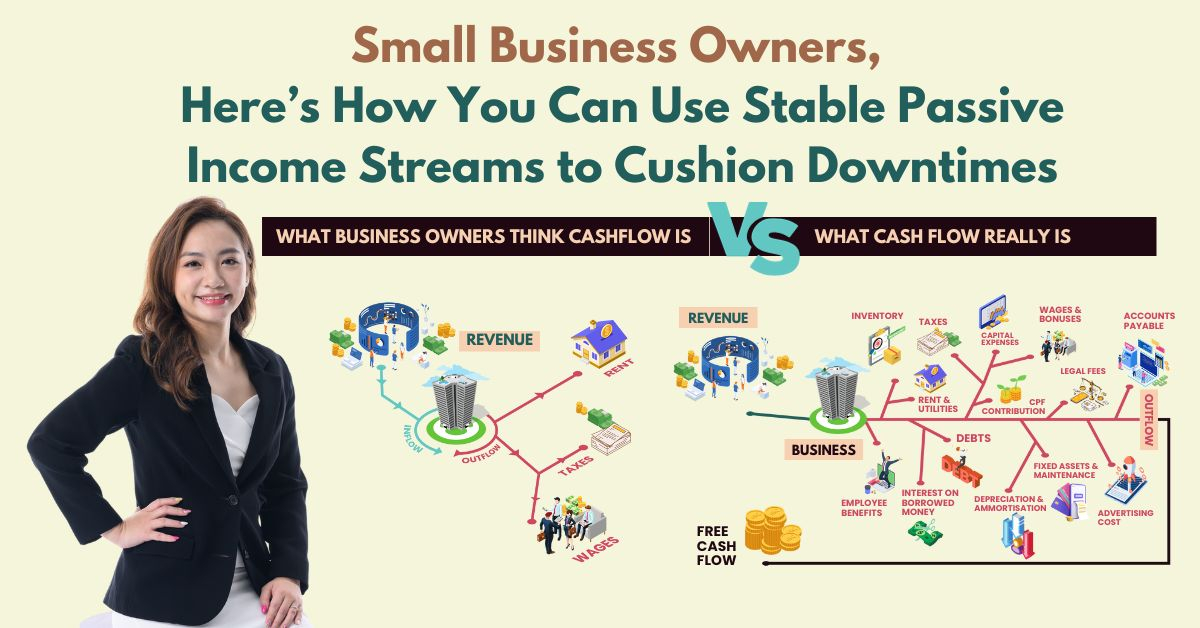

Many small business owners struggle with cash flow. Here’s how you can cushion downtimes

Retirement planning, Recession, Passive income, small businesses • 2023-10-18

“Why does my profit always disappear at the end of the month or year?”

Business owners, you might be very familiar with the constant struggle of cash flow management that can keep you awake at night.

From paying employee salaries, covering rent, and managing taxes to making critical investments, the challenges can seem daunting. Despite generating revenue, it's disheartening to find that after deducting expenses, the returns may not be as substantial as expected.

If you can relate to this, know that you are not alone.

This is a common issue faced by many small businesses that often leads to confusion about effectively managing cash flow for sustainable growth.

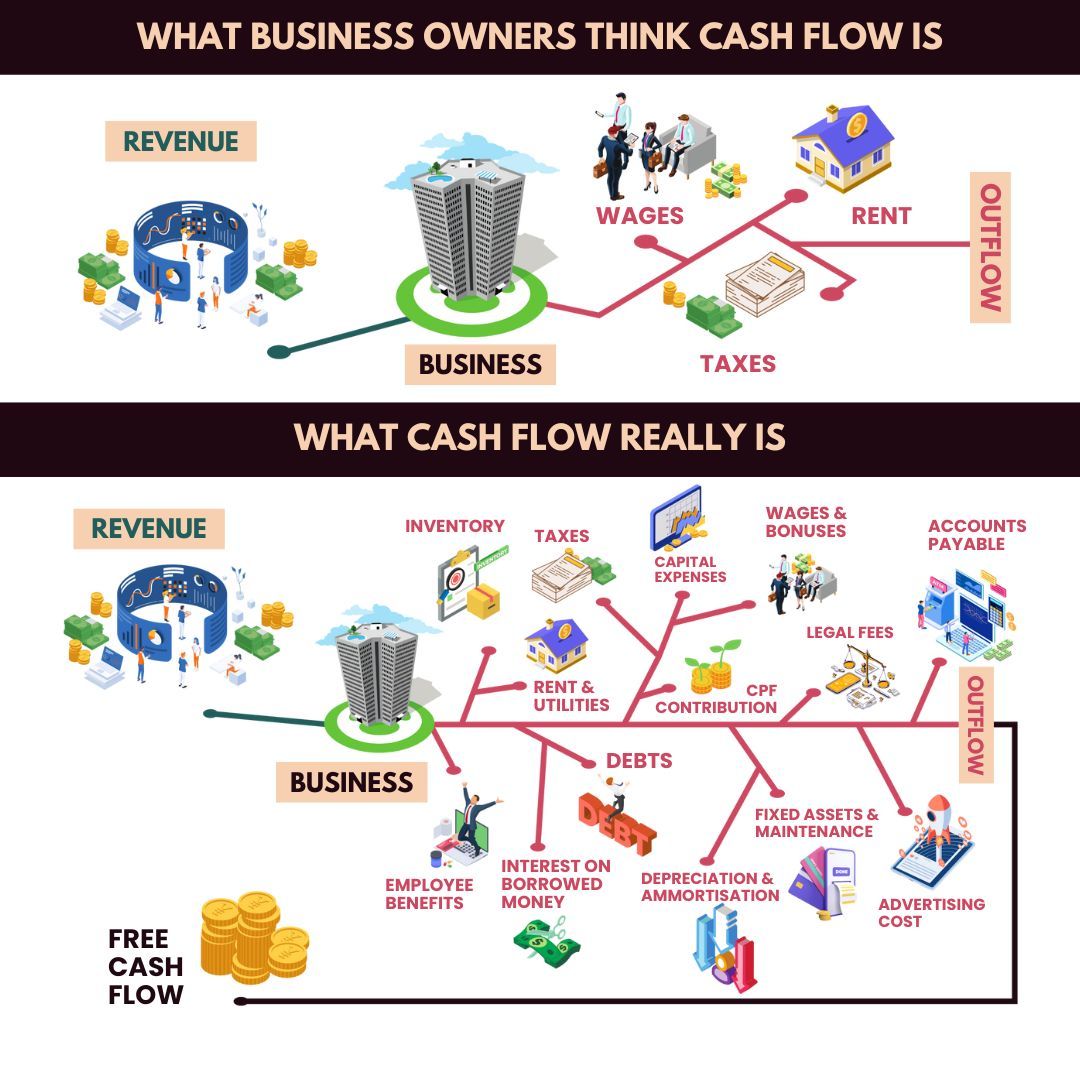

A common mistake made by some business owners is using EBITDA (earnings before interest, taxes, depreciation, and amortisation) to represent cash profit generated by the company’s operations.

Charlie Munger, vice chairman of Berkshire Hathaway (the conglomerate controlled by Warren Buffett) once called the measure of EBITDA “BS Earnings”.

Both Munger and Warren Buffett stressed the importance of accounting for interest, taxes, depreciation and amortisation.

For example, if you own a manufacturing company and you have invested in machinery to be used in your production line, and this machinery has a useful lifespan of 10 years, it is important to measure depreciation so you can determine the true production cost per unit, ensuring proper pricing and maintaining healthy profit margins.

Also, it is only after these deductions that you can understand how much free cash flow you really have, so that you can continue to invest in your business.

In a previous post, I wrote about how the loss (or death) of the key decision-maker in the company can cause a lot of uncertainty.

In a previous post, I wrote about how the loss (or death) of the key decision-maker in the company can cause a lot of uncertainty: https://bit.ly/TFL-HNW-wealth-preservation

If the business owner passes on unexpectedly, the living spouse or other family members would be responsible for liquidating the shares of the company – which takes time.

Would your family have enough cash flow during the transition period to pay off running operational costs such as staff salary?

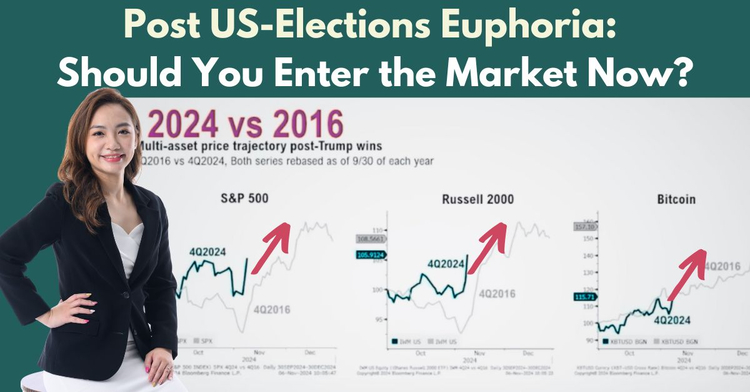

This is why it’s important to have an external source of passive income to support the business and help manage potential risks, tide the business through economic uncertainty and ease the strain on your (and your family’s) finances.

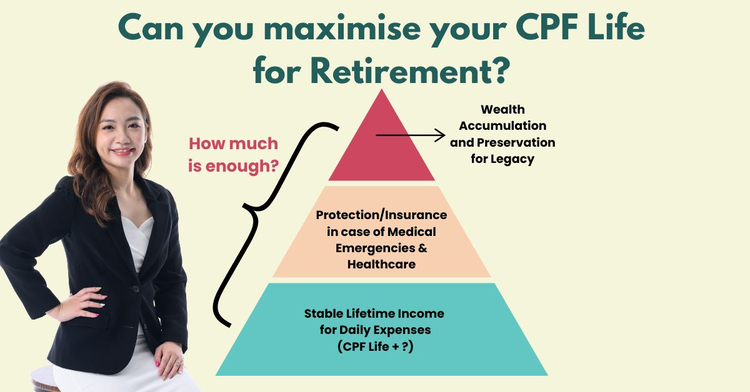

And even if you intend to just sell your business before retiring, how can you ensure that it can give you enough lifetime income for retirement?

A substantial number of my clients are business owners – I have worked with them to ensure they have sufficient asset protection in place, to insulate their business and personal assets from the claims of creditors or potential lawsuits.

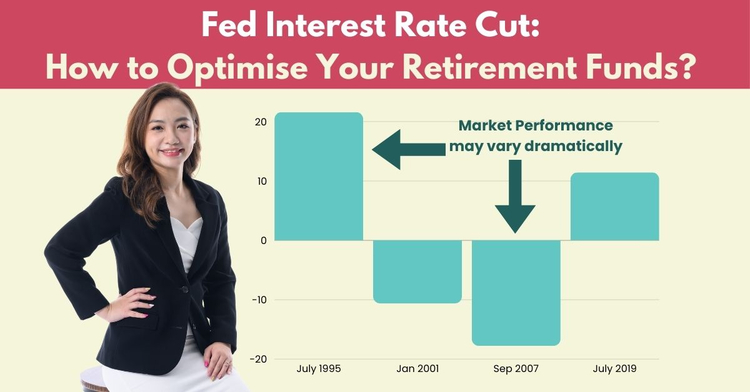

I also employ personalised recession-resilient investment strategies to ensure they potentially have a stable stream of income that can provide them with the necessary cash flow whenever needed.

As a Chartered Financial Consultant (ChFC®) recognised as one of the top 1% in the financial services industry, this is what I can do for you.

If you are keen to find out how I can help you safeguard your business, assets and wealth, and generate stable income streams for you, simply fill up this short application here and I will be in touch.

Disclaimer: This post represents our personal views and opinions and is neither associated with any organisation nor reflect the position of any organisation. This content is also only for informative purposes and should not be construed as financial advice. Past performance does not necessarily equate to future performance. Please seek advice from a Financial Adviser Representative before making any investment decisions.

Delaying your retirement despite having multiple assets?

What is lacking is a sound strategy with the latest solutions to optimise your assets, so you can receive multiple passive income streams. Get a complimentary consultation session now (for qualified applicants only).

Further Reading

Copyright © 2022 TheFinLens by Jasmine Siah. All rights reserved.