How to protect your wealth against high interest risk

Wealth preservation, Refinancing, Property investment, Investment • 2023-10-03

“How are you refinancing your home loan?”

You might be able to relate to this current buzz among many Singaporeans, especially if you have secured low fixed rates during 2020-2021 when interest rates were at one of their lowest points.

Those were great times to purchase property with affordable home loans.

Now that the low fixed rate lock-in period is nearly over for many, many people are anxious about the increase in their home loan payments due to the rising interest rates.

Some are scrambling to refinance their loans with the best rates they can find, but generally, you can’t run away from 3-4% at this point.

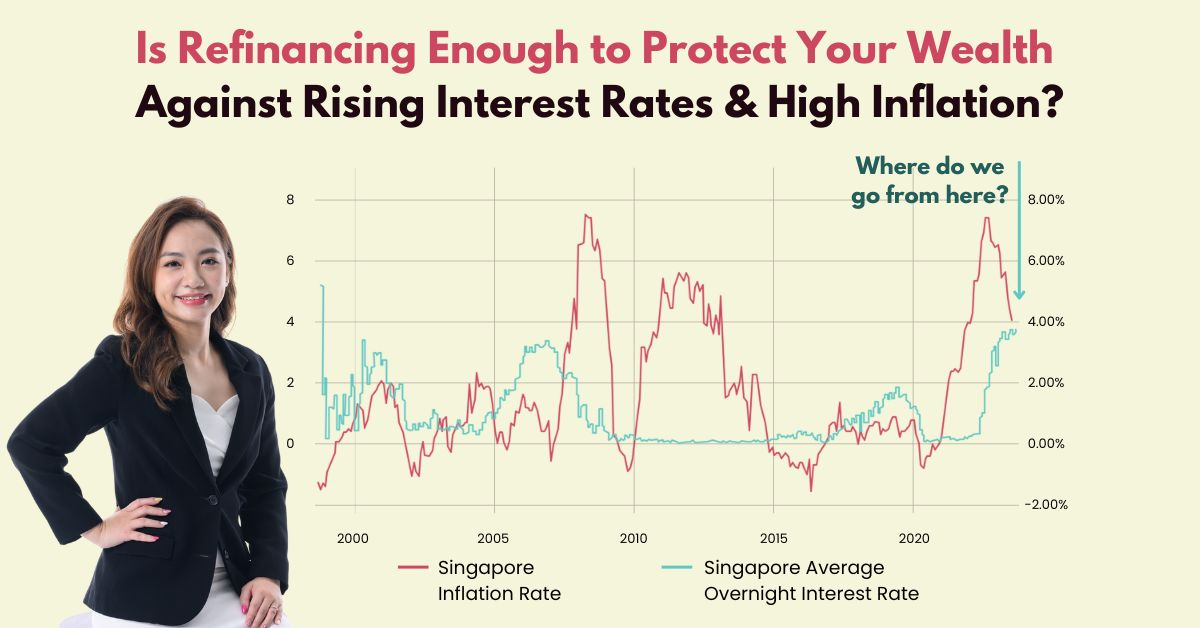

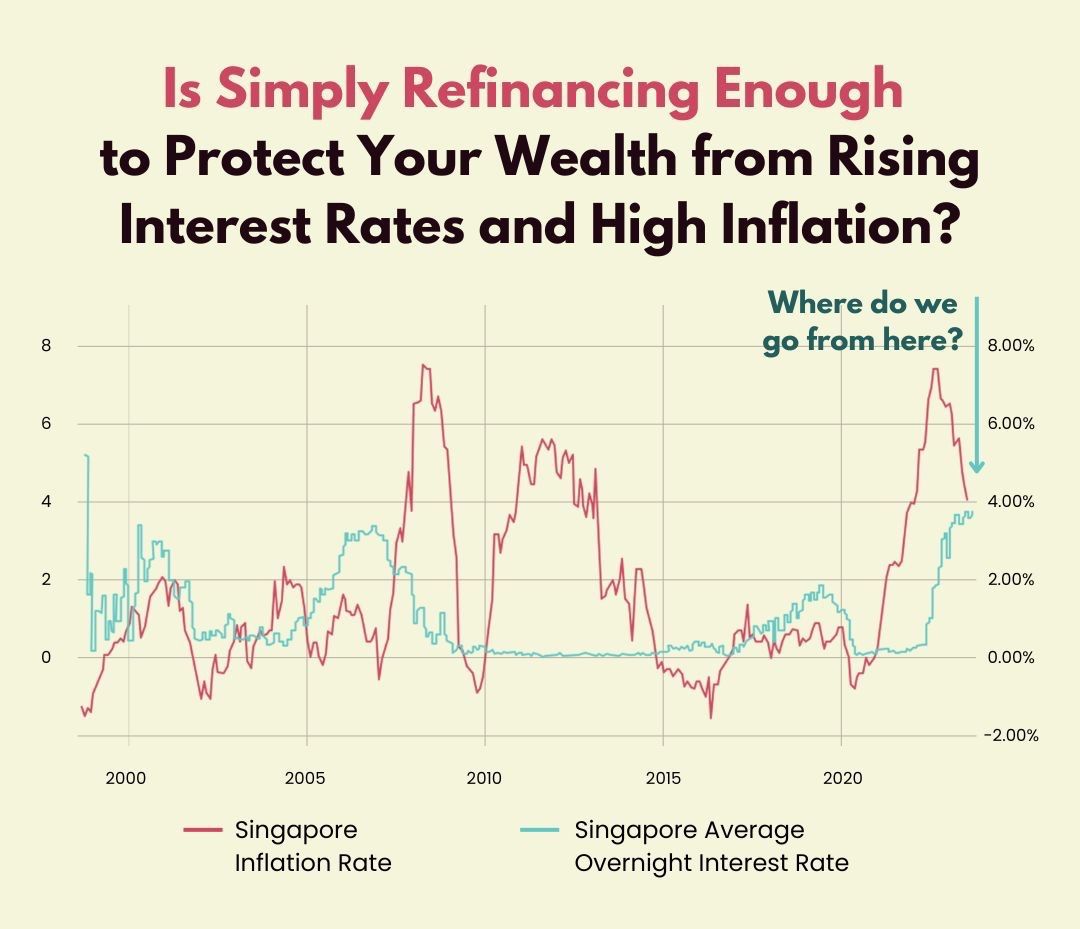

The benchmark interest rate in Singapore (3-month SORA) is 3.77% in September 2023. Meanwhile, Fed Funds Rate continued to rise to 5.25%-5.5% in July.

Coupled with high inflation and rising living costs…

I understand the anxiety and sleepless nights.

Refinancing is important, but if interest rates continue to rise, would just refinancing alone be enough to protect your wealth and assets from having their value eroded by rising interest rates and high inflation?

Sources: Trading Economics

Some might say, “Just get a higher paying job then.”

But how sustainable would it be to job-hop in this economic climate when some industries are already implementing a hiring freeze?

And is it still possible to grow your wealth in this economic climate – even in the short term?

Even when the market appears to be moving sideways too?

Challenging times often call for non-mainstream solutions.

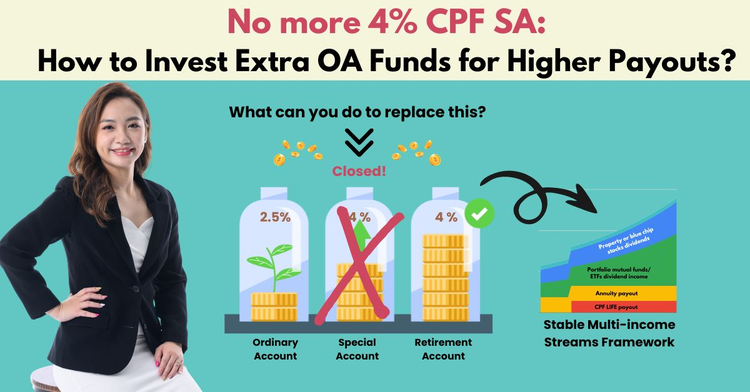

Solutions that can protect their assets from high interest rates, inflation and the volatile market.

I have been working with many of my clients using a holistic financial planning approach – from helping them find the best refinancing plans through mortgage bankers, to using solid strategies that can increase their portfolio’s resilience to interest rate and inflation risks.

This ensures that they are still on track to receiving their desired retirement payouts, and have clarity of their progress without needing to worry about uncertainties in the economic climate.

If you are retiring soon, it’s important to find that sweet spot balancing managing your mortgages, liabilities, wealth growth and wealth preservation strategies – especially during this economic climate.

So you can optimise your wealth, payouts and cash flow, while not compromising on your retirement.

As a Chartered Financial Consultant (ChFC®) and Retirement Wealth Specialist recognised as one of the top 1% in the financial services industry, this is what I have been doing for my mass affluent clients for the past 8 years.

And I can also help you do the same.

If you are keen to find out more about how you can protect, preserve and grow your wealth using holistic recession-resilient strategies, simply fill up this short application here and I will be in touch.

Disclaimer: This post represents our personal views and opinions and is neither associated with any organisation nor reflect the position of any organisation. This content is also only for informative purposes and should not be construed as financial advice. Past performance does not necessarily equate to future performance. Please seek advice from a Financial Adviser Representative before making any investment decisions.

Delaying your retirement despite having multiple assets?

What is lacking is a sound strategy with the latest solutions to optimise your assets, so you can receive multiple passive income streams. Get a complimentary consultation session now (for qualified applicants only).

The information in this article is meant for general information purposes only and does not constitute financial advice. Past performance is not necessarily indicative of future performance. Please consult your Financial Adviser Representative before making any investment decisions.

Further Reading

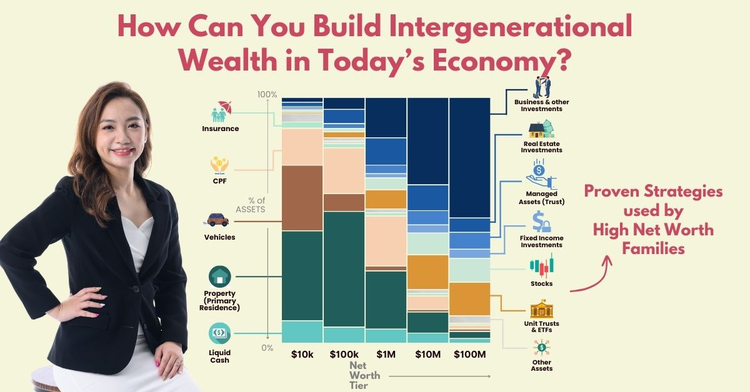

Can you still build intergenerational wealth in today’s economy?

Intergenerational wealth, Wealth preservation, Legacy planning, Estate planning

With rising costs of living, increasing mortgages and high interest rates, it’s getting tougher for the younger generation to build their wealth as compared to before. How can we help our children protect and grow their wealth, so they can thrive in today’s economy?

Copyright © 2022 TheFinLens by Jasmine Siah. All rights reserved.