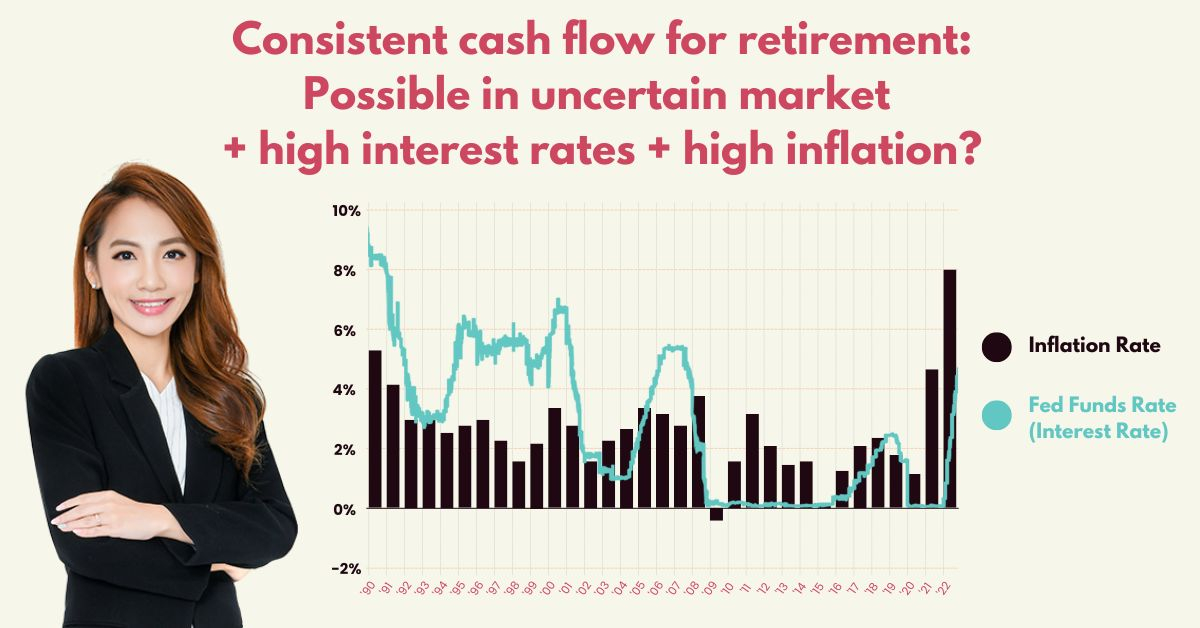

How to generate steady retirement income in an uncertain market with rising interest rates and high inflation?

Retirement planning, Wealth preservation • 2023-05-03

This is the first time in many years that the popular 60/40 investment strategy (60% equities, 40% bonds) made close to 20% losses, according to investment research firm The Leuthold Group.

The economic crisis triggered by the 2020 Covid pandemic has resulted in many unprecedented events indeed.

Such as the combination of high-interest rates and high inflation, which has gotten many investors worried.

At the height of the pandemic, which caused widespread closure of businesses in many sectors, governments and central banks responded with huge stimulus packages to support the economy.

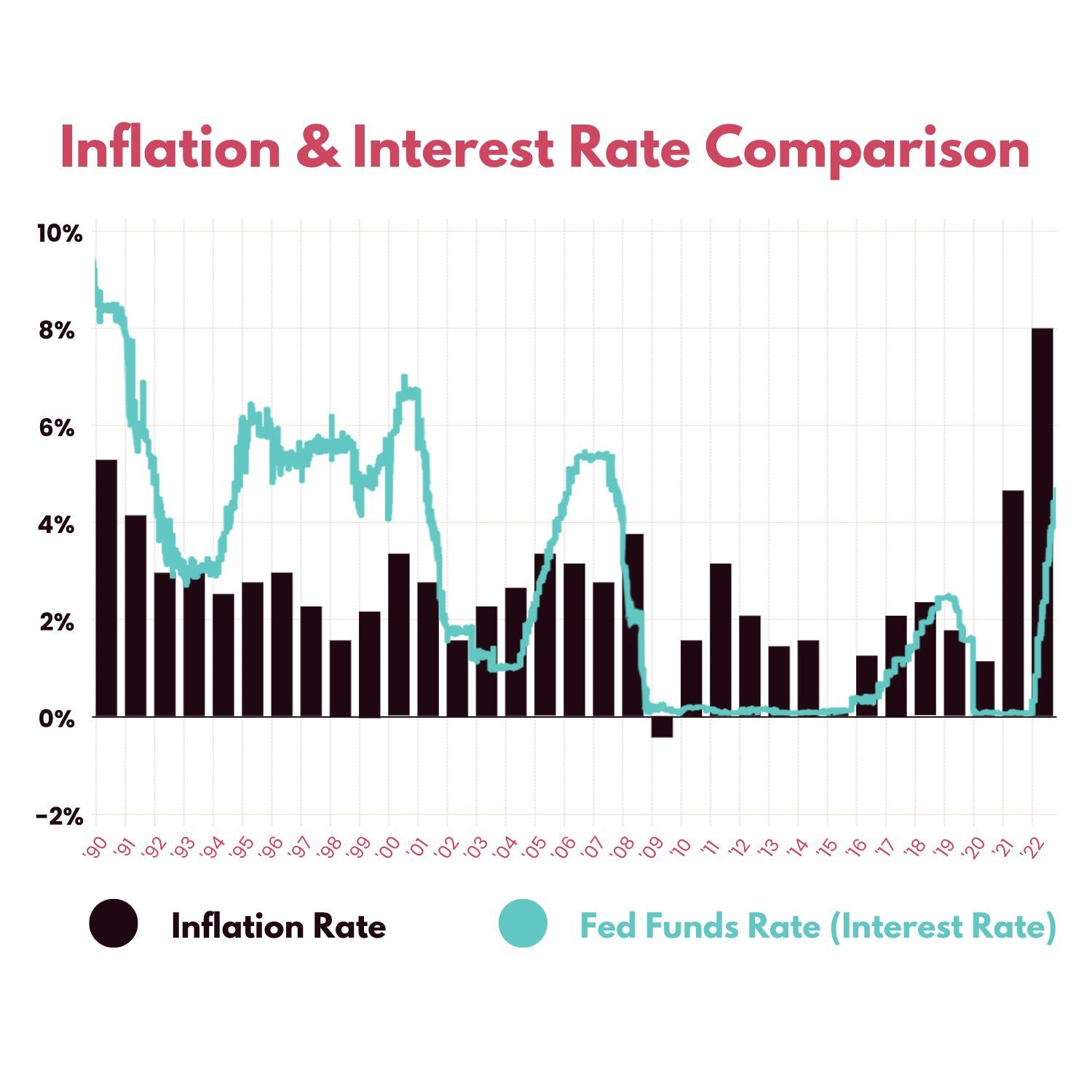

However, this caused inflation to surge to 8% in 2022, prompting the Fed to raise interest rates to control it.

When interest rates are raised, the price of existing bonds tends to fall, because their yields become less attractive relative to newly issued bonds. This was what happened in 2022.

Source: Trading Economics

This also means that if you are already holding bonds, you might make a loss if you cash out now.

You might also have reduced cash flow to invest in other assets with higher potential returns in the long run (such as equities).

And how about for equities?

Looking at S&P 500’s performance, it has been moving sideways since the start of 2023:

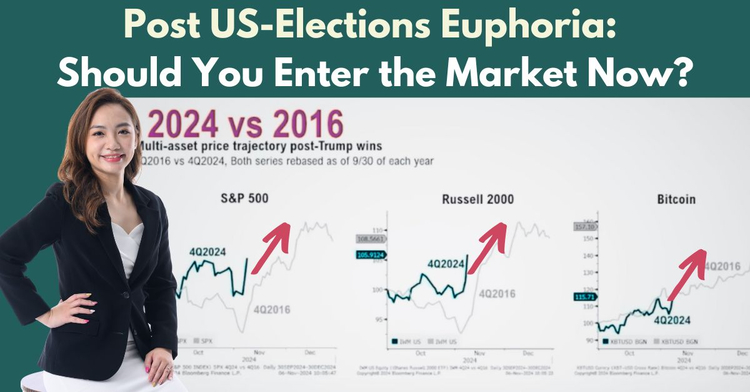

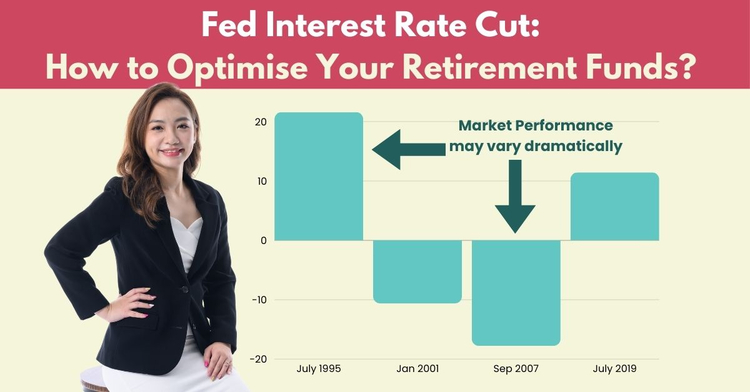

So when would be the “right time” to invest in equities? Would it crash further?

Moreover, if neither bonds nor stocks seem like a good investment option during this period of high inflation, what else can you invest in to prevent your cash value from eroding further?

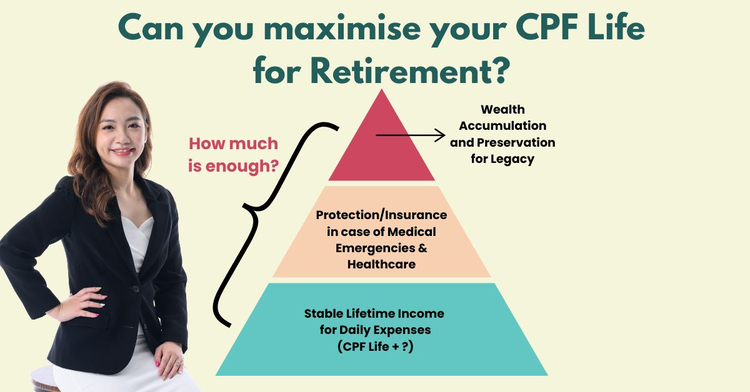

If your goal is to retire soon with steady passive income from your investments, it is very important to invest in suitable assets using the right strategies during this economic climate.

Some investments allow investors to diversify their investments across various asset classes, which allows more flexibility for these investments to be optimised dynamically, based on changing market conditions and trends.

This approach is popular among some of my clients, depending on their risk profile.

However, it's important to note that every investment asset comes with risks. For instance, payouts may be affected during a market downturn if the fund includes fixed-income assets.

Nevertheless, it's crucial to focus on risk management and wealth preservation, especially as you approach your retirement years.

It is also important to identify the gaps in your existing portfolio and optimise your assets according to the changes in the market climate.

As a Chartered Financial Consultant (ChFC®) and Retirement Wealth Specialist* recognised as one of the top 1% in the financial services industry, over the past 8 years, I have helped more than 100 mass affluent families to be on track to retire with steady retirement income, through my recession-resilient income investing strategy.

(*I am an MAS-licensed Financial Adviser Representative with IPP Financial Advisers.)

If you are keen to get an audit of your existing investment portfolio and optimise it for stable retirement income, simply fill up this short application here and I will be in touch.

Disclaimer: This post represents our personal views and opinions and is neither associated with any organisation nor reflect the position of any organisation. This content is also only for informative purposes and should not be construed as financial advice. Past performance does not necessarily equate to future performance. Please seek advice from a Financial Adviser Representative before making any investment decisions.

Delaying your retirement despite having multiple assets?

What is lacking is a sound strategy with the latest solutions to optimise your assets, so you can receive multiple passive income streams. Get a complimentary consultation session now (for qualified applicants only).

Further Reading

Copyright © 2022 TheFinLens by Jasmine Siah. All rights reserved.