How should you handle a recession during your retirement years?

Retirement planning, Wealth preservation, Recession • 2022-07-21

With the current high inflation and high-interest rates, would it be a wise decision to retire soon?

Some of you might think, should you continue working for a while longer just in case?

It can be stressful to consider these when you are preparing for your retirement.

Some of my clients have also brought up their concerns about the rising interest affecting their existing mortgage loans and other leveraged investments.

Some people have also brought up fears of a recession, and if they are still on track to retire early.

During times of uncertainty and market volatility like this, it’s all about managing your risks and using the right strategy that’s adjusted to the current climate.

Here, I will share with you some of the fears, questions, and mistakes that some investors make during a crisis like this, and what we can take away so we avoid making these mistakes.

Don’t have enough for retirement? Many Singaporeans are asset-rich but lack strategy to generate passive income. At The Fin Lens, I help mass affluent clients keep up with the latest solutions and optimise their assets – so they can build multiple income streams and retire earlier. Find out how today.

Disclaimer: This post represents our personal views and opinions and is neither associated with any organisation nor reflect the position of any organisation. This content is also only for informative purposes and should not be construed as financial advice. Past performance does not necessarily equate to future performance. Please seek advice from a Financial Adviser Representative before making any investment decisions.

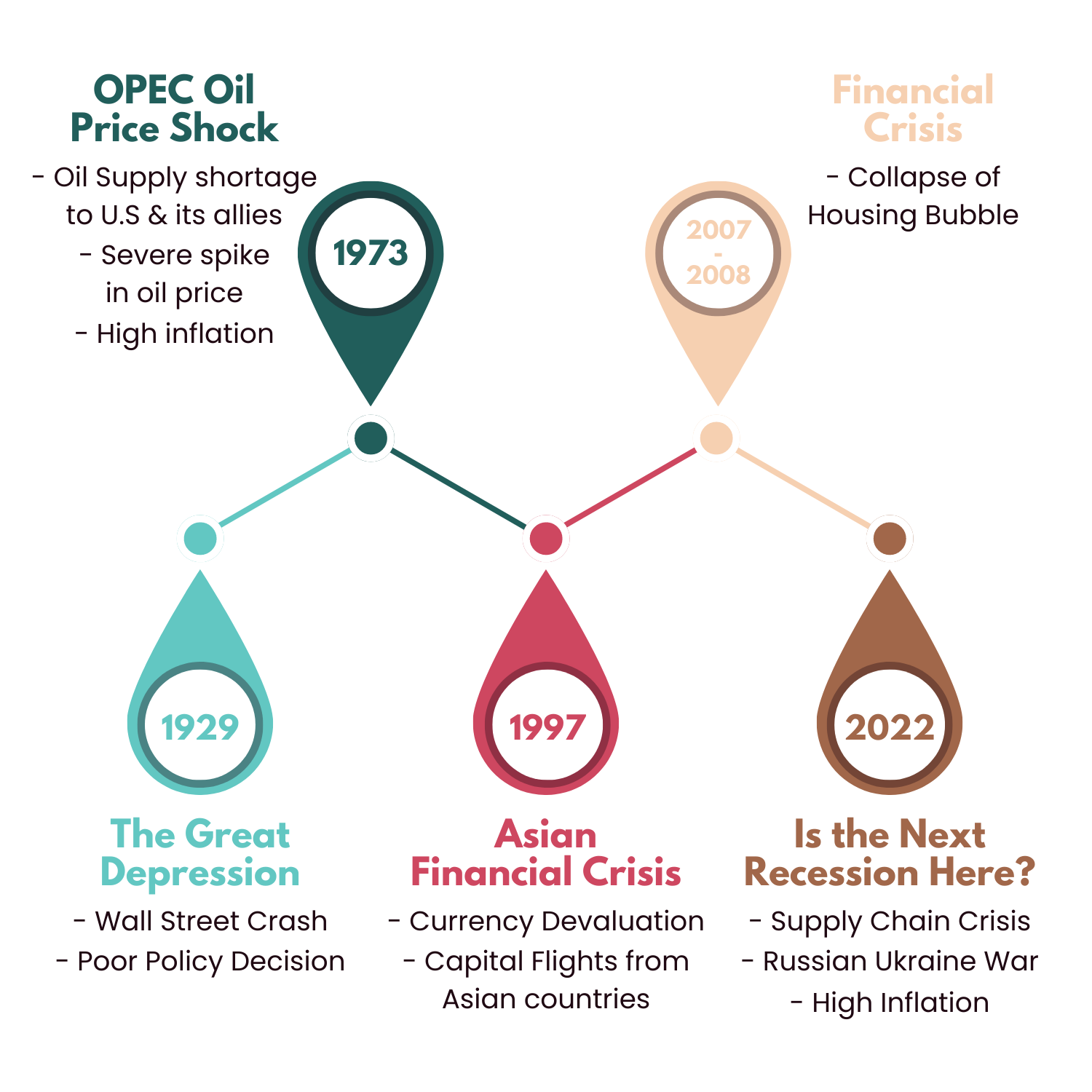

No recession mirrors the other, so what can you expect?

Every recession is different. There were oil crises, credit crises and health crises.

And what happened during past recessions cannot predict future ones.

For illustration purposes only.

In 2022, factors such as geopolitical issues such as China’s lockdown and the Russian-Ukrainian war snowballed into a supply chain crisis globally. China and Russia are two of the largest economies in the world.

Do you think we are going to face a recession due to the supply chain disruption and high inflation that’s happening right now?

One thing all recessions had in common was they were unpredictable. You can expect a lot of uncertainty.

Although the world had its fair share of recessions, it is important not to assume there would be a simple step-by-step guide to recessions.

But what we can do is learn from each recession and prepare our investments and financials for any uncertainties that can possibly happen.

Should you cash out your investments now?

During market uncertainties, extreme volatilities that may be induced by fears and panic in the market might take a toll on your wealth.

Generally, the financial markets are not doing so well as of late 2021 up until 2022 because of the economic influences highlighted above.

Below is the performance of the S&P 500 Index. From the start of 2022, the index saw a decreasing trend. For context, this index tracks the stock performance of the 500 largest publicly traded companies in the U.S. market.

For illustration purposes only. Past performance is not necessarily indicative of future performance. Please seek advice from a Financial Adviser Representative before making any investment decisions. Source: https://finviz.com/

Even bond prices have fallen due to the increasing interest rates.

Below is the Vanguard Total Bond Market Index Fund that tracks the performance of USD-denominated bonds. The Exchange Traded Fund consists of a mix of US Treasury bills, government-related bonds, corporate bonds and mortgage-backed securities.

This fund had been experiencing a decreasing price trend since early 2022.

For illustration purposes only. Past performance is not necessarily indicative of future performance. Please seek advice from a Financial Adviser Representative before making any investment decisions. Source: https://finviz.com/

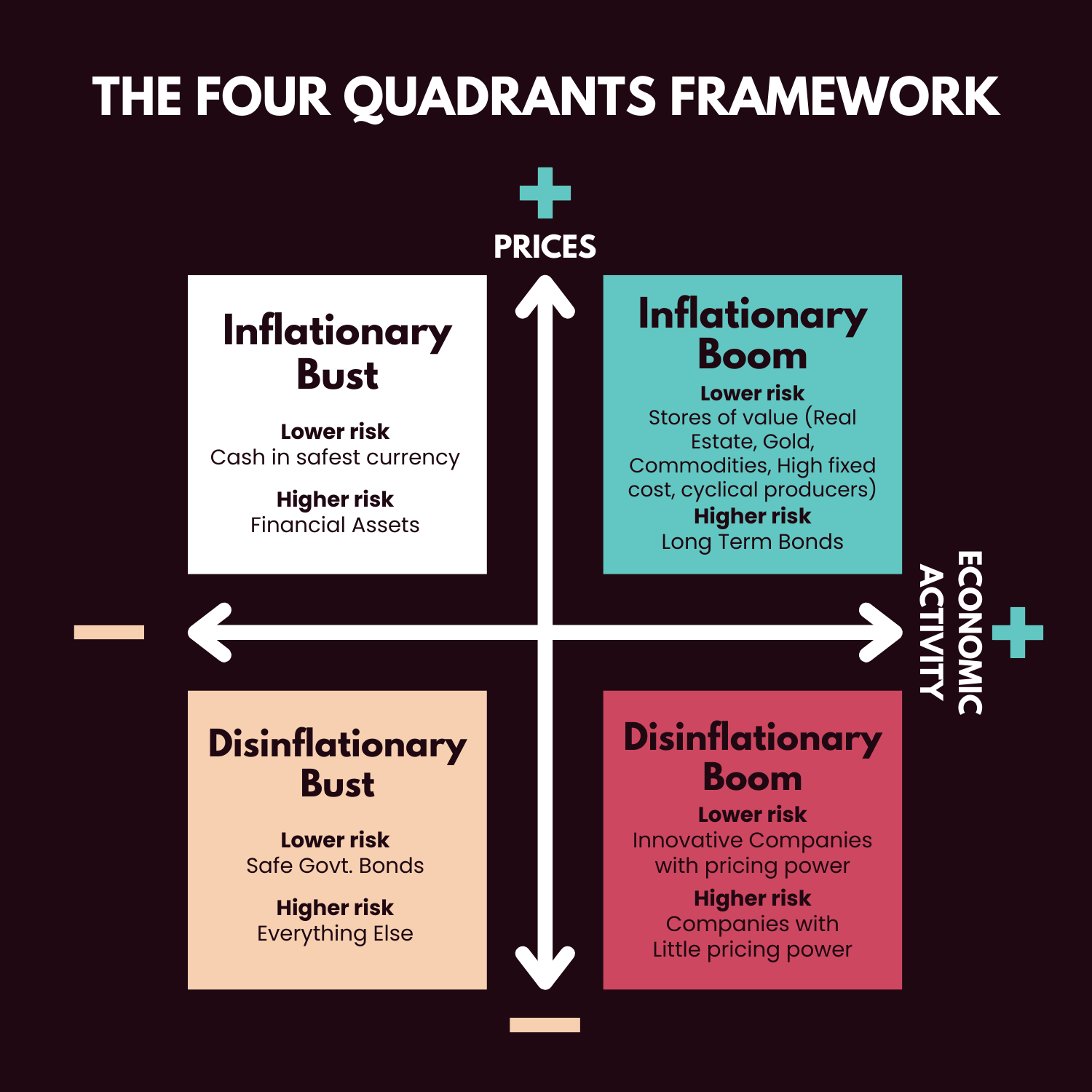

To further illustrate this, our current economic condition is actually a combination of high inflation and slow economic growth. According to the economic rotation quadrant framework below, we are in the ‘Inflationary Bust’ quadrant.

For illustration purposes only. Past performance is not necessarily indicative of future performance. Please seek advice from a Financial Adviser Representative before making any investment decisions.

And according to this quadrant, financial assets are seen to be of higher risk and keeping cash in the safest currency would have a lower risk of losing money.

But will you really be better off cashing out your investments to avoid losing money to the markets now?

Frankly, there are many factors to weigh:

- Cashing out may enable you to avoid further potential losses from short-term volatilities.

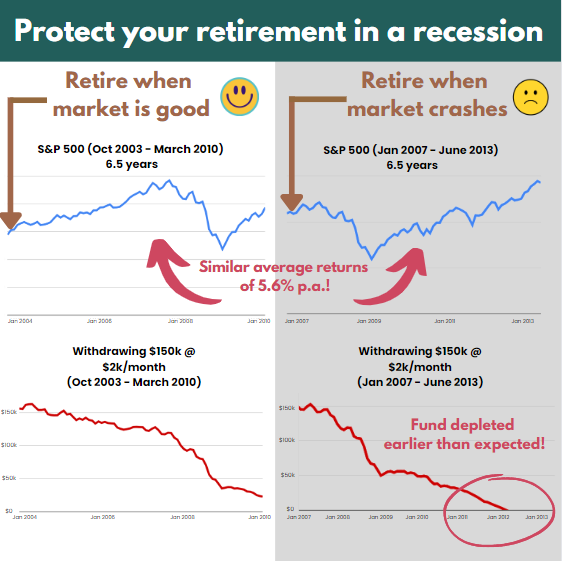

- But it is important to know that withdrawing without the right strategy during a volatile market condition might cause you to lose more money in the long run. This is because of two things: 1) You will realise your paper losses and 2) Because you are no longer invested, you miss out on any possibility of recovery from the losses. Consequently, your nest egg may deplete faster than expected! Refer to the illustration below on the potential consequences of retiring during a good market versus during a market crash!

For illustration purposes only. Past performance is not necessarily indicative of future performance. Please seek advice from a Financial Adviser Representative before making any investment decisions.That is why your withdrawal strategy is important in order to mitigate any losses in a market crash so that your retirement nest egg remains sustainable for you!

That is why your withdrawal strategy is important in order to mitigate any losses in a market crash so that your retirement nest egg remains sustainable for you!

- If you cash out now, you would need to re-enter your investments later on to continue growing your wealth. Would you know when is the right time to re-enter so you don’t make losses? If you enter when an asset is still falling in price, you might be catching a falling knife. Some assets might require time (even decades) to recover – can you afford to wait? Not many investors are capable of timing the market strategically as it requires extensive knowledge and analysis to do it right.

- If you withdraw and do nothing, rising inflation will still cause you to lose the value of your money, through the loss of purchasing power.

So if you want to cash out, it highly depends on your ability to time the market well.

Otherwise, if you are invested in a well-diversified portfolio with good asset allocation, it might be better to stay invested for the long term.

The most important thing is to find the right balance between preserving your wealth, maintaining cash flow and minimising losses accordingly to your investment profile.

Retiring soon? Should you maximise returns or preserve wealth?

In order to move forward, you need to be clear with your priority now – do you want to maximise returns or preserve your wealth?

For many retirees – and I’m sure you will resonate with this if you are also planning to retire soon – the main concern would no longer be about maximising your returns.

Typically, as my clients are approaching their golden age, preserving wealth is their top concern in such an economic climate. Many of them prefer not to undertake too risky investments and they are opting for more stable assets.

Of course, your preference might differ depending on your risk appetite.

If you intend to retire soon, constructing a mix of assets in your portfolio may prove to be useful to weather the storm. This way, you can stay invested in assets that can help you potentially preserve your wealth and also possibly provide you with passive income.

For example, some retirees are investing in assets that can potentially give them regular cash flow such as whole life plans and pension schemes or are getting dividend income from defensive sectors (such as healthcare, consumer staples, etc).

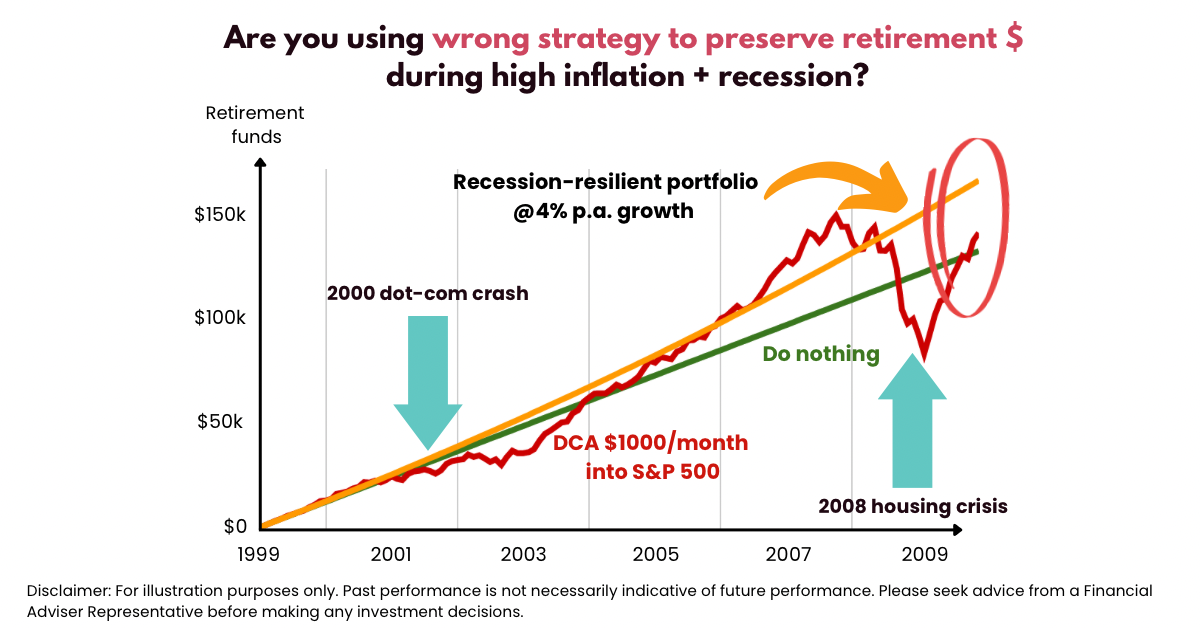

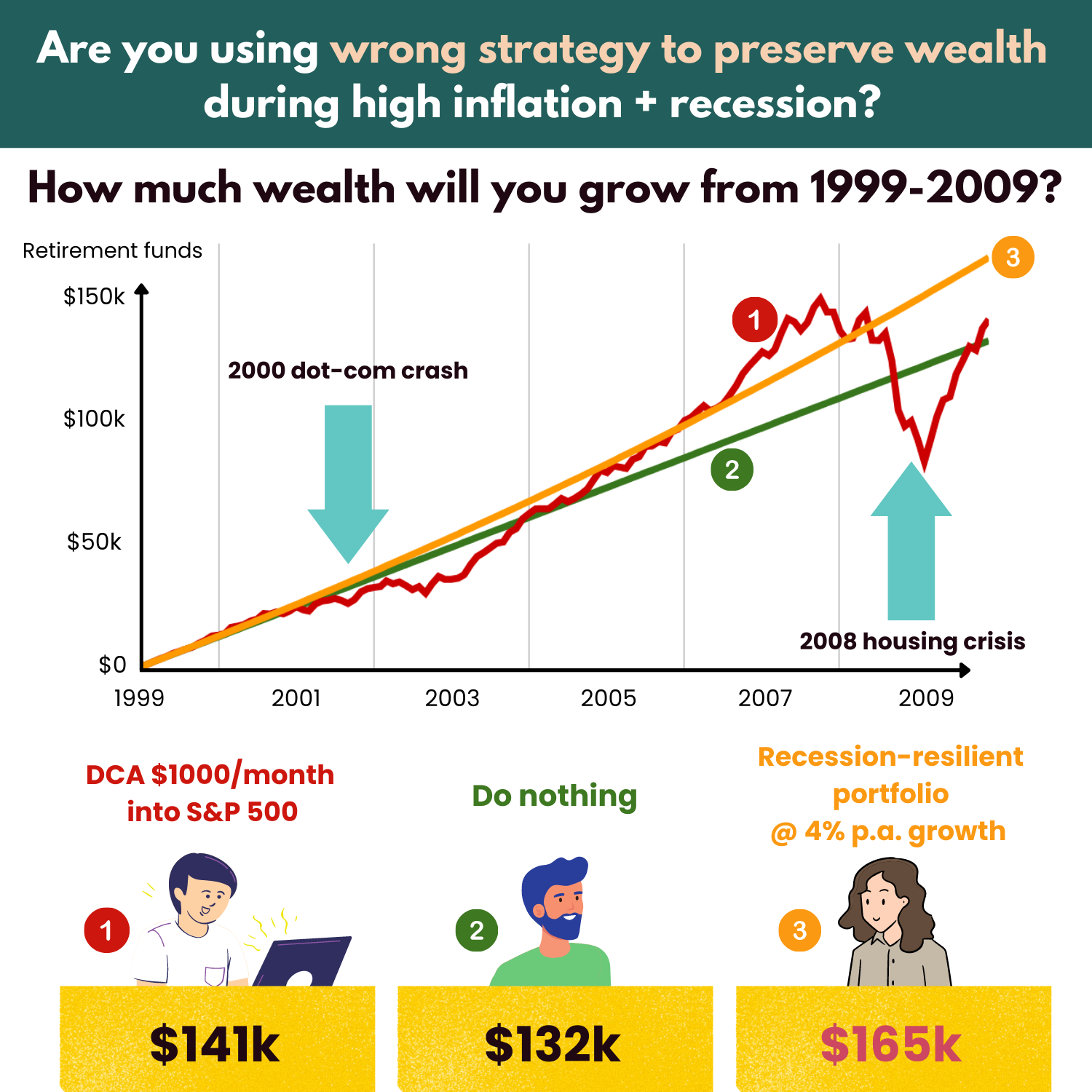

The illustration below shows how an asset that potentially gives you 4% p.a. returns can help you through market volatility.

*DCA = Dollar-cost averaging. For illustration purposes only. Past performance is not necessarily indicative of future performance. Please seek advice from a Financial Adviser Representative before making any investment decisions.

The retirement period is quite a delicate age to be in. Having a regular flow of passive income will come in handy to cover your basic expenses during uncertain periods or even assist you with sudden expenses like medical emergencies or long-term care costs.

And I am here to share that it is possible to get regular income through a careful combination of income-generating assets as mentioned above. If you are keen on these assets, I can help you craft a recession-resilient investment strategy tailored for you.

When in doubt, reach for a helping hand

You are probably frustrated if you have tried your very best but still failed to protect your wealth from continuous losses during this market downturn.

Accepting market volatility and experiencing a market downturn are part and parcel of an investment journey.

To preserve your wealth, it is important to rely on a holistic investment plan with diversification in different asset classes, industrial sectors as well as geography. Evaluate the situation at hand and rebalance your portfolio accordingly.

All we can do is focus on what is within our control and prepare ourselves financially.

And this is exactly what I offer – to help my clients take control of their retirement planning so that they can potentially remain financially secure even in a recession.

Many of my clients are mass affluent pre-retirees and retirees. Those who are already retiring are doing so comfortably with the regular passive income they are looking for. Those who are retiring soon are on track to retire earlier than planned.

With my 8 years of experience working with more than 100 mass affluent families to potentially retire 10-15 years earlier, I will be able to help you do the same.

Delaying your retirement despite having multiple assets?

What is lacking is a sound strategy with the latest solutions to optimise your assets, so you can receive multiple passive income streams. Get a complimentary consultation session now (for qualified applicants only).

Further Reading

Copyright © 2022 TheFinLens by Jasmine Siah. All rights reserved.