Can you maximise your CPF Life?

CPF, Retirement planning, Passive income, Wealth preservation, Investment • 2025-03-06

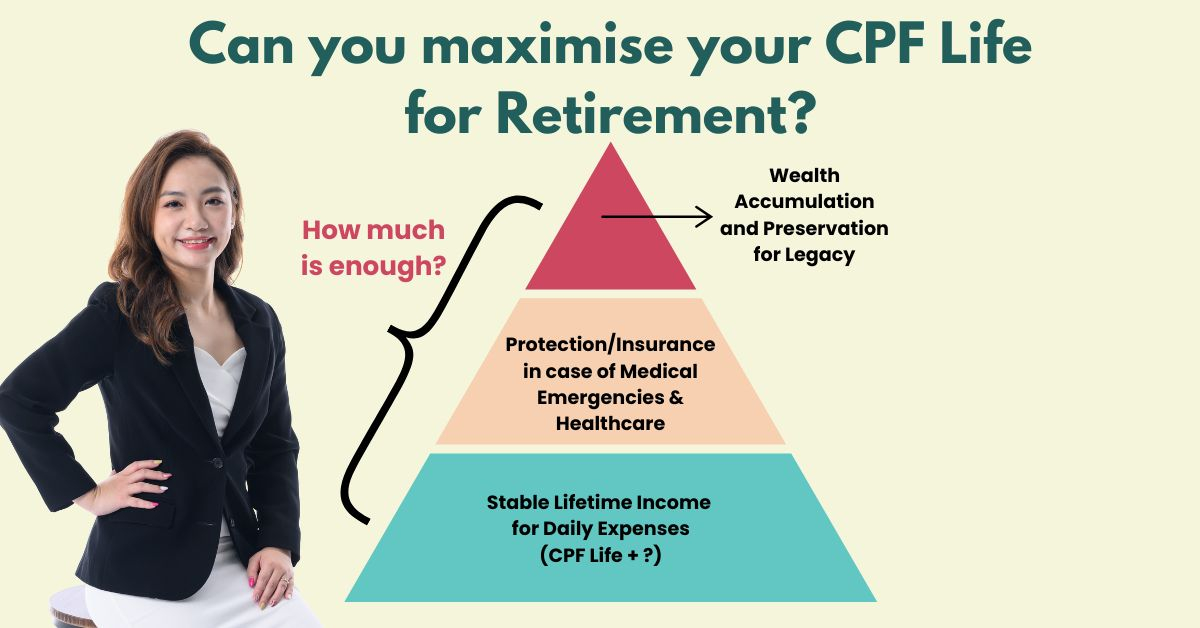

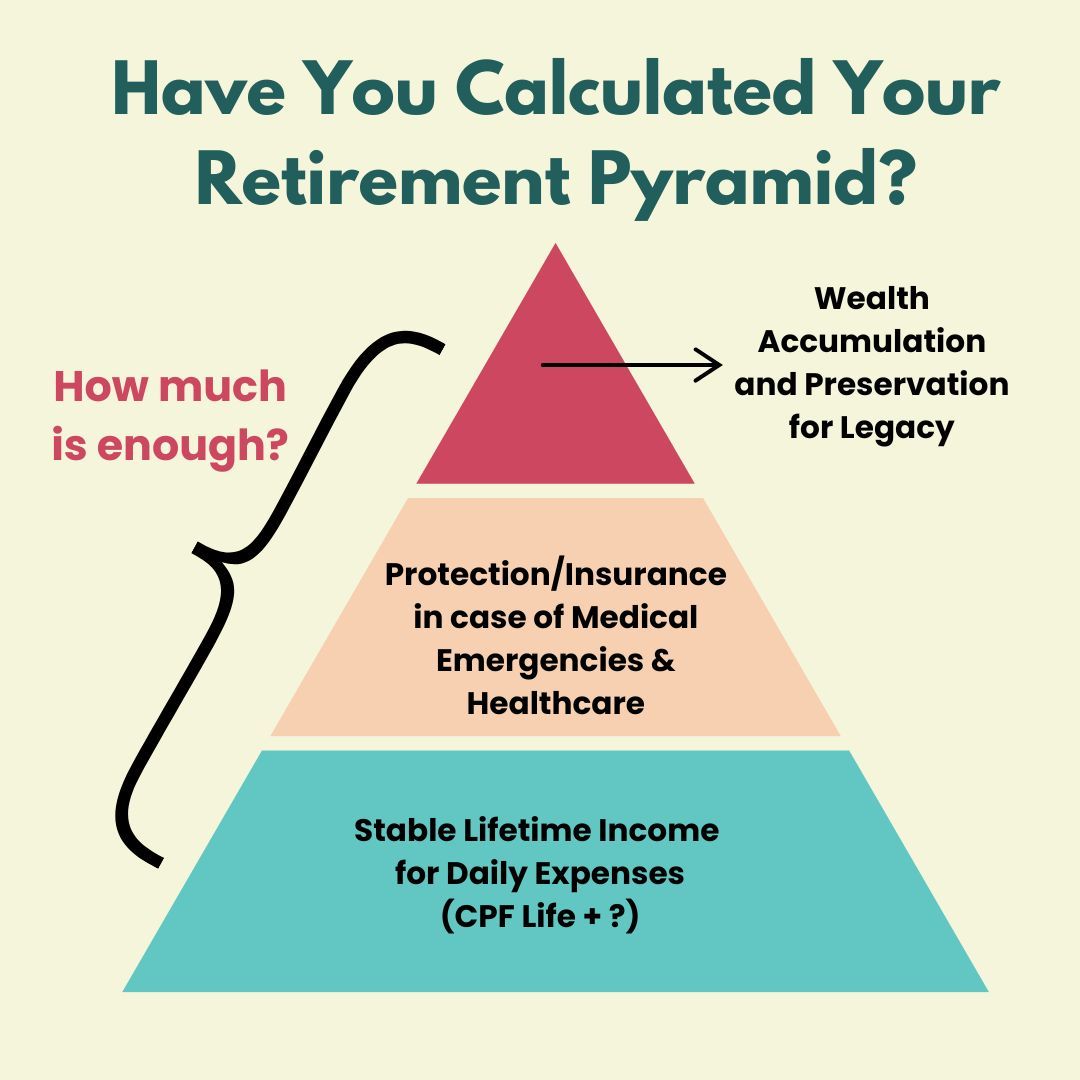

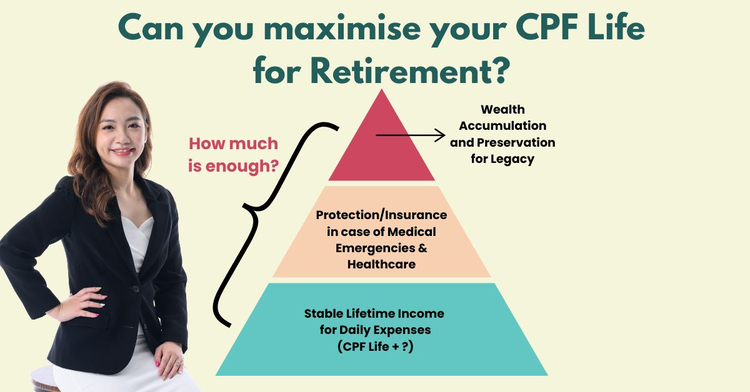

How do you maximise your CPF Life payouts for a stable and comfortable retirement?

The main purpose of CPF Life is to provide you with guaranteed lifetime income.

When you reach 55 years old, your CPF Special Account (SA) will be closed, and all your savings from your SA and/or Ordinary Account (OA) will be transferred to your Retirement Account (RA) up to the Full Retirement Sum.

The savings in your RA will be deducted as the CPF Life annuity premium when you start your payouts (anytime between the ages of 65 and 70). You will then receive monthly payouts for life.

If you live longer (even after all your capital has been paid out), you will still continue to receive the payouts for the rest of your life.

So this is simply an insurance against longevity, in case we outlive our savings.

Hence if you are looking for guaranteed lifelong income, CPF Life is a good foundation. But what if you want to receive earlier payouts and pass on more wealth to your loved ones?

While you can nominate your loved ones to receive your CPF monies after you have passed on, the amount would be your unused CPF Life capital after deducting all your payouts, together with any remaining CPF savings.

This means that any interest earned from your CPF Life will not be passed on – these are only used for your monthly payouts.

So if you want to supplement your CPF Life with additional income streams and preserve your wealth, it’s important to have other financial assets that can help you do so.

How about maximising your retirement payouts? There is a cap on how much you can receive from your CPF Life. You can only contribute up to the Enhanced Retirement Sum (ERS).

In 2025, ERS is $426,000, so you can get higher CPF Life monthly payouts of up to $3,300.

If you only contribute up to FRS, your monthly payouts would be around $1,500+.

Is this enough for your retirement, considering the rising cost of living and healthcare?

For the past 11 years, I have been helping pre-retirees and retirees plan holistic retirement portfolios to optimise all their investments and assets – so that they can get stable lifetime income, grow their wealth and leave a legacy for their loved ones without compromising on their retirement lifestyle.

And I can do the same for you.

If you are keen to find out more, reach out to me here.

Disclaimer: This post represents our personal views and opinions and is neither associated with any organisation nor reflect the position of any organisation. This content is also only for informative purposes and should not be construed as financial advice. Past performance does not necessarily equate to future performance. Please seek advice from a Financial Adviser Representative before making any investment decisions.

Delaying your retirement despite having multiple assets?

What is lacking is a sound strategy with the latest solutions to optimise your assets, so you can receive multiple passive income streams. Get a complimentary consultation session now (for qualified applicants only).

Further Reading

Copyright © 2022 TheFinLens by Jasmine Siah. All rights reserved.