Are you keeping losers? 4 Expensive mistakes investors make in a market crash

Investment • 2022-05-10

“My hands became cold and sweaty as I saw my portfolio took the deepest dive I’ve ever witnessed... What should I do?”

How many of you can resonate with this?

You did your best to grow your wealth, you invested, you did dollar-cost averaging, you felt proud that you were well on track to your financial or even retirement goals.

Things appeared rosy.

Then... everything crashed.

For those who have invested heavily in tech stocks, you would have felt it so intensely earlier this year when everything was in the red.

We know, it’s damn scary. It’s normal for most people to panic.

“When will it recover? Should I sell at a loss? Or should I hold?”

These questions were on most people’s minds.

It’s easy to invest when things are well, when you can see that whatever money you have put in, your capital is growing steadily year after year.

Most investors know that it’s normal to see volatility, of course. The stock market would fluctuate.

We expect it, rationally. But when we truly experience it, how many of us can still be rational?

And worse, when there’s an unforeseen market crash like what we have seen in early 2022, when we see our hard-earned capital crash into the negatives, that’s when we come face-to-face with the moment of truth – how much risk can we actually realistically stomach?

And when this happens, what can we actually do?

Here, I will be sharing some of the most expensive mistakes investors often make during a market crash.

“The strength of an investor can be seen through how they perform during the worst years.”

For those of you who are still feeling the terrible impact of the crash, this article is for you. I understand it can be tough to stomach, but I hope it can bring you a different perspective, a rational perspective, and you can consider if you need to take any action.

For those of you who have recovered from the crash, this article is for you too. It’s important to read this when you are rational, and hopefully, if we experience another market crash again, it will help you make rational decisions and avoid some of these expensive mistakes.

Brace yourselves, and let’s go.

Don’t have enough for retirement? Many Singaporeans are asset-rich but lack strategy to generate passive income. At The Fin Lens, I help mass affluent clients keep up with the latest solutions and optimise their assets – so they can build multiple income streams and retire earlier. Find out how today.

Disclaimer: This post represents our personal views and opinions and is neither associated with any organisation nor reflect the position of any organisation. This content is also only for informative purposes and should not be construed as financial advice. Past performance does not necessarily equate to future performance. Please seek advice from a Financial Adviser Representative before making any investment decisions.

1. Selling winners and keeping losers

In a bear market, salvaging what you can seems to be the most logical thing to do...

So you go on and cash out your winning assets to lock in your profits before they evaporate completely and you hold on to losing ones in the hopes that they will eventually recover.

Does this sound like you?

Ironically, this could potentially be one of the damaging things an investor can do.

Here there are two things that may affect your investment portfolio:

- You may be limiting your upside potential from the winning assets by cashing out too early.

- You are holding on to losing assets – what if they plunge further or never recover from their losses?

Isn’t it counterproductive to sell a performing asset while keeping a failing one? This is only the case if you are holding on to ‘losers’.

What you can consider instead: Keep your winners and evaluate if you should still continue holding on to losers

It can be a ‘blood bath’ in a market crash.

And you may be drowned with fear and anxiety when all you see is red in the market.

It is only human to be emotional...

But emotions sometimes cloud our judgments to decide hastily.

At this moment, it is important for you to zoom out and take a step back.

This way you are able to see the big picture and reassess the current situation objectively.

⚠️ What are the market sentiments on the current situation?

⚠️ What are the sectors and asset classes that fared best and worst?

⚠️ How much are your losses?

From here, you would have an overall idea of the market and how your investment portfolio fared in comparison.

If you are experiencing more losses than what you can tolerate, sometimes it is best to evaluate if you should cut your losses and reduce your exposure to the losing assets.

But how about the ones that are still profitable, should you keep them or cash out the profits as soon as possible?

And how do we determine which are ‘winners’ and ‘losers’?

Are they simply those that are still profiting and those that are losing money respectively?

Many investors would think from this perspective and that’s fair. However, we wish to invite you to consider it from another perspective.

If you are investing in individual stocks, you might want to review the company’s business performance, business fundamentals as well as management practices.

✔️ Does the business still have growth prospects — what are their plans to get their business out of the rut?

✔️ On top of that, how does the business operate financially? Is it depending too much on leverage?

✔️ Are there any external factors such as political influence or economic sector rotation that may hold the assets down?

If you find that the losing asset may no longer bring value and may no longer help you reach your financial goals, you may want to evaluate if you should continue holding on to them.

And on the other hand, if you find that the assets still have growth prospects and will bring value to you, you can potentially consider holding on to them even if they are currently in the red.

Or even better, if they are experiencing positive growth now, it may be a good idea to continue holding on to them instead of capping your profits by cashing out early.

The above mostly applies if you are investing in individual stocks or more volatile/higher-risk investments.

However, if you are investing in ETFs, unit trusts and other more diversified assets, based on my experience, despite short-term losses, these assets are generally able to recover in the long term.

I usually do a yearly review with my clients to reassess their portfolios, before discussing with them a realistic action plan moving forward that can still enable them to be on track to achieve their financial goals.

Most importantly, make an informed investment decision that is supported by proper financial analysis.

If you are unsure, it is best to consult a trained and licensed professional, such as a financial advisor representative, who will be able to help you with the analysis and give you specific financial advice that is catered to your needs.

2. Catching the Falling Knife (Buying the Dip)

How many times have you heard, “Y is only $X now, should I buy the dip?”

Sometimes, buying the dip can bring you good profit when the asset has positive growth again.

However, we need to also see that there are instances when the asset never recovers from its plunge.

And if you choose to buy the dip, in this instance, it can be an expensive mistake.

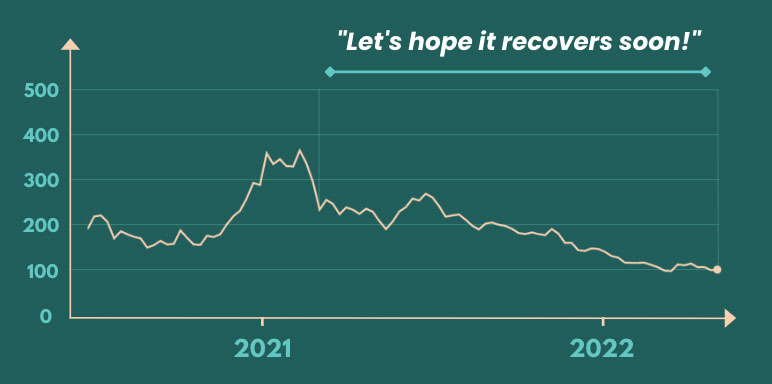

Take the price crash in China’s technology assets for example.

Tech companies are generally facing the double whammy of tight regulations and domestic economic slowdown due to covid restrictions.

To add salt to the wound, they are further dragged by getting caught in between geopolitical tensions that might get them delisted from the United States stock market.

For illustration purposes only. Please seek advice from a Financial Adviser Representative before making any investment decisions.

Here is the share price trend of one of the tech stocks in China. It had been declining in value since late 2021.

Considering the circumstances, will you buy the dip now?

Additionally, have you considered the time horizon the asset requires to recoup its value?

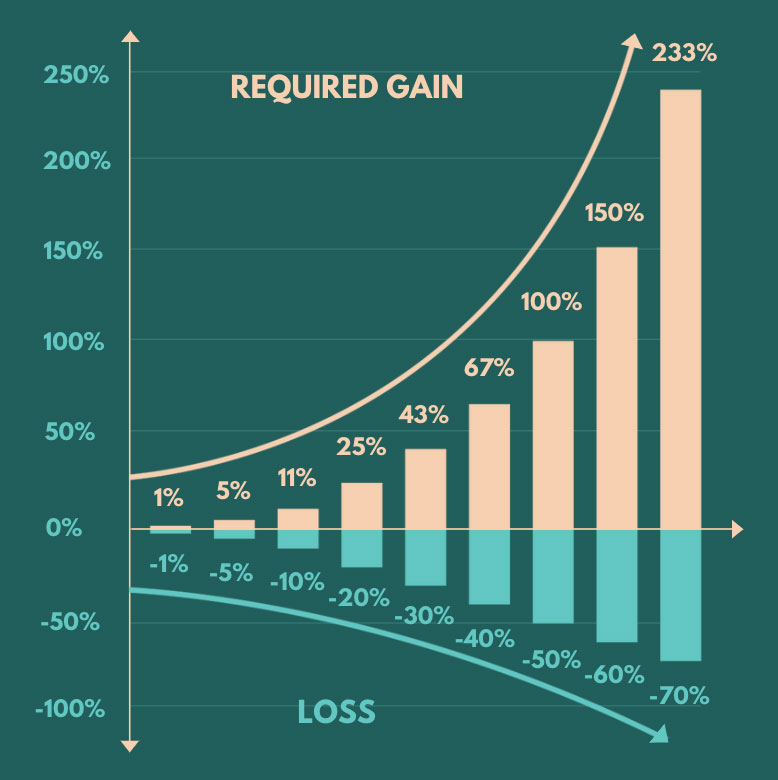

This is how much gains are actually needed for an asset to fully recover its value.

For illustration purposes only. Please seek advice from a Financial Adviser Representative before making any investment decisions.

For example: Whenever an asset drops by 50%, you actually require it to appreciate by 100% to recoup your losses. How long will it take to appreciate by 100%?

Typically, it takes quite a significant amount of time for an asset to rebound from its losses.

Do you have the time to wait it out?

What if it takes decades to recover?

Buying the dip has been working for some people, yes, but only when you understand how to do it right.

What you can do instead: Ask yourself, are the discounts worth it?

Before buying a losing asset, be sure that it is potentially worth your money.

For example, if you are looking into buying an individual fund, do more research to find out more about the fundamentals of the sector, industry and geography the fund is invested in.

✔️ Is the fund invested in high-quality companies with strong financial standing that can ride out the waves?

✔️ Is the fund correctly rebalanced to potentially achieve better sector growth?

✔️ Is this sector and industry in the specific geography set to grow in the short-term economic climate?

✔️ What is the potential outlook in the mid to long-term?

There is more to consider in a potentially profitable investment that may involve technical analysis as well.

Let’s say that you’ve done your due diligence and an asset that you’ve been eyeing has dipped.

This might be your sign to go for it, to purchase good quality assets at a relatively cheaper price.

Again, if you are not sure of how to do the necessary financial assessments, it is best to consult a professional.

I will be able to help you do the necessary financial analysis and give you specific recommendations that are catered to your needs and goals.

3. Do nothing and wait it out

Many people, after seeing everything in the red and panicking, when they have calmed down, they may decide to just “wait and see”.

This is very common, because sometimes, when we are scared, we just don’t want to do anything at all.

We want to wait and see what other people do first, before taking any action.

Some of us might still hold a tiny ray of hope that things would improve, and decide to wait it out and see.

This is similar to what I explained above about keeping losers.

But actually, if you have a proper strategy in place, and have taken action to sell your losers and keep your winners, this may be the best thing to do after that.

Yes, I’m saying, do nothing, ONLY after you have done the necessary asset reallocation, rebalancing, etc.

As I am actively involved in my client’s portfolio performance regardless of market conditions, I will only ‘do nothing’ after doing this one crucial step.

What you can do instead: Take the chance to build a better portfolio.

It is all about perspective.

I would consider a market crash an opportunity to build a better portfolio. Hence, reflect on the current situation and see if there is room for any improvement.

Look at what are the assets in your existing portfolio that are thriving.

Assess the market conditions and understand the reasons why they are thriving, how the market is forecasted to change and the reliability of the forecasts themselves.

From there, you may have a better sense of whether you should pump in more investment in these assets.

If you are unsure, it is better to discuss this with a trained professional.

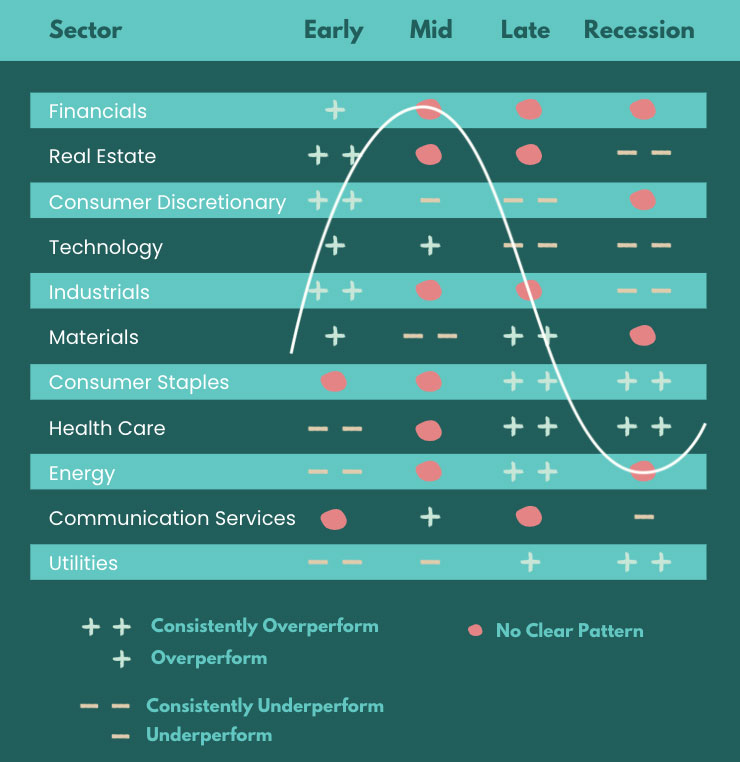

For illustration purposes only. Please seek advice from a Financial Adviser Representative before making any investment decisions.

For example, if you take a look at the table above, technology assets typically do not fare well in a recession. During this time, the consumer staples and health care assets might have a more positive uptrend.

✔️ Is your current portfolio optimised to the prevailing economic sector?

✔️ Even so, is your portfolio diversified in other sectors too? What about geographically?

✔️ You must be prepared for any market developments and sector rotations.

So... do we invest in everything?

You can if you want to, but the secret sauce in any successful investment portfolio is to be diversified with a proper asset allocation that is personalised to your needs.

This is so that you can potentially achieve your financial goals while still investing within your risk tolerance level.

Is your current asset allocation strategised to potentially reach your desired returns?

Or has it greatly deviated due to the crash?

Is your current investment strategy protecting you from a worse market downturn?

For example, if you realise that your portfolio is down by 30% in equities and has increased in fixed income by 5%, from an initial 50% and 50% allocation which you are comfortable with, you can consider buying more quality equities and take advantage of the current market crash.

Or let’s say you are not comfortable with this asset allocation anymore, adjust your asset allocation accordingly to your needs.

This way, you are able to have a resilient portfolio that is always optimised and updated to current market developments.

If everything is aligned, you will be set to brave the market crash.

4. Stop investing and lose faith altogether

A dear friend of mine shared with me that before she had a “recession-proof” investment strategy in place, she quit investing when she faced her first market crash.

Losing so much of her hard-earned money was too much for her to bear and it kind of felt like gambling — and she hated it.

On top of that, she lost faith in investments altogether due to their volatility.

But now, after reaching out to professionals to guide her through her investment journey, she realised that her initial feeling of ‘taking a chance’ on investment was because she didn’t exactly know what she was doing.

That was why she felt like she was ‘gambling’.

Although exiting the market may seem to be a safe move when you don’t know what you are doing, it can be a mistake that can adversely affect your long-term financial goals.

What you can do instead: Stay invested, one step at a time

Investment requires patience and patience requires purpose.

Establish a clear purpose on why you are invested in the first place.

Staying invested is key to growing your wealth and ultimately achieving your financial goals. But keep in mind that this is only applicable if the assets that you are invested in are ‘winning’ assets.

If you have done your own research and due diligence on each asset you are investing in and you have a well-diversified portfolio in place, don’t give up on your investments.

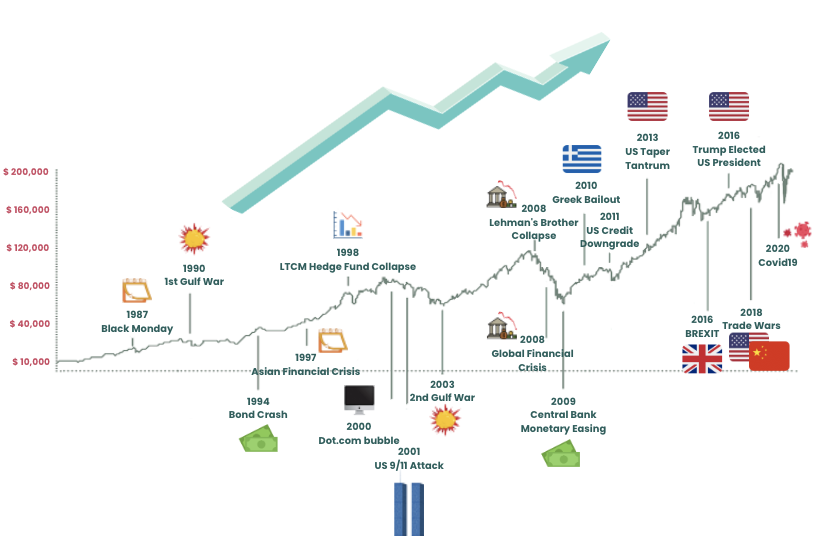

This is because, historically, the financial market in general had been resilient through any market crash.

For illustration purposes only. Please seek advice from a Financial Adviser Representative before making any investment decisions.

So, for a ‘winning’ asset, chances are it would potentially remain resilient too. If you had been doing dollar-cost averaging as well, in a market crash, you may be able to take advantage of the price drop.

There is no reason to lose faith because you had already done your research and made a well-informed decision.

It is important to buy and hold good quality assets with a plan and strategy in mind so you can maximise your potential returns through time invested in the market.

It is best to reach out to experts to help you with your investment portfolio if you are not sure if you can handle a market crash.

They will be able to give you sound financial advice and take the stress off your shoulders.

On top of that, you have the assurance that your portfolio is in the good hands of professionals with relevant skills and experience to manage it objectively.

If you are keen to have a recession-resilient investment strategy personalised to you, do feel free to reach out so we can chat further on how to achieve your financial needs and potentially retire earlier.

As a Chartered Financial Consultant (ChFC®), I have planned, strategised and managed my clients’ retirement portfolios that are optimised to perform during any market condition.

With more than 8 years of experience, I’m recognised as one of the top 1% in the financial services industry, having achieved Top of the Table ®(MDRT) in 2020, 2021 and 2022.

I have also worked with more than 100 mass affluent families to help them be on track to retire 10-15 years earlier. And I can also help you do the same.

Delaying your retirement despite having multiple assets?

What is lacking is a sound strategy with the latest solutions to optimise your assets, so you can receive multiple passive income streams. Get a complimentary consultation session now (for qualified applicants only).

Further Reading

Copyright © 2022 TheFinLens by Jasmine Siah. All rights reserved.