Interest rate cut: How to optimise your investments?

Retirement planning, Investment, Passive income, CPF • 2024-10-14

How will the latest interest rate cut affect your retirement funds?

The Federal Reserve System (Fed), central bank of the United States, reduced the target for its key lending rate by 0.5 percentage points on 18th September, lowering interest rates to 4.75%-5%.

This rate cut came after the recent announcement of the US inflation slowdown to 2.5% in August, which is close to the Fed’s 2% target.

The lowered borrowing rates would likely provide a much-needed boost to the economy, especially after the worrying August unemployment report (where US unemployment stands at 4.2%).

There were also speculations that rates would be further reduced by the end of the year.

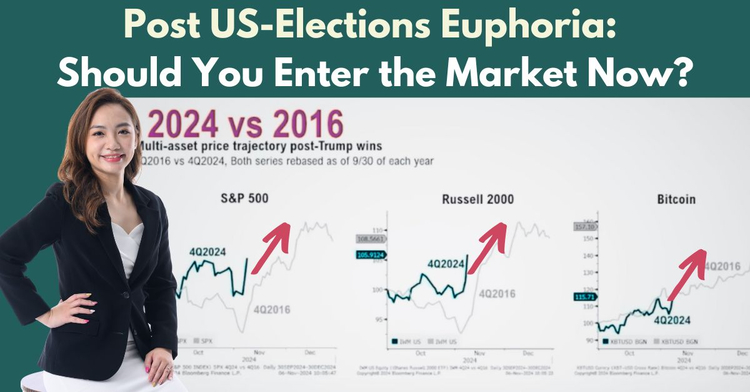

While the cuts were taken in stride by the financial markets, how the market would behave in the mid-term depends on investors’ perceptions of the rate cuts, as well as the strength of the fundamentals of the stock itself.

The market will react differently if investors perceive the central bank as confident and in control while providing a soft landing for the economy, compared to if investors think the bank is being reactionary, slashing rates amid the threat of recession.

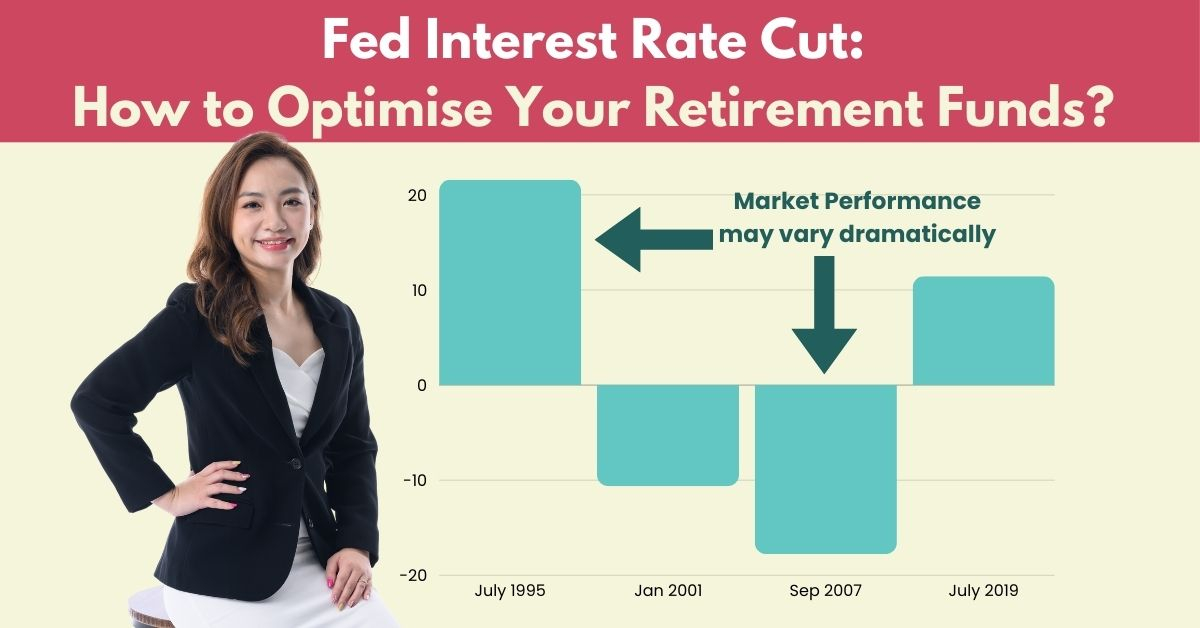

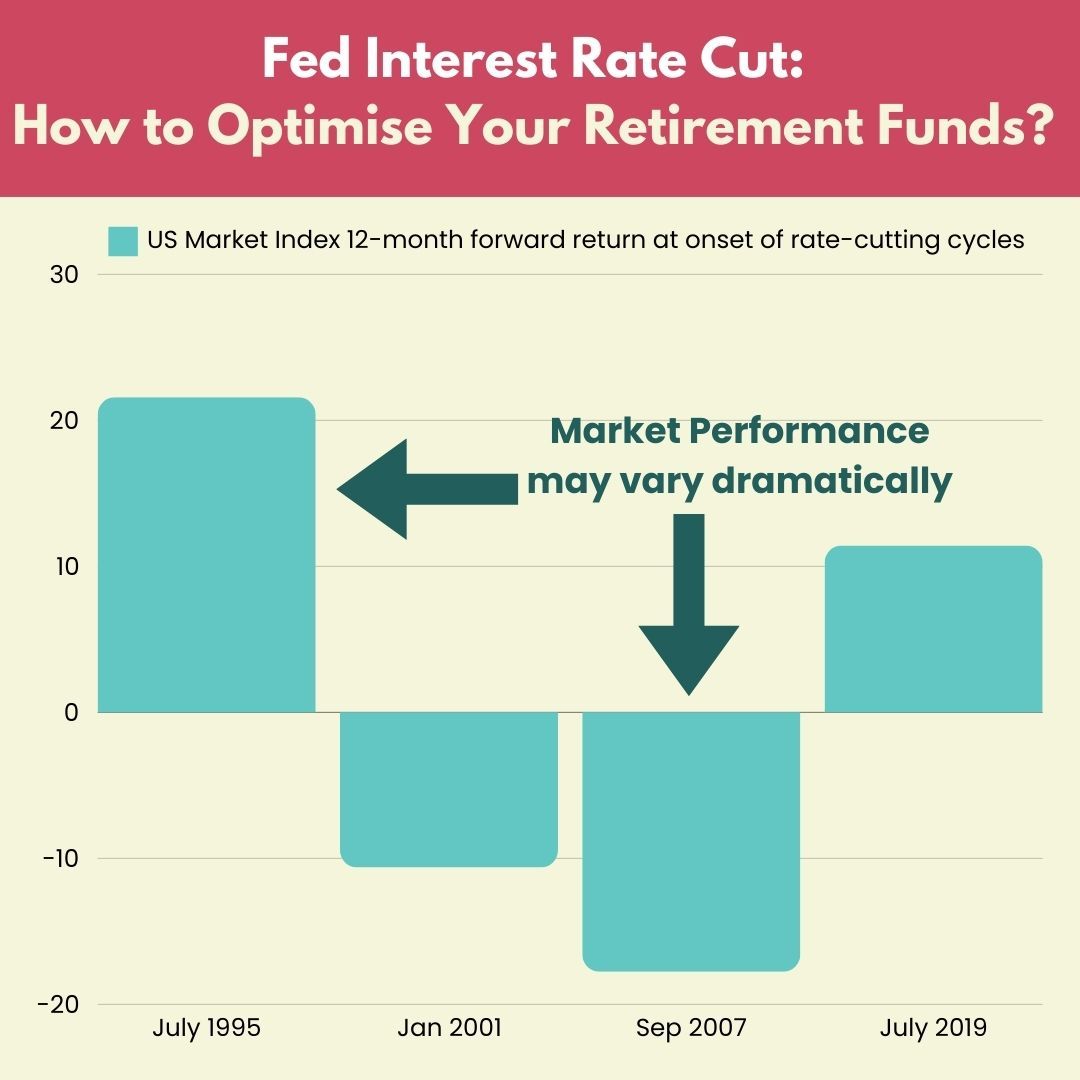

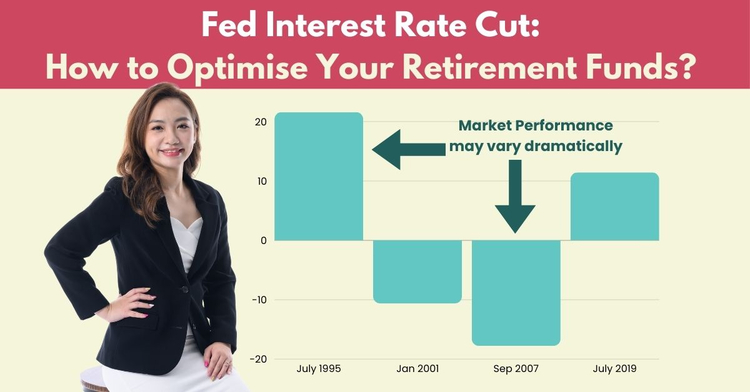

Historically, during the past few rate cuts, the market has reacted very differently each time.

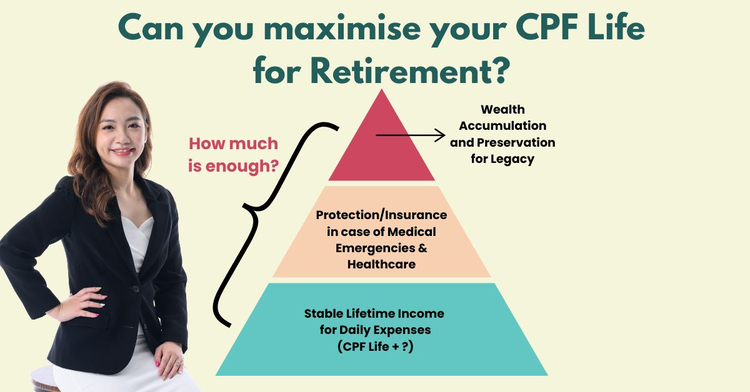

For those of you who have achieved your CPF Full Retirement Sum and are waiting for the right moment to invest your excess monies for a more comfortable retirement, what can you do right now?

As a Chartered Financial Consultant (ChFC®) recognised as one of the top 1% in the financial services industry, I always keep ahead of market trends and opportunities while managing the risks involved.

For the past 10 years, I have been helping mass affluent families grow and preserve their wealth, so that they can retire comfortably with stable lifetime payouts.

If you are keen to find out how you can capitalise on today’s opportunities sustainably in today’s market, simply reach out to me through this short application here.

Disclaimer: This post represents our personal views and opinions and is neither associated with any organisation nor reflect the position of any organisation. This content is also only for informative purposes and should not be construed as financial advice. Past performance does not necessarily equate to future performance. Please seek advice from a Financial Adviser Representative before making any investment decisions.

Delaying your retirement despite having multiple assets?

What is lacking is a sound strategy with the latest solutions to optimise your assets, so you can receive multiple passive income streams. Get a complimentary consultation session now (for qualified applicants only).

Further Reading

Copyright © 2022 TheFinLens by Jasmine Siah. All rights reserved.