Market at all-time high? Will it crash soon – time to buy?

Recession, Investment, Wealth preservation, income investing • 2024-02-20

If you have been keeping a close eye on the market, you might have noticed that S&P 500 is now at an all-time high.

Similarly, NASDAQ has also been going up.

The market has reacted positively after Fed announced that they foresee three rate cuts this year.

But would it continue to go up after this initial euphoria?

U.S. inflation dropped to 3.1% in January 2024, down from 3.7% in September 2023, while unemployment rate is still low at 3.7% in January.

Additionally, U.S. GDP growth has gone up to 4.9% in 2023 Q3.

According to Bloomberg, investors have been stockpiling cash – more than $8.3 trillion of cash were held in money market funds as at November 2023.

Investors are waiting for the right moment to enter the market, and these positive signals could encourage them to do so.

This could cause the market to continue on an upward trend.

Sources: Trading Economics, Finviz

However, we also notice that on the other hand…

Savings rates decreased to 4.1% in November, from 5.3% in May 2023.

People are spending more on expensive luxury experiences, as they worry that they may not be able to do so later.

US household debt and credit card debt have also gone up.

Delinquency rates on credit card loans are up to 2.98% in Q3 2023, compared to 2.08% in Q3 2022.

This could lead to more defaults and a reduction in spending, causing the economy to slow down.

Employers in the U.S. have also slowed their hiring late last year.

And although inflation has fallen, it is still not at the 2% target the Fed has set.

So it seems like in 2024, we could be seeing the delayed impact of the interest rate hikes in 2023, as it could take 12 months to see its widespread impact on the economy.

Given these signals, some investors speculate that the market could crash.

With so much uncertainty, how can you best capture the current opportunities in the market?

As a Chartered Financial Consultant (ChFC®) recognised as one of the top 1% in the financial services industry, I will usually keep abreast of the latest changes in the market and share these firsthand with my clients.

This is so that I can adjust their portfolio based on their needs and the ever-changing economic climate.

Many of them are still on track to receiving stable lifetime payouts without needing to worry about economic uncertainties.

If you are keen to find out more about what you can do to capitalise on current market sentiments, reach out to me through this short application here and I will be in touch.

Disclaimer: This post represents our personal views and opinions and is neither associated with any organisation nor reflect the position of any organisation. This content is also only for informative purposes and should not be construed as financial advice. Past performance does not necessarily equate to future performance. Please seek advice from a Financial Adviser Representative before making any investment decisions.

Delaying your retirement despite having multiple assets?

What is lacking is a sound strategy with the latest solutions to optimise your assets, so you can receive multiple passive income streams. Get a complimentary consultation session now (for qualified applicants only).

The information in this article is meant for general information purposes only and does not constitute financial advice. Past performance is not necessarily indicative of future performance. Please consult your Financial Adviser Representative before making any investment decisions.

Further Reading

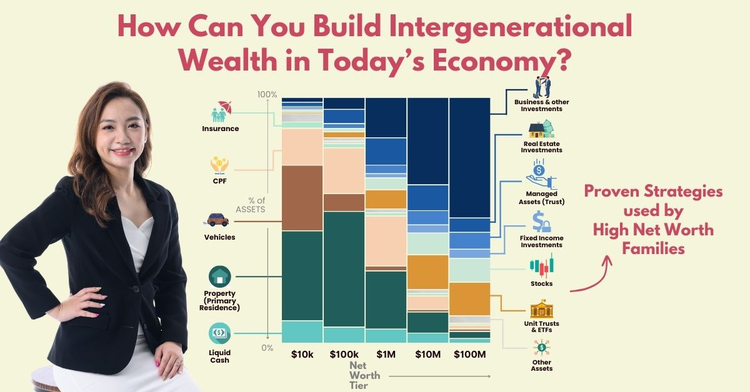

Can you still build intergenerational wealth in today’s economy?

Intergenerational wealth, Wealth preservation, Legacy planning, Estate planning

With rising costs of living, increasing mortgages and high interest rates, it’s getting tougher for the younger generation to build their wealth as compared to before. How can we help our children protect and grow their wealth, so they can thrive in today’s economy?

Copyright © 2022 TheFinLens by Jasmine Siah. All rights reserved.