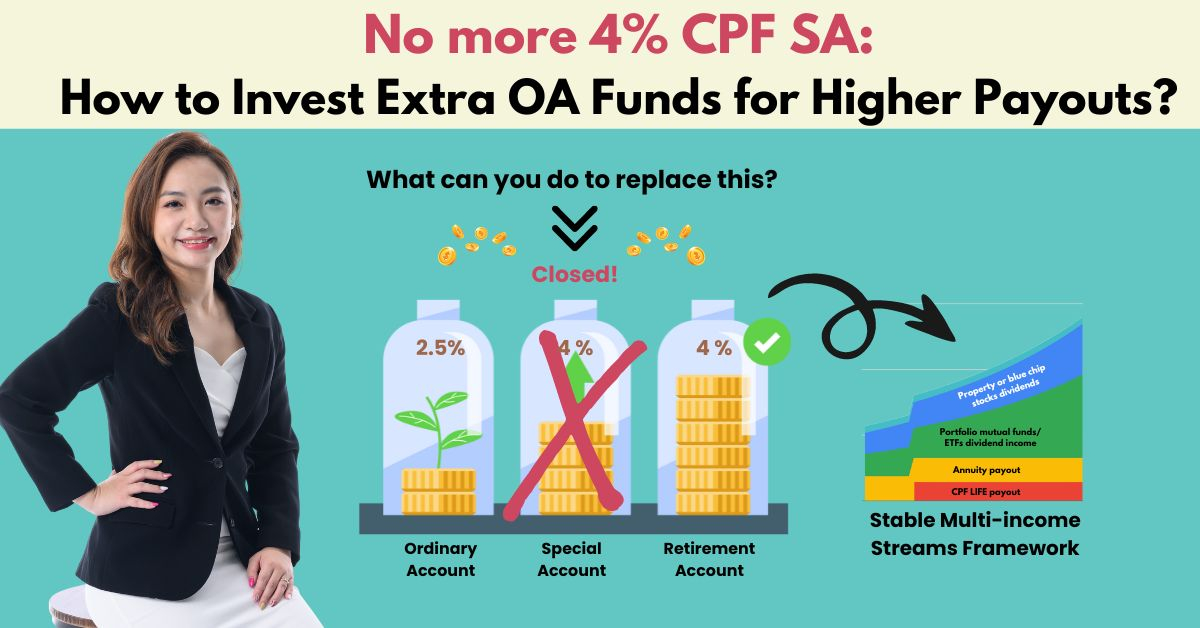

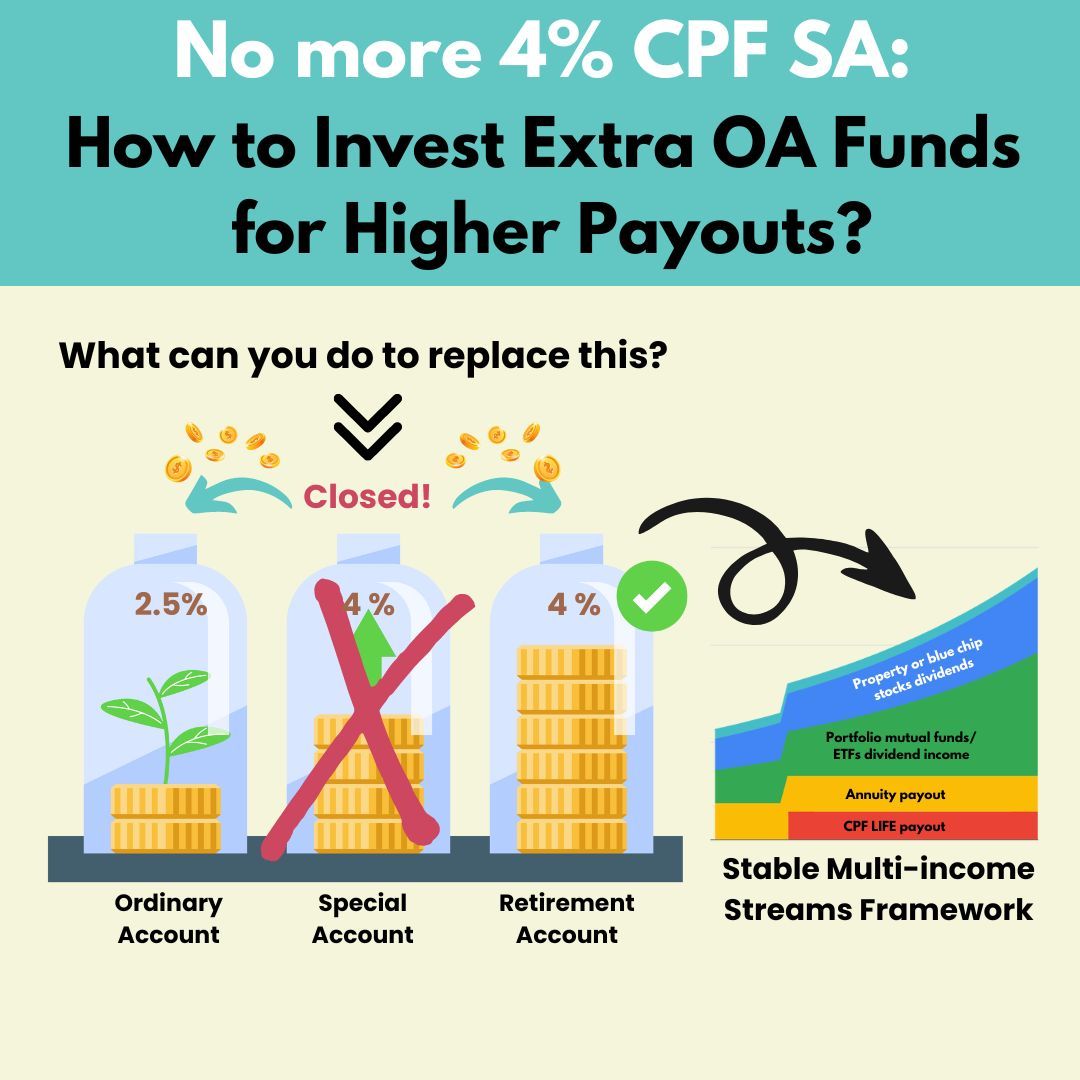

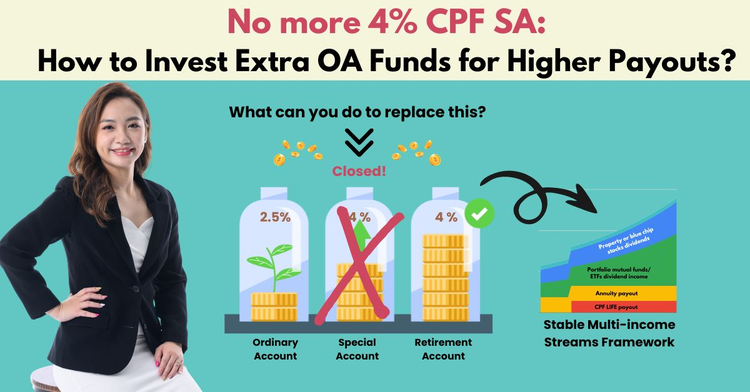

No more 4% interest from CPF Special Account: How can pre-retirees invest Ordinary Account funds for higher payouts?

Investment, Retirement planning, CPF, Wealth preservation • 2024-03-14

Pre-retirees, what can you do now to optimise your CPF returns?

Have you been investing monies from your CPF Special Account (SA) to optimise your gains, while enjoying the 4% interest rates and withdrawal flexibility?

Now that the SA will be closed for those age 55 and above in 2025, many people are trying to find alternative strategies to optimise their CPF monies.

With the upcoming SA closure, the proceeds from your CPF SA investments (after they are sold or reach maturity) will be paid into your Retirement Account (RA), which can’t be withdrawn but will give you monthly payouts upon retirement.

And if you meet the Full Retirement Sum in the RA, the excess monies will then go to the Ordinary Account (OA), where interest rate is at 2.5%.

For those of you who are willing to take a higher risk to potentially optimise your returns, instead of enjoying the 2.5% OA interest, what could be some alternative strategies you can look out for?

If you look around, many banks are now offering interest rates above the OA rate of 2.5% with other rewards, especially for senior citizens, to tempt you to move your monies to their fixed deposits or savings accounts.

These generally offer interest yields of above 3%, while some even offering up to more than 7% provided the monies are locked in for more than 2 years.

Singapore Savings Bonds and T-bills similarly offer higher rates ranging from 2.7% to 3.6%.

But are these payouts enough to cover increasing costs of living and healthcare?

Although Singapore’s inflation has now dropped to 2.9% (Jan 2024), how can we expect inflation to remain low throughout our retirement years?

As a Chartered Financial Consultant (ChFC®) recognised as one of the top 1% in the financial services industry, I have been helping pre-retirees grow and preserve their wealth for the past 9 years.

By helping them to optimise their assets, my mass affluent clients have been able (and are on track) to retire comfortably with stable lifetime payouts.

If you are keen to find out more, do reach out to me.

I will discuss with you how you can:

✔️ Preserve your wealth by optimising your assets through risk-managed portfolio investing

✔️ Receive steady multi-income streams for retirement that can combat inflation and weather interest rate risks

✔️ Leave a legacy for your loved ones while having a comfortable retirement

Simply reach out to me through this short application here and I will be in touch.

Disclaimer: This post represents our personal views and opinions and is neither associated with any organisation nor reflect the position of any organisation. This content is also only for informative purposes and should not be construed as financial advice. Past performance does not necessarily equate to future performance. Please seek advice from a Financial Adviser Representative before making any investment decisions.

Delaying your retirement despite having multiple assets?

What is lacking is a sound strategy with the latest solutions to optimise your assets, so you can receive multiple passive income streams. Get a complimentary consultation session now (for qualified applicants only).

The information in this article is meant for general information purposes only and does not constitute financial advice. Past performance is not necessarily indicative of future performance. Please consult your Financial Adviser Representative before making any investment decisions.

Further Reading

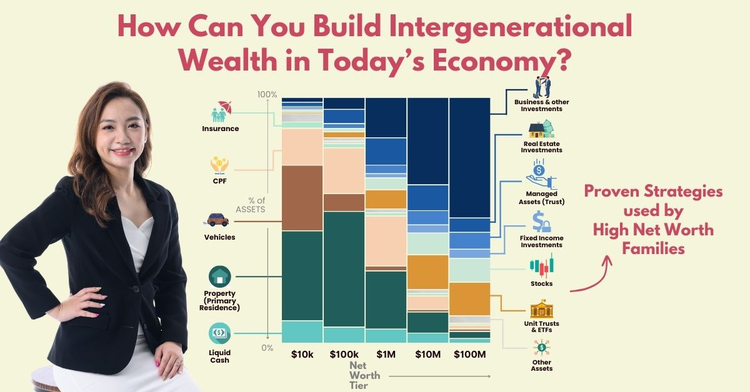

Can you still build intergenerational wealth in today’s economy?

Intergenerational wealth, Wealth preservation, Legacy planning, Estate planning

With rising costs of living, increasing mortgages and high interest rates, it’s getting tougher for the younger generation to build their wealth as compared to before. How can we help our children protect and grow their wealth, so they can thrive in today’s economy?

Copyright © 2022 TheFinLens by Jasmine Siah. All rights reserved.