High interest yields? How much is enough to cover increasing mortgages?

Retirement planning, Investment, Passive income, Property investment, Wealth preservation, income investing • 2023-11-24

With the stock market moving sideways and falling bond prices, people have been looking for a “safe haven” to park their extra cash.

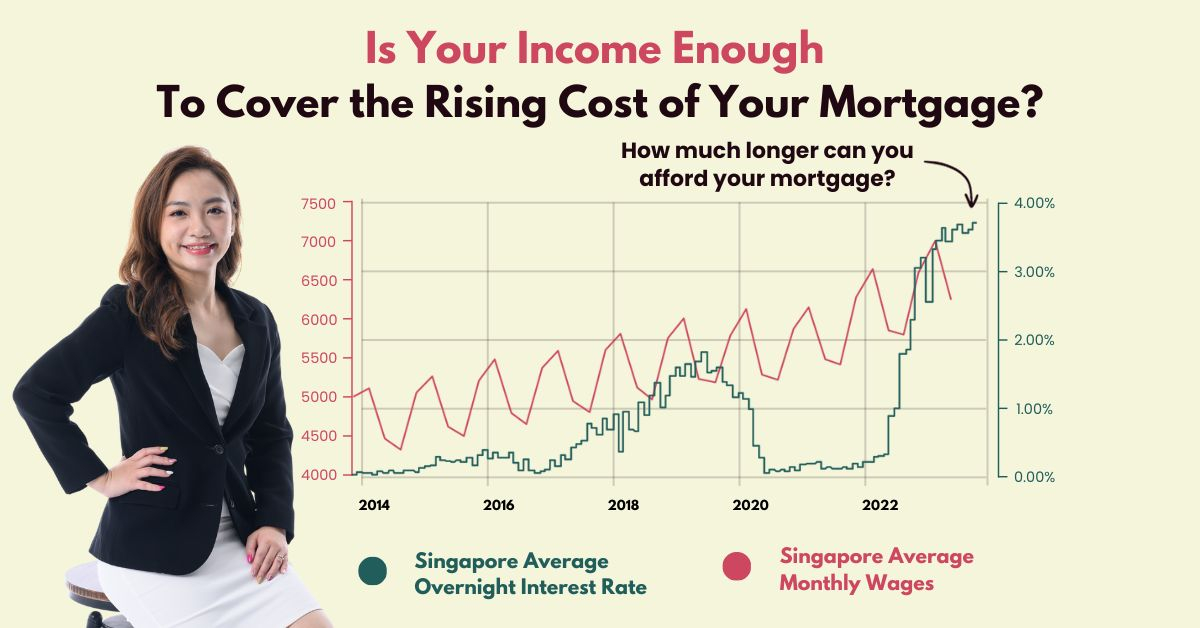

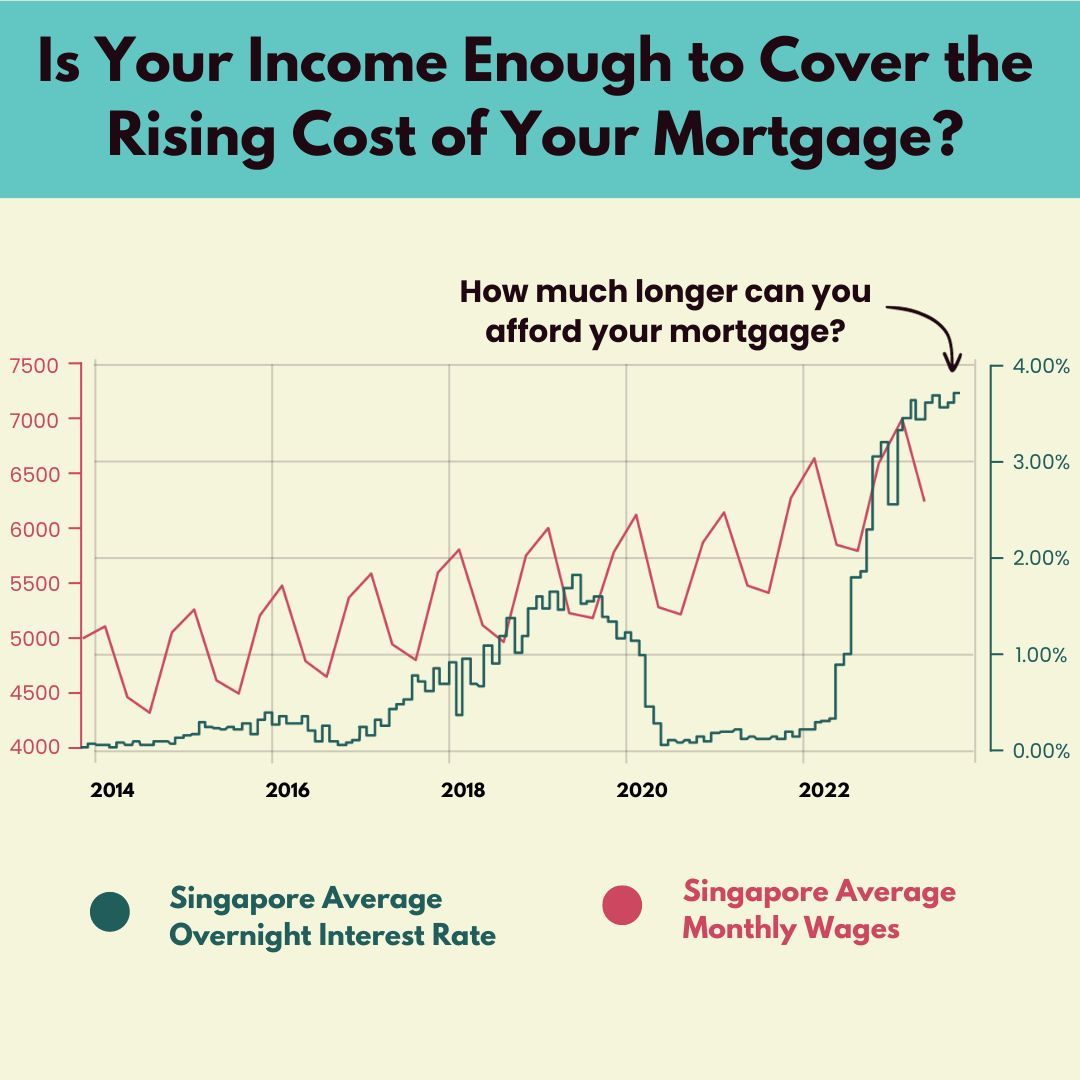

Some popular instruments include fixed deposits, high-interest yield savings accounts, Money Market Funds, and so on, given that the Singapore Average Overnight Interest Rate (SORA) is hovering at around 3.5 to 4%.

These are relatively shorter-term, lower-risk solutions during this period of uncertainty.

With inflation in Singapore edging up to 4.7% in October, many people know that in the current economic climate, their interest payouts are often not enough to beat inflation.

On top of this, the increasing cost of home loans is a challenge for many.

Can your annual increase in wages cover the increasing cost of mortgages?

And what if one day, the unexpected happens and you find yourself stretched to repay your home loans?

How can you better protect your family and loved ones from this potential financial burden?

So that they will not lose their home even if the unexpected happens?

Right now, it’s important to know how you can:

✔️ Protect your assets, and

✔️ Preserve your wealth

In the short to mid-term.

For example, asset protection solutions such as mortgage insurance allow you to transfer the risks of your home loan to a third party.

(If you own private property, HDB’s Home Protection Scheme will not be applicable for you – so you will need to source for your own asset protection plan.)

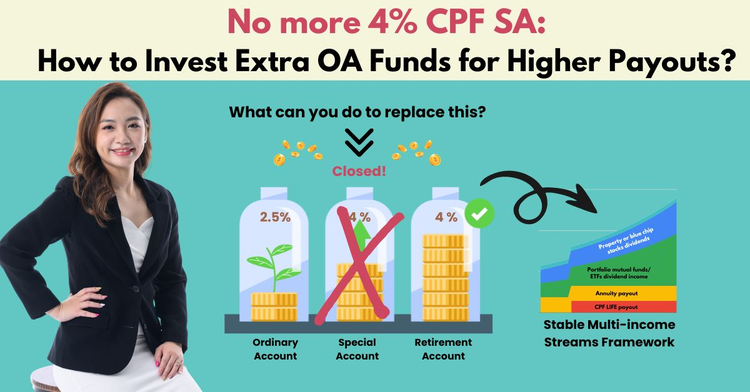

On top of mortgage protection, I also help some of my clients employ strategies like Indexed Universal Life policies (IULs) that can enable them to enjoy returns from the upsides of stock market indices (such as S&P 500) while protecting their money from the downsides.

This means you still get to preserve your principal and receive the guaranteed minimum crediting rate even when the stock market is not doing well.

These are strategies that my clients appreciate during times like these.

As a Chartered Financial Consultant (ChFC®) recognised as one of the top 1% in the financial services industry, I have been using a holistic financial planning approach with my clients for the past 9 years.

This approach is tailor-made according to their needs and the ever-changing economic climate, so that they will always be relevant for them.

Right now, these include asset protection plans, refinancing their home loans, as well as optimising their assets and investments holistically, so they can increase their portfolio’s resilience to interest rate and inflation risks.

Many of them are still on track to receiving stable lifetime payouts (such as for retirement) without needing to worry about economic uncertainties.

And I can also help you do the same.

If you are keen to find out more on how you can protect and preserve your assets using recession-resilient strategies, simply fill up this short application here and I will be in touch.

Disclaimer: This post represents our personal views and opinions and is neither associated with any organisation nor reflect the position of any organisation. This content is also only for informative purposes and should not be construed as financial advice. Past performance does not necessarily equate to future performance. Please seek advice from a Financial Adviser Representative before making any investment decisions.

Delaying your retirement despite having multiple assets?

What is lacking is a sound strategy with the latest solutions to optimise your assets, so you can receive multiple passive income streams. Get a complimentary consultation session now (for qualified applicants only).

The information in this article is meant for general information purposes only and does not constitute financial advice. Past performance is not necessarily indicative of future performance. Please consult your Financial Adviser Representative before making any investment decisions.

Further Reading

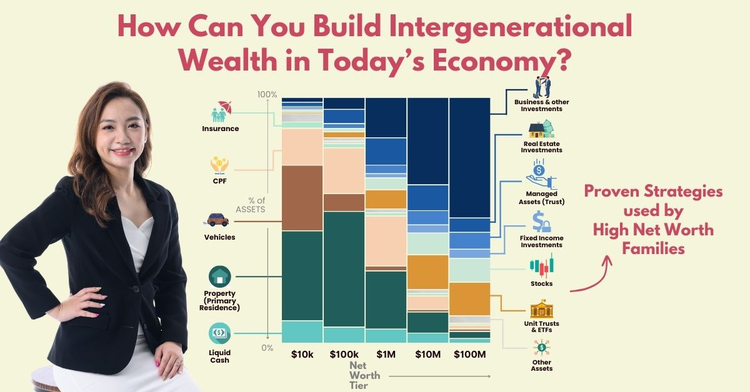

Can you still build intergenerational wealth in today’s economy?

Intergenerational wealth, Wealth preservation, Legacy planning, Estate planning

With rising costs of living, increasing mortgages and high interest rates, it’s getting tougher for the younger generation to build their wealth as compared to before. How can we help our children protect and grow their wealth, so they can thrive in today’s economy?

Copyright © 2022 TheFinLens by Jasmine Siah. All rights reserved.