High interest rates in 2023? What are the opportunity costs if you go for short-term returns?

Retirement planning, income investing, Passive income, Investment • 2023-07-17

Current high-interest rates may seem like a golden opportunity to grow your cash, especially when the economic outlook is uncertain and equities appear to be moving sideways.

But some of you might know, there is a catch that could potentially cost you more than you realise –

Will it cause you to miss out on other significant wealth accumulation opportunities?

A study conducted by the U.S. National Bureau of Economic Research (NBER) found that individuals who hold excessive amounts of cash in low-yielding investments tend to miss out on significant wealth accumulation opportunities over the long term.

Warren Buffett has also emphasized the importance of maintaining liquidity to seize investment opportunities.

He famously said, "Cash combined with courage in a time of crisis is priceless."

Also, given that Singapore’s inflation rate has risen to 5.7% in April this year, can your short-term payouts beat inflation?

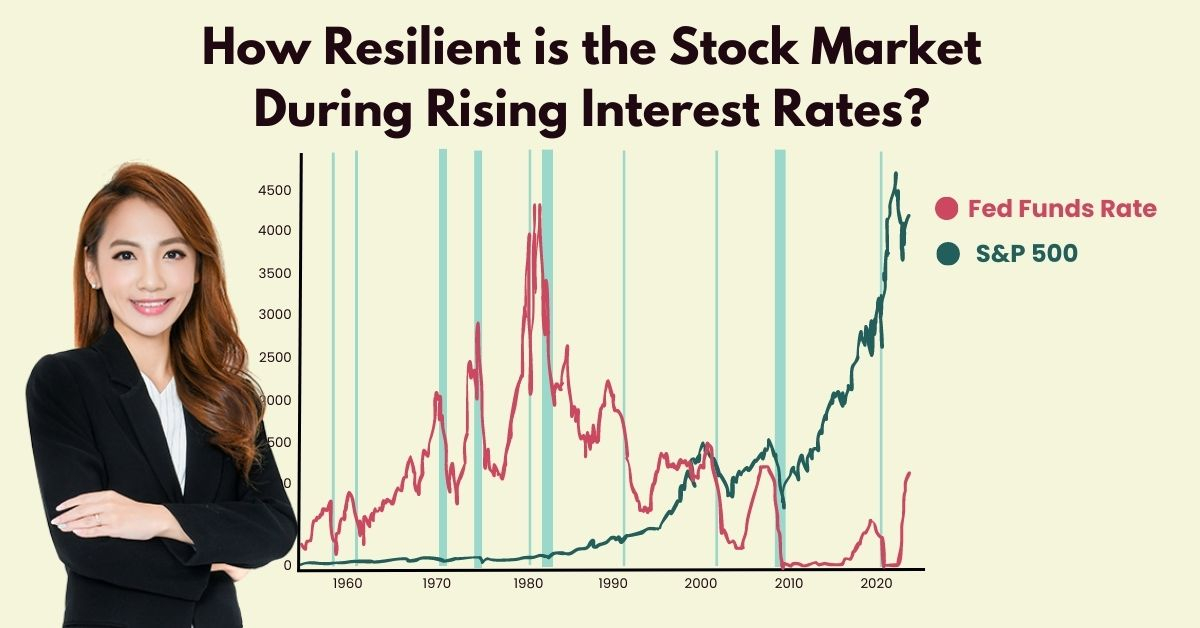

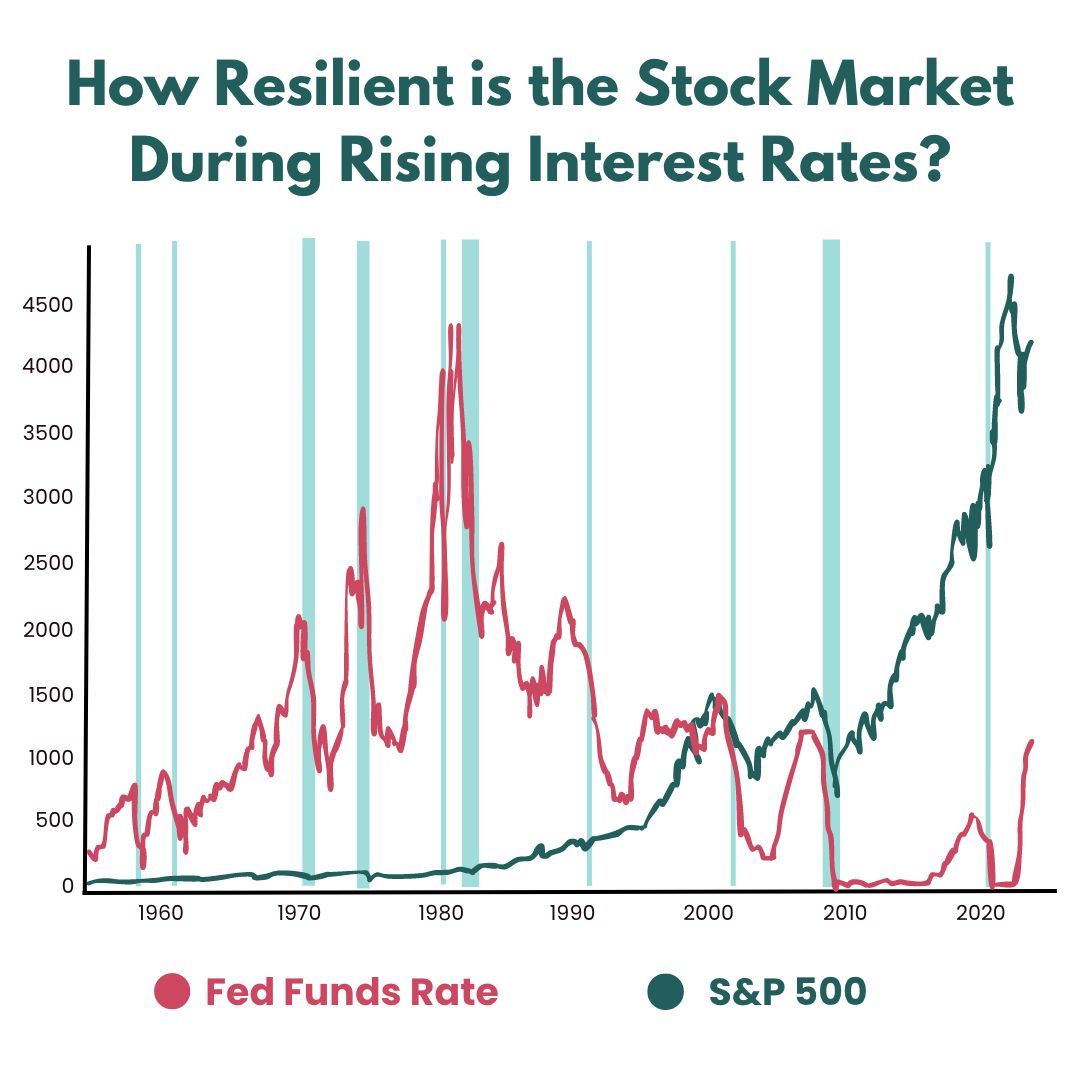

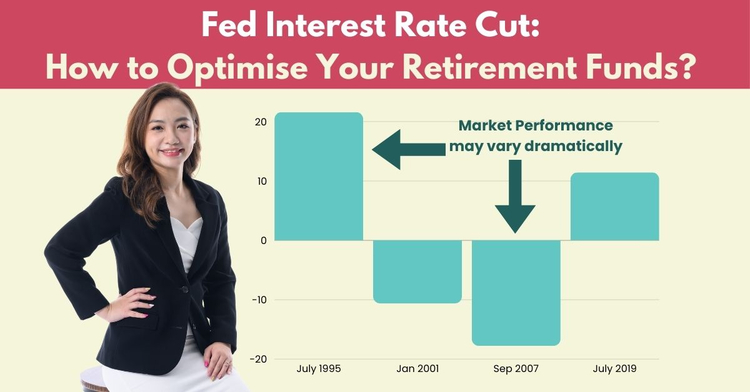

Although past performance is not necessarily predictive of future performance, we can learn some interesting trends from history:

When interest rates are at their peak, equities have shown their potential to rise.

Some of you might remember, from 1979 to the early 1980s, when the U.S. faced high inflation, it prompted then-Fed chairman Paul Volcker to raise interest rates to unprecedented levels.

Although the announcement to raise interest rates in 1979 caused stock prices to fall momentarily, U.S. equities subsequently embarked on a bull market from 1982 to 1987, and the S&P 500 has witnessed overall long-term growth till now.

Similarly, in 1994, the Fed hiked interest rates aggressively to prevent overheating of the economy.

And contrary to expectations, the stock market rallied that year and S&P 500 delivered positive returns, demonstrating its resilience even during rising interest rates.

Sources: Finviz and Trading Economics

One important lesson we can take away is this – the stock market sometimes moves in ways we don’t expect it to. And we have to be prepared.

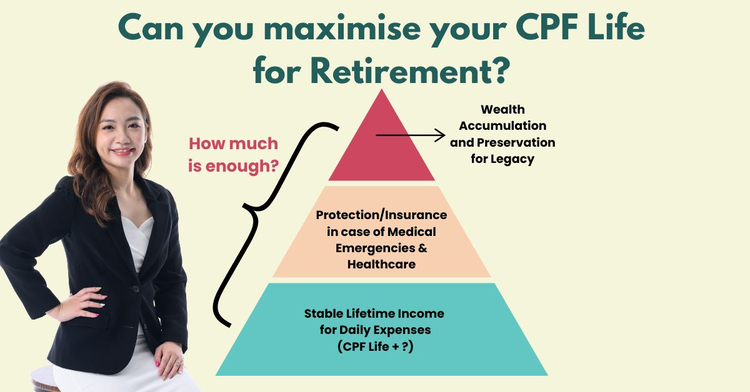

So instead of being distracted by short-term opportunities, it is better to strategise your asset allocation based on your risk profile, so you can still get short-term returns on your spare cash while not sacrificing long-term wealth preservation and growth.

If you are retiring soon, it might be better to allocate your resources to assets that could potentially give you stable lifetime payouts for better peace of mind.

As a Chartered Financial Consultant (ChFC®) and Retirement Wealth Specialist recognised as one of the top 1% in the financial services industry, this is what I have been doing for my mass affluent clients for the past 8 years –

– So that they can receive their desired retirement payouts, without worrying about uncertainties in the economic climate.

My recession-resilient income investing strategy helps to give them the clarity they need for their retirement and legacy.

And I can also help you do the same.

If you are keen to get an audit of your existing investment portfolio and optimise it for stable retirement income, simply fill up this short application here and I will be in touch.

Disclaimer: This post represents our personal views and opinions and is neither associated with any organisation nor reflect the position of any organisation. This content is also only for informative purposes and should not be construed as financial advice. Past performance does not necessarily equate to future performance. Please seek advice from a Financial Adviser Representative before making any investment decisions.

Delaying your retirement despite having multiple assets?

What is lacking is a sound strategy with the latest solutions to optimise your assets, so you can receive multiple passive income streams. Get a complimentary consultation session now (for qualified applicants only).

Further Reading

Copyright © 2022 TheFinLens by Jasmine Siah. All rights reserved.