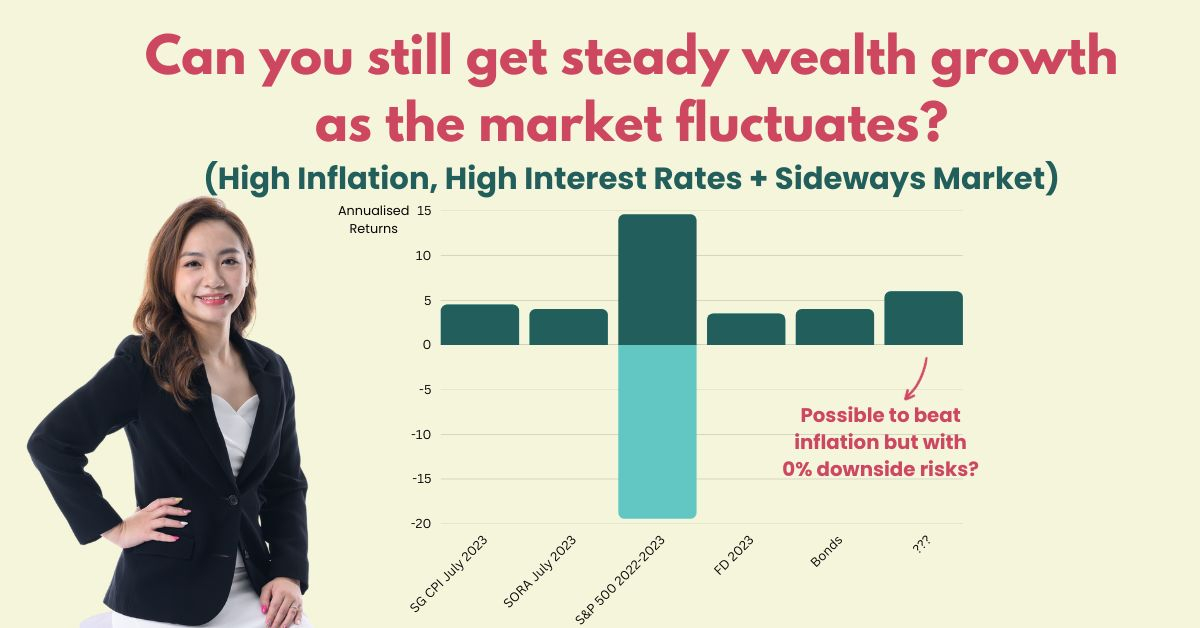

Can you still get steady wealth growth even when the market fluctuates?

Retirement planning, Investment, Passive income, Wealth preservation, Legacy planning • 2023-09-21

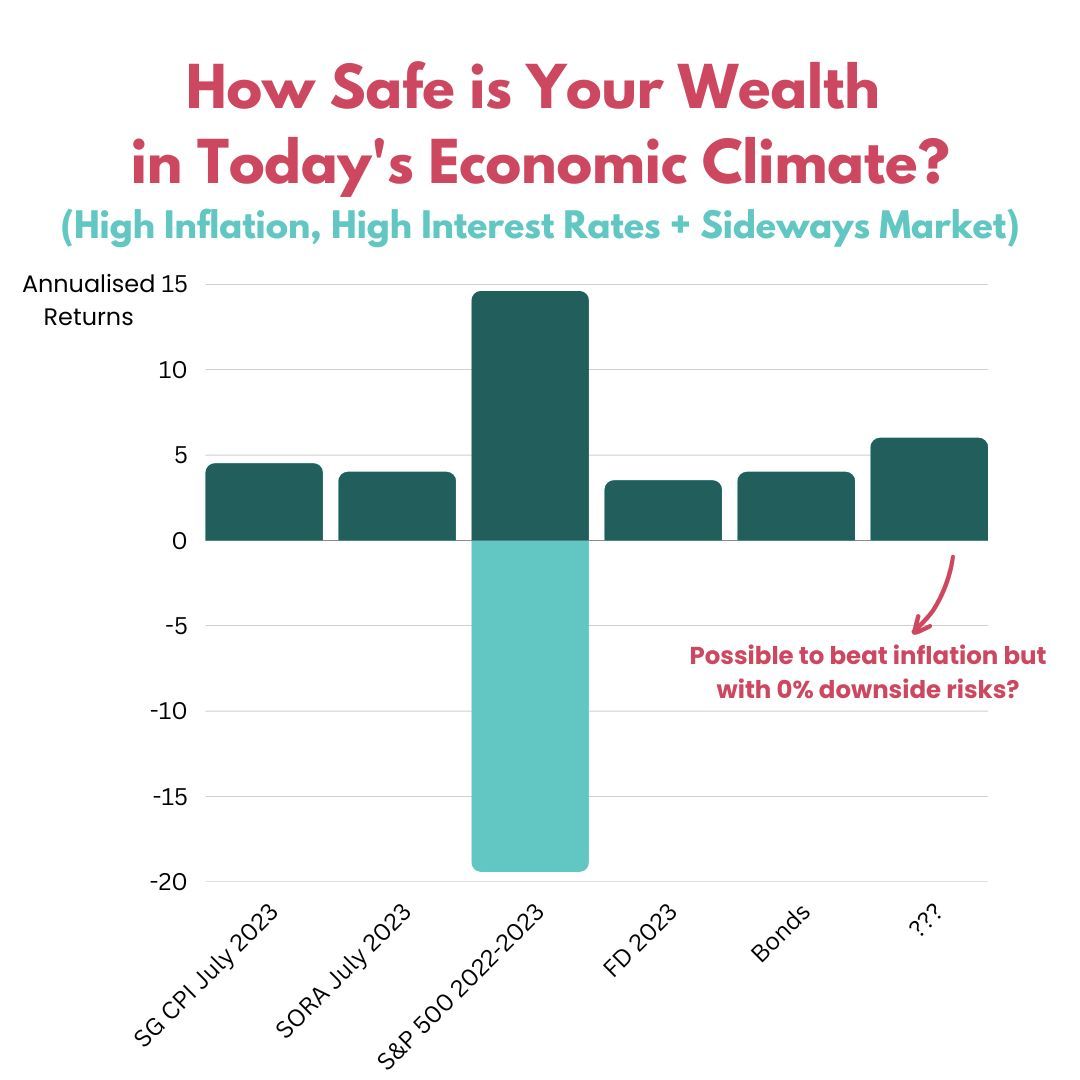

Unless you have been actively trading or entered the market before 2021, many people have been feeling the hard pinch of the market moving sideways, coupled with the double blow of rising interest rates and high inflation.

Many of you might have chosen to lock up your cash in “safe” assets that can give you steady payouts.

But is it still possible to grow your wealth and receive steady payouts for retirement in this current market condition?

The truth is, if everyone is doing the same thing, it’s tough for everyone to make money.

Just like during the gold rush, those who made money were the minority early prospectors.

Once the crowd is on board, no one makes money.

The same goes for every trend – bubble tea boom, crypto, certain funds… you name it.

In the current economic climate, it is tough to time the stock market. Especially if you have a full-time job, family, kids, and don’t have time to trade actively.

And to grow and manage your wealth effectively, you need to be able to spot and find opportunities that are tailored to your goals, needs and risk profile.

What if there’s a way to protect your wealth from the impact of market downturns?

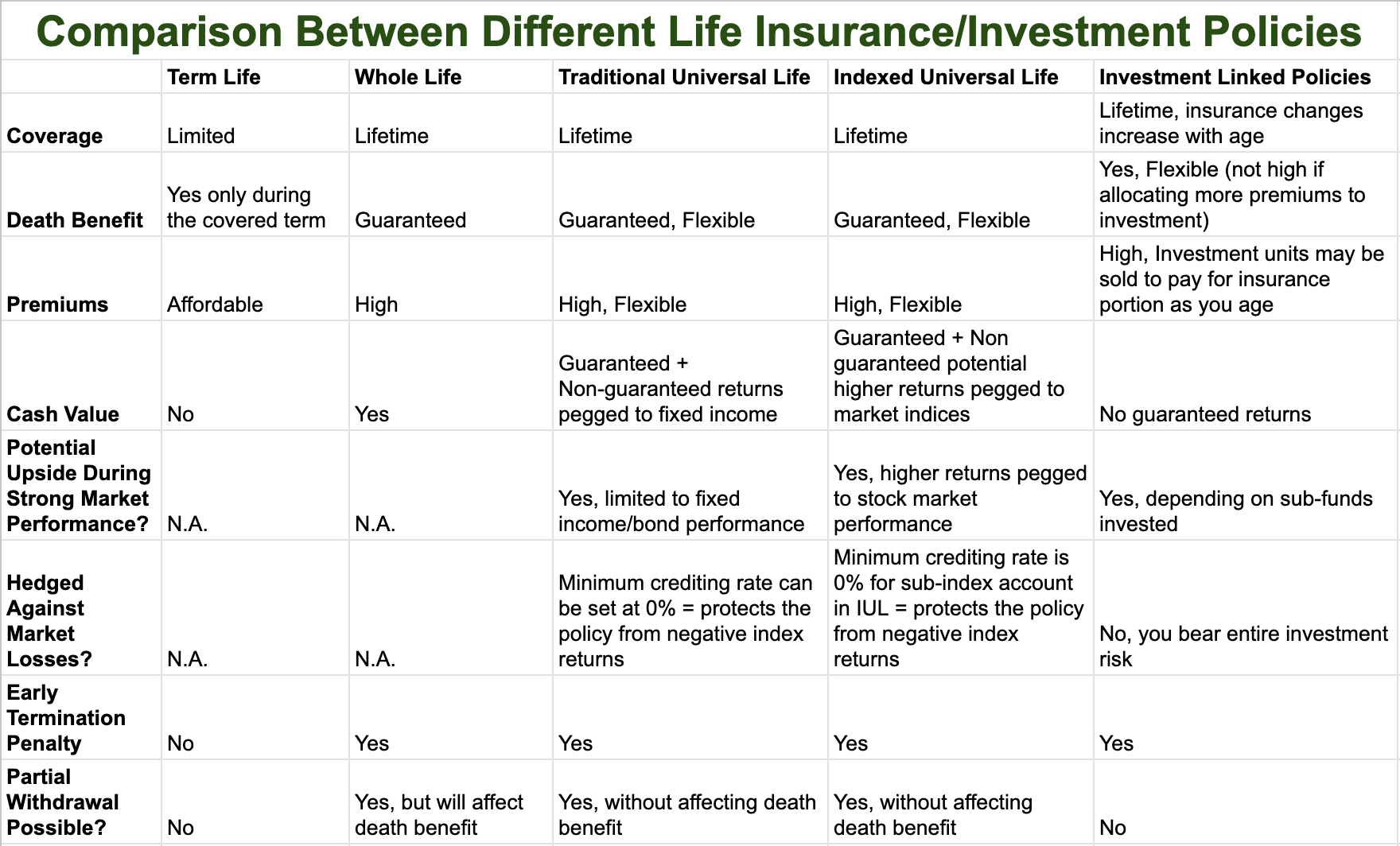

For those who are affluent and are looking to balloon their portfolio, eliminate all liabilities, and enjoy the upsides of the market while protecting their wealth from the impact of market downturns, there is one product that has benefited them greatly – Indexed Universal Life Insurance (IUL).

Universal Life Insurance is traditionally used by the wealthy to leave a large sum of inheritance to their loved ones, and policyholders get both insurance protection and investment returns.

UL policies usually allow policyholders to withdraw a percentage of their policy value without affecting the death benefit. Also, you have the option of adjusting the sum assured and the cash value of your policy even after the inception of your policy.

These options are usually not available with typical Whole Life policies.

With ULs, you will also usually enjoy a guaranteed portion of the crediting rate (eg. 2%) regardless of market conditions. This means that even if the market is performing badly, it hedges against potential losses on your policy value.

In this market climate, this is an attractive benefit to many when compared with other products such as Investment-Linked Plans (ILPs), for example.

(With ILPs, policyholders bear the investment risk entirely. The value of an ILP depends on how the investment portion performs. This means that you can potentially lose the entire value of your investment.)

While traditional ULs focus most of their investments on bonds (which isn’t great currently as bonds usually lose value in high-interest rate environments), IULs peg a large portion of their returns and crediting rate to selected stock market indices, such as S&P 500.

This means when the indices perform well, you can get higher payouts, subject to the cap stipulated by the insurer.

When it doesn’t, you still get to preserve your principal and receive the guaranteed minimum crediting rate from the fixed income portion.

Sources: Forbes, Moneysense, The Annuity Expert

Of course, you can say that one can potentially grow more wealth by investing directly in the index, or relevant ETFs or unit trusts – this works for investors with a longer-term horizon.

But for those who are retiring soon and need passive income sources for retirement, how long can you afford to wait till the market recovers?

Products like IULs can give you steady wealth over time and substantial death benefit – but these also come with higher premiums, since the insurer is bearing part of the market risks for policyholders. It also comes with early surrender penalties.

But these can be effective tools for wealth preservation and legacy in the current economic climate.

Nowadays, IULs are also more accessible and more affordable for the mass affluent and retail investors.

As a Chartered Financial Consultant (ChFC®) and Retirement Wealth Specialist recognised as one of the top 1% in the financial services industry, I usually tailor-make my recommendations based on my clients’ goals and risk profiles.

This is what I have been doing for my mass affluent clients for the past 8 years.

And I can also help you do the same.

If you are keen to find out more on how you can protect, preserve and grow your wealth using holistic recession-resilient strategies, simply fill up this short application here and I will be in touch.

Disclaimer: This post represents our personal views and opinions and is neither associated with any organisation nor reflect the position of any organisation. This content is also only for informative purposes and should not be construed as financial advice. Past performance does not necessarily equate to future performance. Please seek advice from a Financial Adviser Representative before making any investment decisions.

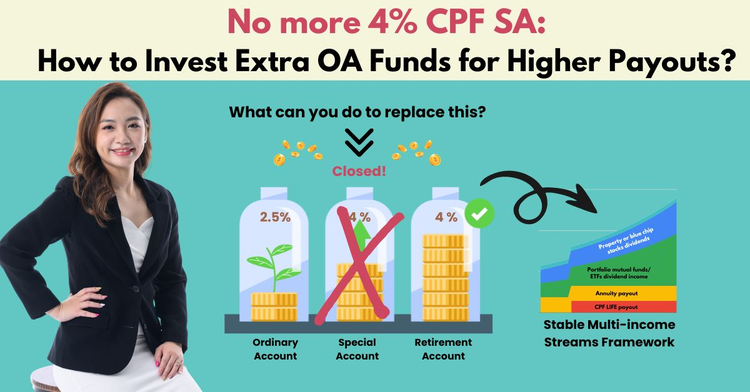

Delaying your retirement despite having multiple assets?

What is lacking is a sound strategy with the latest solutions to optimise your assets, so you can receive multiple passive income streams. Get a complimentary consultation session now (for qualified applicants only).

The information in this article is meant for general information purposes only and does not constitute financial advice. Past performance is not necessarily indicative of future performance. Please consult your Financial Adviser Representative before making any investment decisions.

Further Reading

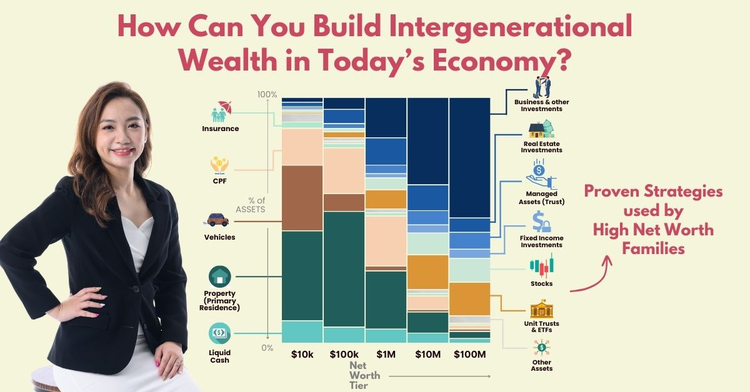

Can you still build intergenerational wealth in today’s economy?

Intergenerational wealth, Wealth preservation, Legacy planning, Estate planning

With rising costs of living, increasing mortgages and high interest rates, it’s getting tougher for the younger generation to build their wealth as compared to before. How can we help our children protect and grow their wealth, so they can thrive in today’s economy?

Copyright © 2022 TheFinLens by Jasmine Siah. All rights reserved.