Will the market improve in 2024?

Investment, Retirement planning, Passive income, Equity Investment, Bond Investment • 2024-01-17

Will the market improve in 2024? And should you enter before rate cuts?

2023 ended with much uncertainty –

Globally, we are seeing a weaker job market due to the higher borrowing costs.

At the same time, geopolitical unrest and recession in various parts of the world have resulted in much apprehension about what could come in 2024.

While economists expect Singapore’s headline inflation to drop to 3.4%, rate cuts are predicted to happen in the second half of 2024.

Cash was king in 2023 as investors waited on the sidelines.

According to Bloomberg, global investors added a record $1.1tn to their cash holdings in 2023, the highest allocation since the pandemic.

But now that the stock market is picking up, keeping too much cash might no longer be the most optimal asset allocation.

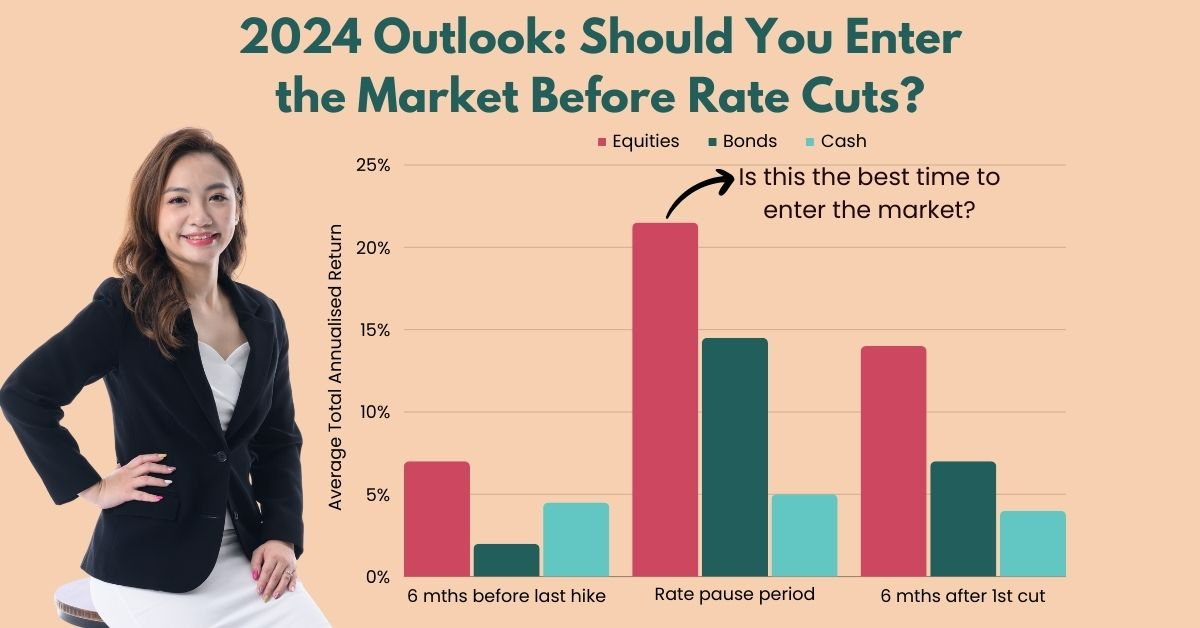

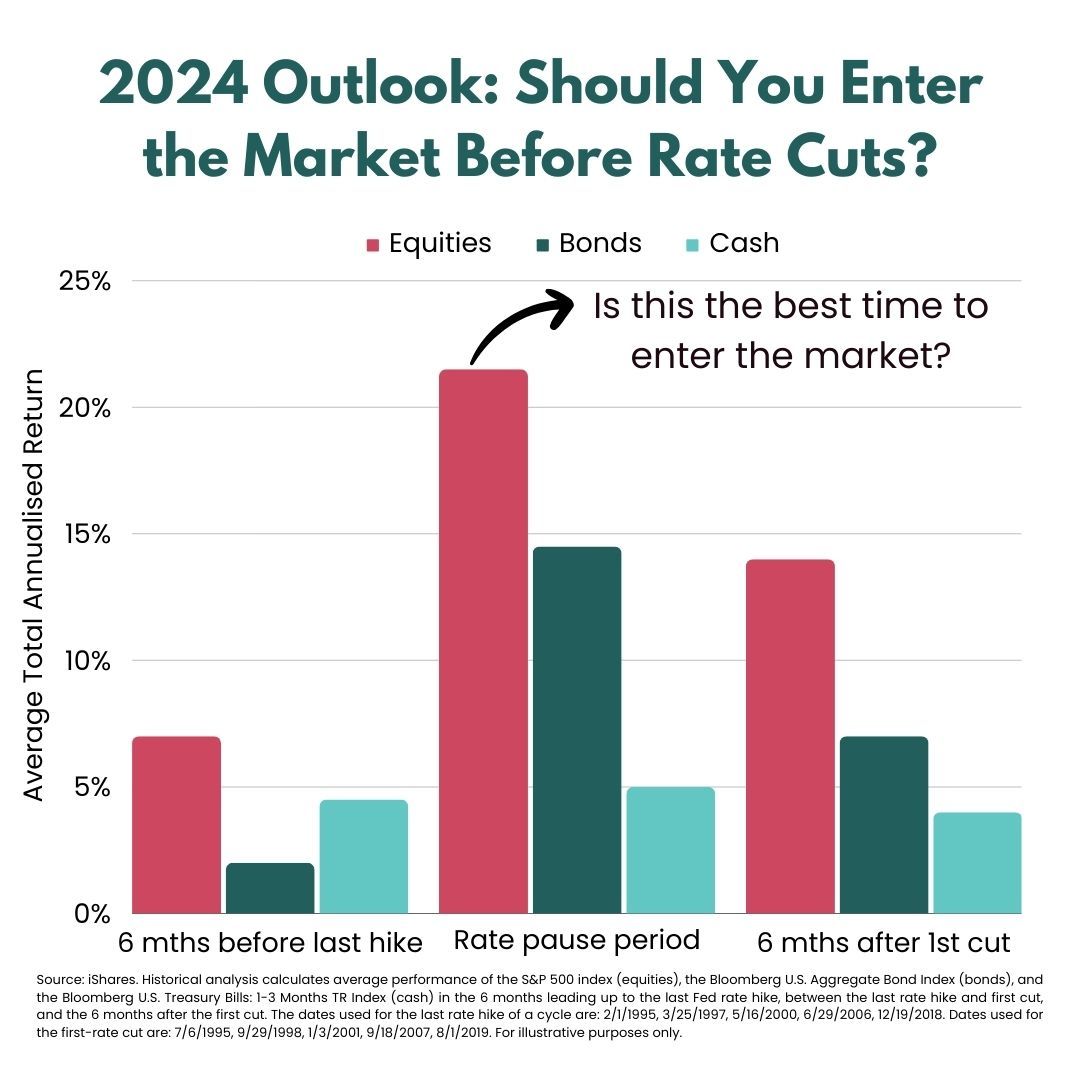

In fact, did you know that both equities and bonds have performed well during rate pause periods historically, even more so than easing periods?

And while the U.S. Treasury yield curve remains inverted as of October 2023, longer-term bonds, such as 10-year bonds, have been pushing out of their negative returns after September 2023.

These are positive signs.

On the other hand, some say that global economic growth could still be sluggish in 2024, which means that stock prices are mostly determined by changes in their PE ratio rather than earnings.

Investors would need to figure out the right valuation in an environment of discounted rates and uncertainty.

So when would be the right moment to enter to capture the best opportunities in the market?

As a Chartered Financial Consultant (ChFC®) recognised as one of the top 1% in the financial services industry, I will usually keep abreast of the latest changes in the market and share these firsthand with my clients.

This is so that I can adjust their portfolio based on their needs and the ever-changing economic climate.

Many of them are still on track to receiving stable lifetime payouts (such as for retirement) without needing to worry about economic uncertainties.

If you are keen to find out more about what are the best actions you can take now to capitalise on current market sentiments, reach out to me through this short application here and I will be in touch.

Disclaimer: This post represents our personal views and opinions and is neither associated with any organisation nor reflect the position of any organisation. This content is also only for informative purposes and should not be construed as financial advice. Past performance does not necessarily equate to future performance. Please seek advice from a Financial Adviser Representative before making any investment decisions.

Delaying your retirement despite having multiple assets?

What is lacking is a sound strategy with the latest solutions to optimise your assets, so you can receive multiple passive income streams. Get a complimentary consultation session now (for qualified applicants only).

The information in this article is meant for general information purposes only and does not constitute financial advice. Past performance is not necessarily indicative of future performance. Please consult your Financial Adviser Representative before making any investment decisions.

Further Reading

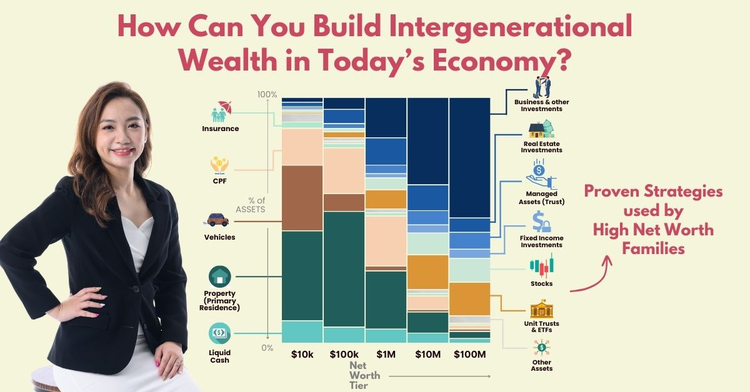

Can you still build intergenerational wealth in today’s economy?

Intergenerational wealth, Wealth preservation, Legacy planning, Estate planning

With rising costs of living, increasing mortgages and high interest rates, it’s getting tougher for the younger generation to build their wealth as compared to before. How can we help our children protect and grow their wealth, so they can thrive in today’s economy?

Copyright © 2022 TheFinLens by Jasmine Siah. All rights reserved.