Inverted bond yield curve: Is recession here?

Recession, Investment, Wealth preservation, Passive income • 2023-12-01

The bond market has been crashing.

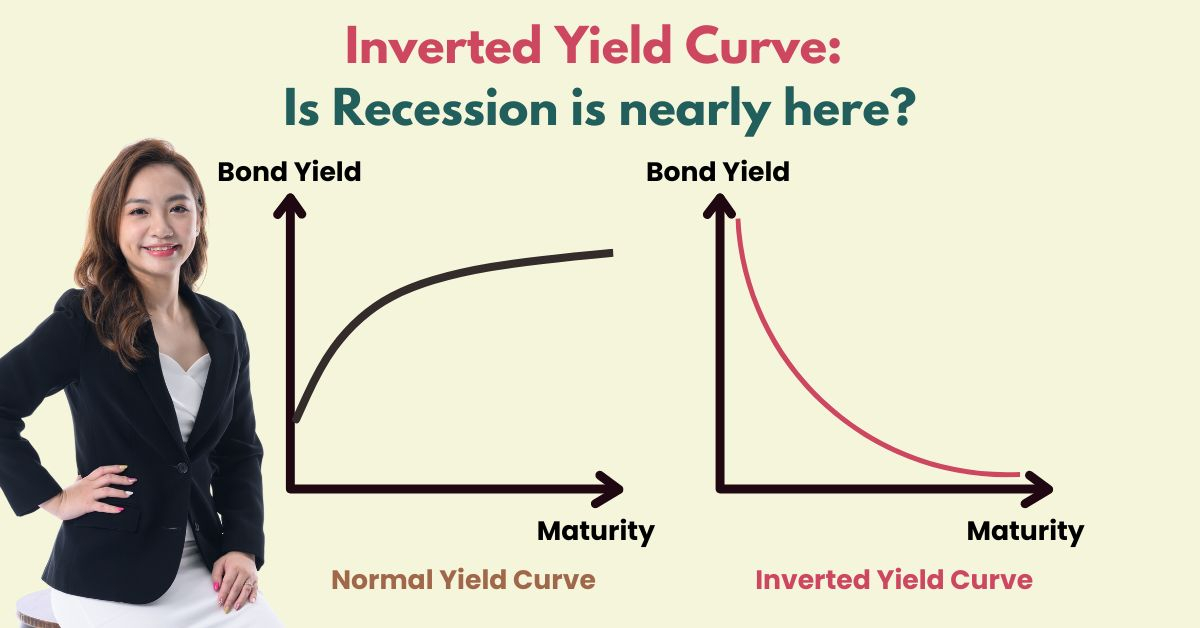

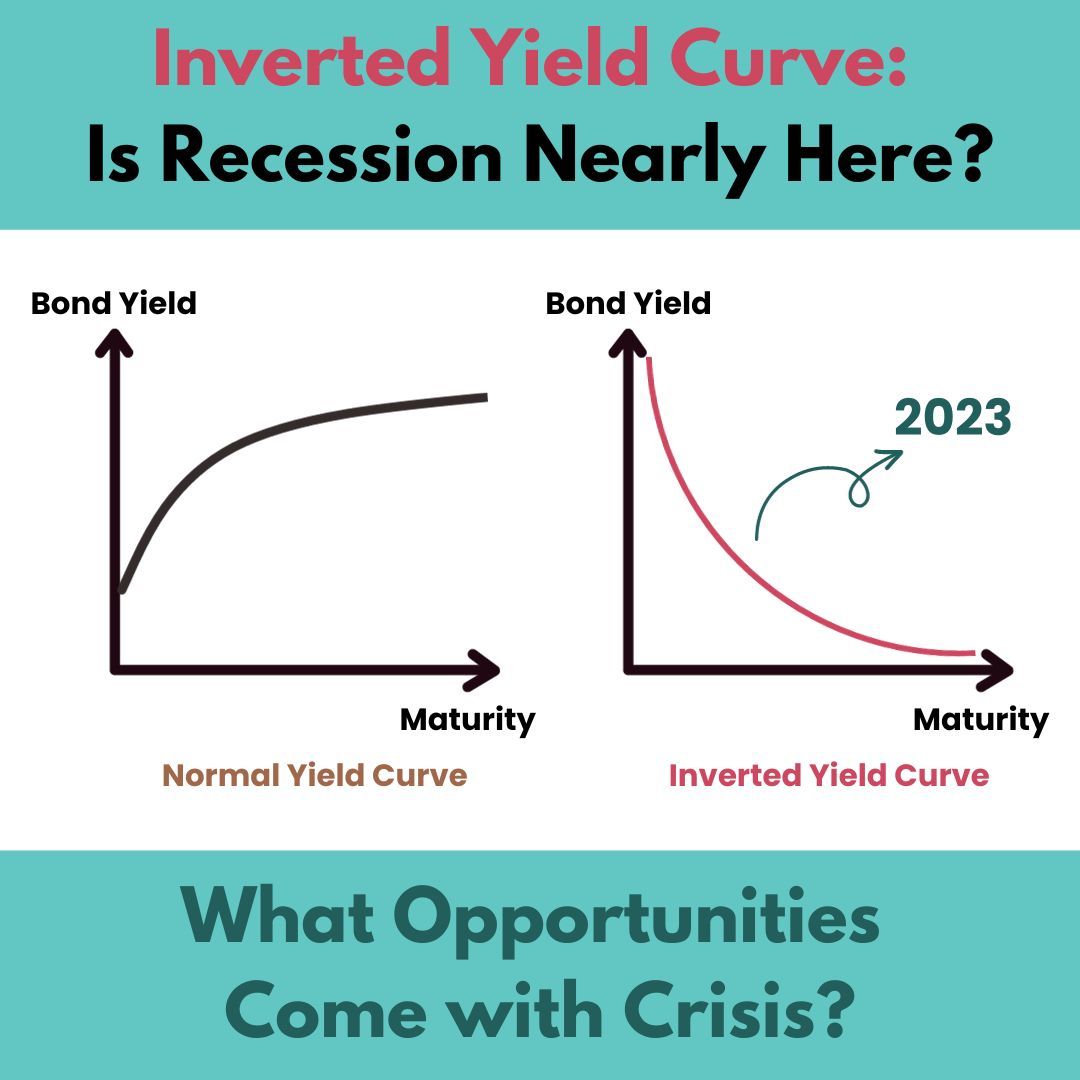

And if you have been watching closely, the current inverted yield curve has worried investors.

This trend has historically been an indicator of impending recession:

Normally, investors get higher interest yields from longer-term government bonds, because the longer you lock up your money, the more returns you want.

But what’s happening now is – shorter-term bonds such as two-year Treasury bonds are getting higher yields than 10-year Treasurys, hence inverting the yield curve.

This is mainly caused by pessimism in the market –

Investors are betting that a recession is coming.

Long-term rates typically reflect expectations of future economic conditions, and people are expecting that today will be better than tomorrow.

This means investors are expecting the Fed to reduce interest rates in the future, so as to improve the economy.

This drives down yields for longer-term bonds.

Since 1955, the inverted yield curve has preceded all 9 recessions, except for once in 1966, according to a 2018 San Francisco Federal Reserve Bank report.

But is this pessimism unwarranted?

Goldman Sachs recently projected that the inverted yield curve does not necessarily indicate recession this time.

According to GS, as 10-year Treasury yields increased to 4.3% in September, they believe bond investors expect the Fed to lower interest rates soon as inflation comes down.

This could also be the driver of the yield inversion.

So is recession really coming soon?

Let’s not forget that with crisis comes opportunity.

With their higher yield, shorter-term bonds are now more attractive to some investors.

On the other hand, longer-term bonds are also attractive to investors who prefer to lock in current higher interest rates for an extended period, despite their lower yield.

With this present situation, how can you best capture the opportunities available?

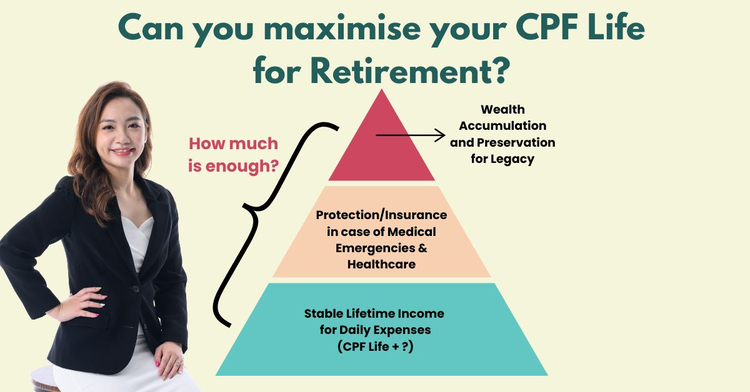

As a Chartered Financial Consultant (ChFC®) recognised as one of the top 1% in the financial services industry, I have been using a holistic financial planning approach with my clients for the past 9 years.

This approach is tailor-made according to their needs and the ever-changing economic climate, so that they will always be relevant for them.

Many of them are still on track to receiving stable lifetime payouts (such as for retirement) without needing to worry about economic uncertainties.

If you are keen to find out more about what are the best actions you can take now to capitalise on current market sentiments, reach out to me through this short application here and I will be in touch.

Disclaimer: This post represents our personal views and opinions and is neither associated with any organisation nor reflect the position of any organisation. This content is also only for informative purposes and should not be construed as financial advice. Past performance does not necessarily equate to future performance. Please seek advice from a Financial Adviser Representative before making any investment decisions.

Delaying your retirement despite having multiple assets?

What is lacking is a sound strategy with the latest solutions to optimise your assets, so you can receive multiple passive income streams. Get a complimentary consultation session now (for qualified applicants only).

Further Reading

Copyright © 2022 TheFinLens by Jasmine Siah. All rights reserved.