Can you still build intergenerational wealth in today’s economy?

Intergenerational wealth, Wealth preservation, Legacy planning, Estate planning • 2024-03-08

Many of you might have built your wealth over the years. After decades of hard work, you might be ready to retire soon.

But you are worried about your children.

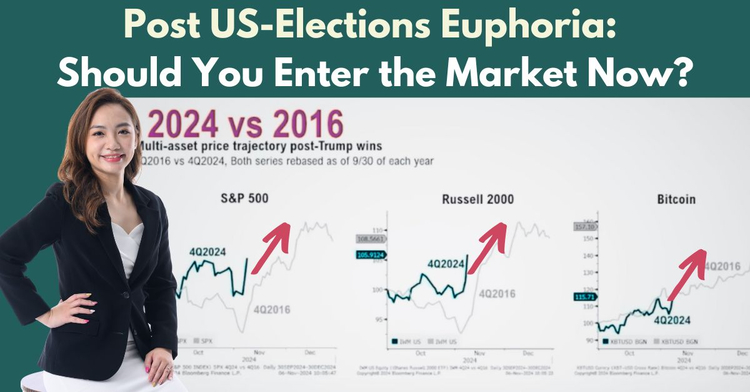

With inflation at 2.9% (Jan 2024) and interest rate at 3.36% (Feb 2024), it’s getting tougher for the next generation to build and preserve wealth.

Not to mention recent mass layoffs and company cost-cutting measures mean this is a year of job instability.

Coupled with increasing mortgages, increasing debt, rising costs of living and the rise in illnesses (such as Covid), many young adults are struggling to make ends meet, not to even mention build assets for their future.

Can they afford their first home?

Can they sustain the lifestyle we’ve worked so hard to provide?

How can we help our children protect and grow their wealth?

So that they can have a headstart to not just survive, but thrive in this harsh economy?

Building intergenerational wealth can give our next generation the time, opportunity and buffer to build their own wealth despite economic uncertainty.

And this is not just about wealth accumulation, but about sustainable wealth optimisation, preservation and even wealth enhancement with the right assets and strategy.

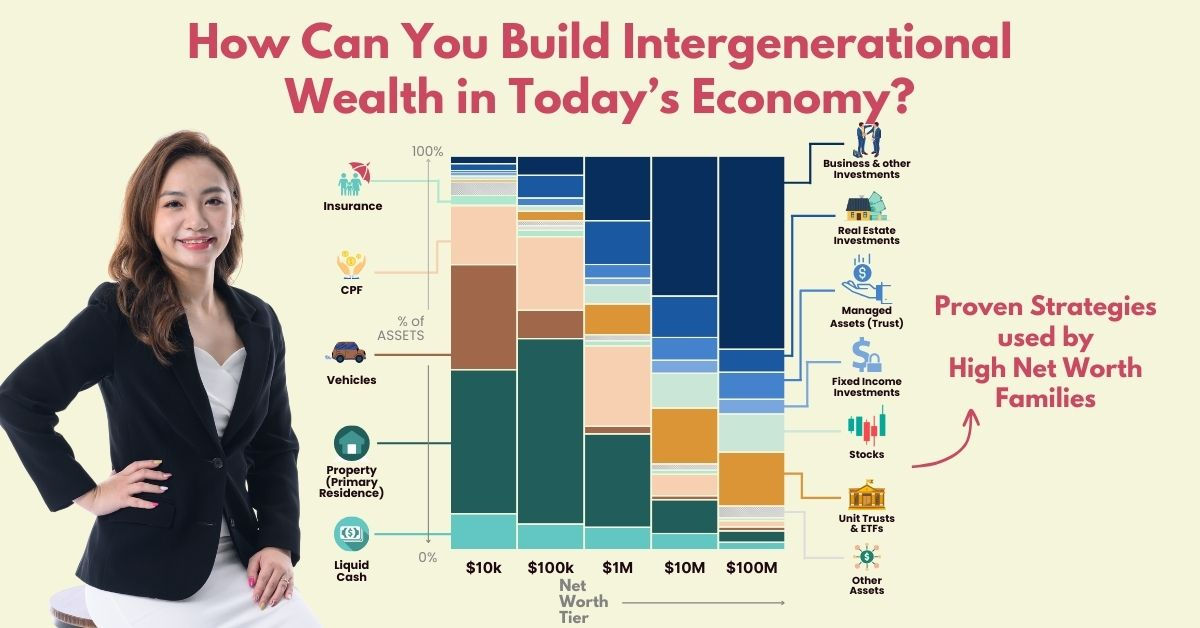

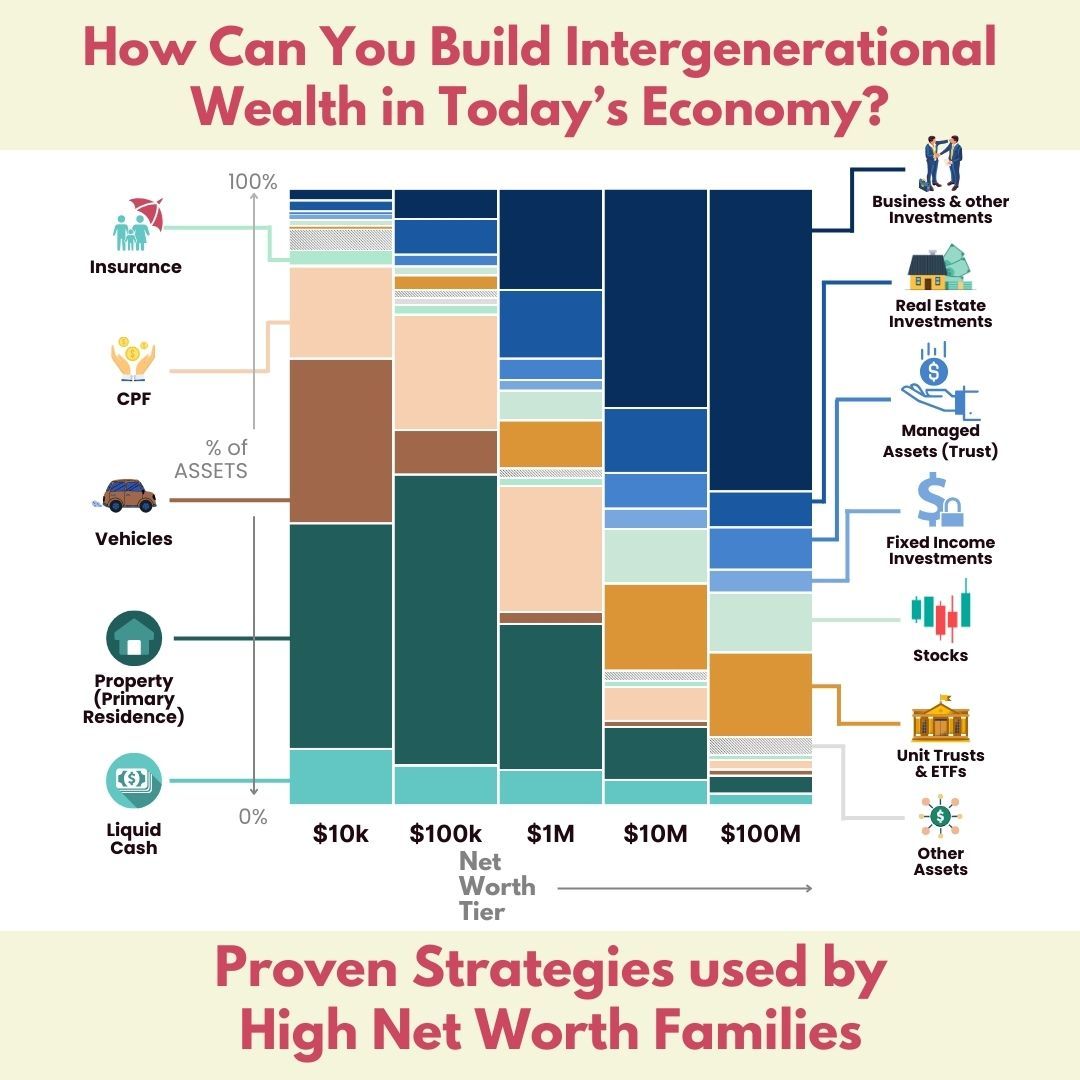

These are strategies traditionally used by high-net-worth individuals to pass on their wealth from one generation to the next.

And today, these proven time-tested strategies have been adapted to suit the needs of the mass affluent and the masses, and are increasingly popular.

And this is exactly what I have been helping my clients to do at TheFinLens:

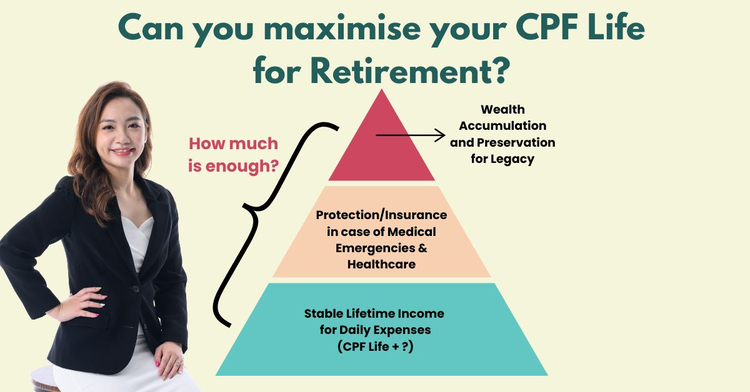

✔️ Preserving your wealth by optimising your assets through risk-managed portfolio investing

✔️ Helping you attain sustainable multi-income streams that can weather interest rate risks while still combating inflation

✔️ Expanding your wealth for generational wealth planning while having a comfortable retirement

As a Chartered Financial Consultant (ChFC®) recognised as one of the top 1% in the financial services industry, I help my clients create legacies that can last generations, without compromising on their retirement.

I’m also a licensed legacy planner, and I can help to ensure that your wealth distribution is well taken care of.

If you are keen to grow and preserve your wealth sustainably for your children’s financial future, reach out to me through this short application here and I will be in touch.

Disclaimer: This post represents our personal views and opinions and is neither associated with any organisation nor reflect the position of any organisation. This content is also only for informative purposes and should not be construed as financial advice. Past performance does not necessarily equate to future performance. Please seek advice from a Financial Adviser Representative before making any investment decisions.

Delaying your retirement despite having multiple assets?

What is lacking is a sound strategy with the latest solutions to optimise your assets, so you can receive multiple passive income streams. Get a complimentary consultation session now (for qualified applicants only).

Further Reading

Copyright © 2022 TheFinLens by Jasmine Siah. All rights reserved.